The outbreak of COVID-19 has had a profound impact on the global economy, and the US stock market is no exception. The pandemic has caused significant disruptions, leading to volatility and uncertainty in the financial markets. In this article, we will explore the various ways in which COVID-19 has affected the US stock market.

Rapid Market Decline

The initial impact of the pandemic on the US stock market was immediate and severe. In February and March 2020, the S&P 500 index plummeted by nearly 30%, marking one of the fastest bear markets in history. This rapid decline was driven by a combination of factors, including widespread panic, a decrease in consumer spending, and a halt in economic activity.

Sector-Specific Impacts

The COVID-19 pandemic has had a varied impact on different sectors of the US stock market. Industries such as energy, travel, and hospitality have been hit particularly hard, with companies experiencing significant revenue losses and increased uncertainty. In contrast, sectors like technology and healthcare have seen strong gains, as demand for remote work solutions and medical supplies surged.

Technology Stocks Soar

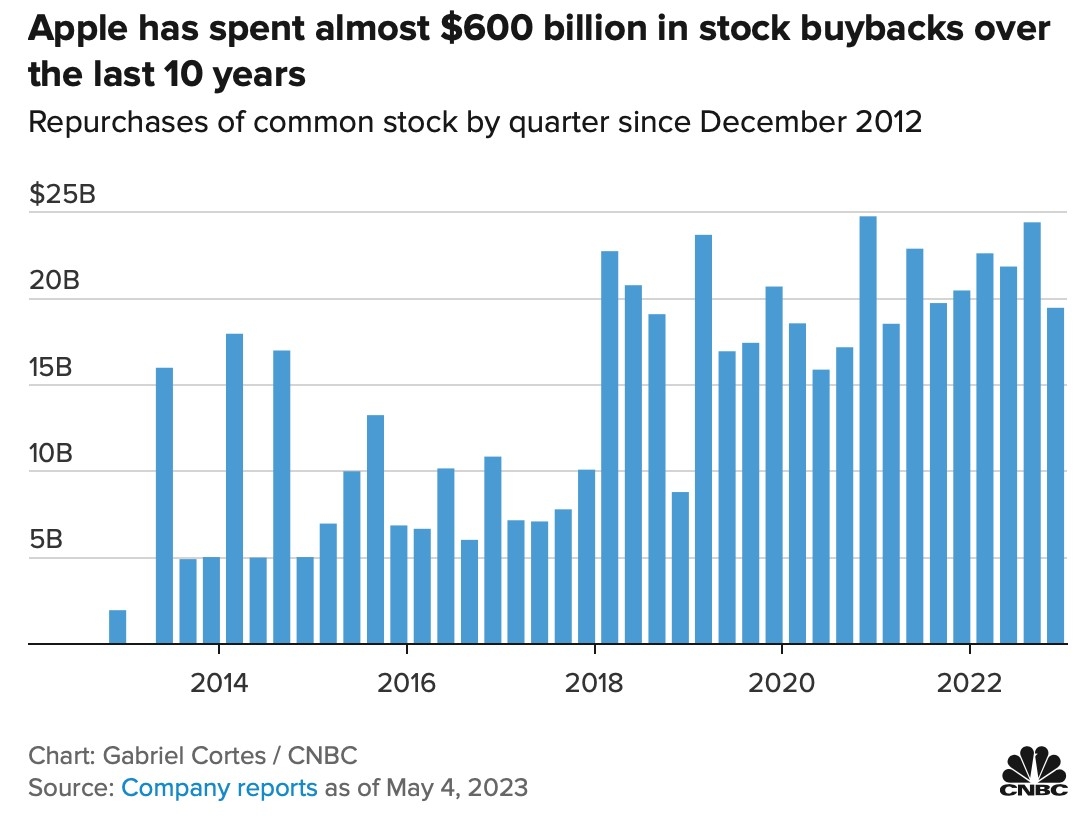

One of the most notable trends during the pandemic has been the surge in technology stocks. Companies like Apple, Microsoft, and Amazon have seen their shares soar, driven by increased demand for their products and services. This trend has been attributed to the shift towards remote work and online shopping, which has accelerated the adoption of technology in various aspects of daily life.

Healthcare Stocks on the Rise

The healthcare sector has also seen significant gains during the pandemic. Companies involved in the development and production of medical supplies, vaccines, and treatments have seen their shares soar. This has been driven by the increased demand for these products and the expectation that the sector will continue to grow as the pandemic progresses.

Volatility and Uncertainty

The COVID-19 pandemic has introduced a new level of volatility and uncertainty to the US stock market. The rapid spread of the virus, changes in government policies, and the effectiveness of vaccines have all contributed to this uncertainty. As a result, investors have become increasingly cautious, leading to periods of significant market volatility.

Case Studies

One notable case study is the impact of the pandemic on the airline industry. Major airlines such as American Airlines, Delta, and United have seen their shares plummet, with some even filing for bankruptcy. However, as vaccines become more widely available and travel restrictions are lifted, there is hope that the industry will begin to recover.

Another case study is the impact of the pandemic on the video game industry. Companies like Nintendo and Sony have seen their shares soar, driven by increased demand for video games and gaming consoles. This trend has been attributed to the shift towards remote entertainment as people stay at home to avoid the virus.

Conclusion

The COVID-19 pandemic has had a significant impact on the US stock market. While some sectors have seen strong gains, others have been hit particularly hard. The pandemic has introduced a new level of volatility and uncertainty, making it more challenging for investors to predict market trends. However, as the pandemic continues to evolve, the market is likely to adapt and find new ways to grow.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....