Understanding Cross-Border Investment Opportunities

Have you ever wondered if you can trade in US stocks if you are a Canadian investor? The answer is yes, you can. However, there are several factors to consider before you dive into this exciting opportunity. In this article, we will explore the process, benefits, and challenges of trading US stocks from a Canadian perspective.

The Basics of Trading US Stocks from Canada

Firstly, it is important to understand that trading US stocks from Canada is quite similar to trading stocks in your home country. You can buy and sell shares of US companies through a brokerage account that allows international trading. Many Canadian brokerage firms offer access to the US stock market, making it easier for Canadian investors to participate.

Choosing a Brokerage Firm

The first step in trading US stocks from Canada is to choose a brokerage firm that supports international trading. Some popular Canadian brokerage firms that offer access to the US stock market include TD Ameritrade, Questrade, and Interactive Brokers. These firms provide a user-friendly platform, competitive fees, and access to a wide range of US stocks.

Understanding Tax Implications

One of the most critical aspects of trading US stocks from Canada is understanding the tax implications. Since you are a Canadian resident, any capital gains or dividends earned from US stocks will be subject to Canadian tax laws. This means that you will need to report your US stock investments on your Canadian tax return and pay the applicable taxes.

Advantages of Trading US Stocks

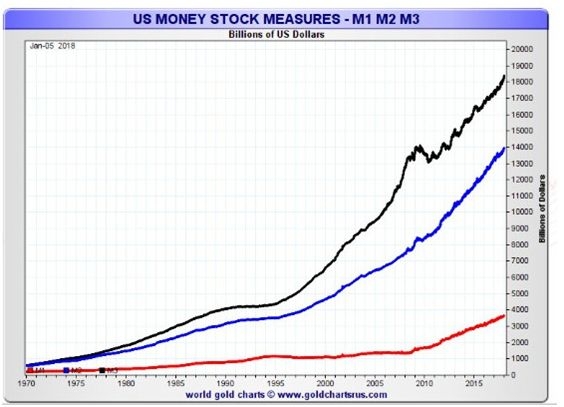

Trading US stocks from Canada offers several advantages. Firstly, the US stock market is one of the largest and most diversified in the world, offering access to a wide range of sectors and industries. This diversification can help mitigate risk and potentially enhance returns.

Secondly, many US companies are leaders in their respective industries, providing Canadian investors with the opportunity to invest in high-quality businesses with strong growth potential. Some examples of popular US stocks include Apple, Microsoft, and Google.

Challenges of Trading US Stocks

Despite the benefits, there are also challenges to consider when trading US stocks from Canada. One major challenge is the currency exchange rate. When you trade US stocks, you will be buying and selling in US dollars, which means you are exposed to currency risk. Additionally, US stock market hours are different from those in Canada, which can be a challenge for investors who prefer to trade during regular business hours.

Case Study: Investing in US Tech Stocks

Let's consider a hypothetical case study to illustrate the process of trading US stocks from Canada. Imagine you are a Canadian investor interested in the technology sector. You decide to open a brokerage account with a Canadian firm that offers access to the US stock market. After thorough research, you decide to invest in a popular US tech stock, such as Apple.

To purchase shares of Apple, you would need to convert your Canadian dollars to US dollars, place an order through your brokerage platform, and wait for the transaction to be executed. Once you own the shares, you can monitor their performance and sell them at a later date, potentially earning a profit.

Conclusion

Trading US stocks from Canada can be an exciting opportunity for Canadian investors to diversify their portfolios and access high-quality companies. However, it is important to understand the tax implications, currency risk, and other factors involved in cross-border investment. By doing thorough research and choosing the right brokerage firm, you can make informed decisions and potentially benefit from the opportunities available in the US stock market.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....