Introduction

The Relative Strength Index (RSI) is a widely-used technical indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. As we approach July 2025, investors are keen to understand how RSI can be applied to US stocks to make informed decisions. This article delves into the RSI analysis of US stocks for July 2025, providing insights and strategies for investors.

Understanding RSI

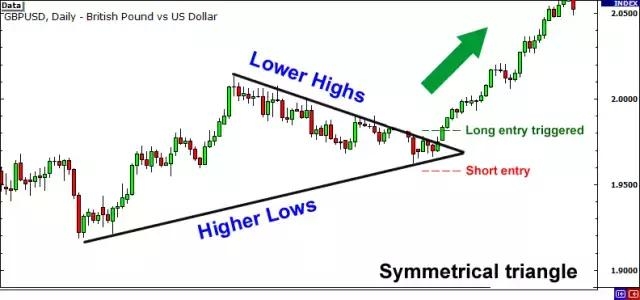

The RSI is calculated by comparing the average gains to the average losses over a specified period. The RSI ranges from 0 to 100, with readings above 70 indicating an overbought condition, suggesting that the stock may be due for a pullback. Conversely, readings below 30 indicate an oversold condition, suggesting that the stock may be undervalued and could potentially rise.

Analyzing US Stocks Using RSI in July 2025

Sector Analysis: Different sectors may exhibit varying RSI readings. For instance, technology stocks may have higher RSI readings due to their volatile nature, while utilities may have lower readings due to their stability. Investors should analyze the RSI of stocks within a specific sector to identify potential opportunities or risks.

Individual Stock Analysis: Analyzing the RSI of individual stocks is crucial. By comparing the RSI readings of a stock with its historical data, investors can identify trends and patterns. For instance, if a stock's RSI reading is consistently above 70, it may indicate an overbought condition, suggesting a potential for a pullback.

RSI Divergence: RSI divergence occurs when the price of a stock is making new highs, but the RSI is not. This can be a sign of weakness in the stock and may indicate a potential reversal. Conversely, if the stock is making new lows, but the RSI is not, it may suggest a potential for a rebound.

Combining RSI with Other Indicators: While RSI is a powerful tool on its own, combining it with other indicators can enhance the accuracy of predictions. For example, combining RSI with moving averages can help identify potential entry and exit points.

Case Studies

Tesla Inc. (TSLA): In July 2025, Tesla's RSI reading was around 75, indicating an overbought condition. However, considering the strong momentum in the stock, some investors may have chosen to stay invested, while others may have taken profits.

Apple Inc. (AAPL): Apple's RSI reading was around 50 in July 2025, suggesting a neutral condition. Investors may have viewed this as an opportunity to buy or sell, depending on their outlook for the stock.

Conclusion

The RSI analysis of US stocks in July 2025 can provide valuable insights for investors. By understanding the RSI and applying it to individual stocks and sectors, investors can make more informed decisions. However, it's important to remember that RSI is just one tool among many and should be used in conjunction with other indicators and analysis methods.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....