The US stock market all-time chart is a powerful tool for investors and analysts to gauge the performance of the market over time. This article delves into the intricacies of this chart, highlighting key trends and insights that can inform investment decisions. By examining historical data, we can better understand the market's behavior and potential future movements.

Understanding the All-Time Chart

The US stock market all-time chart typically displays the performance of a broad index, such as the S&P 500, over an extended period. This chart allows investors to visualize the market's ups and downs, identify long-term trends, and make informed decisions based on historical data.

Key Trends in the All-Time Chart

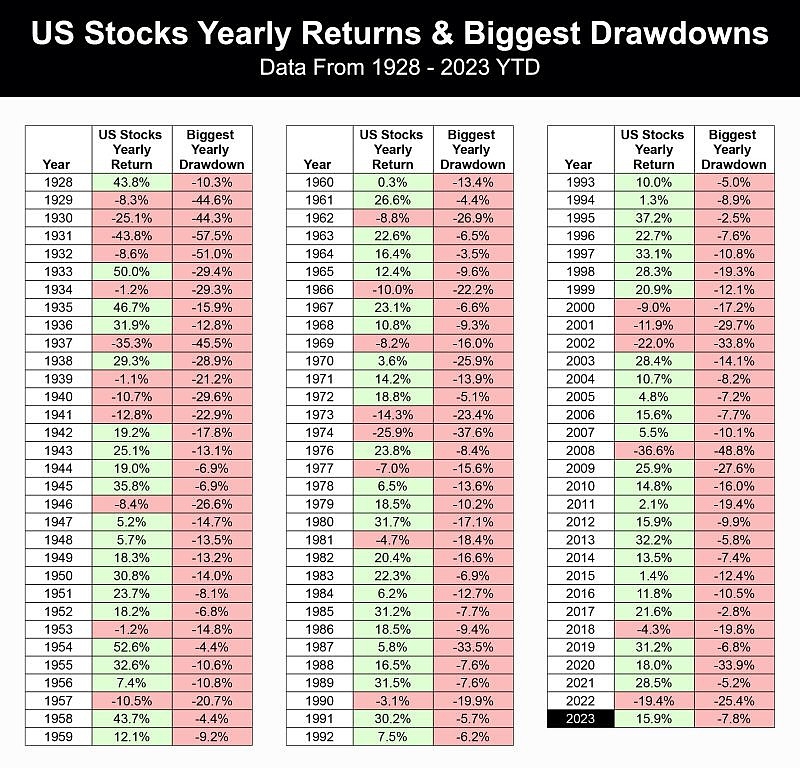

Long-Term Growth: Over the past century, the US stock market has experienced significant growth. The all-time chart shows that the market has generally trended upwards, with occasional corrections and bear markets.

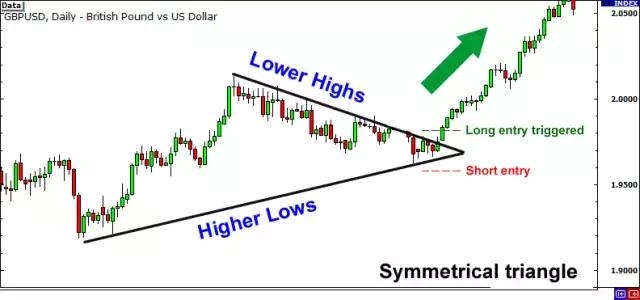

Market Cycles: The all-time chart reveals distinct market cycles, including bull markets (periods of rising stock prices) and bear markets (periods of falling stock prices). Understanding these cycles can help investors time their investments more effectively.

Market Volatility: The all-time chart also illustrates the level of market volatility over time. While the market has experienced periods of high volatility, it has also shown periods of relative stability.

Inflation and Dividends: The all-time chart can be used to analyze the impact of inflation and dividends on stock prices. Over time, the real return on stocks has often outpaced inflation, making them a valuable investment.

Case Studies

To illustrate the value of the all-time chart, let's consider a few case studies:

The Dot-Com Bubble: The late 1990s saw the rise of the dot-com bubble, which eventually burst in 2000. The all-time chart shows a sharp increase in stock prices during this period, followed by a significant decline. Investors who recognized the bubble's unsustainable nature and exited the market before the crash likely avoided substantial losses.

The Financial Crisis of 2008: The all-time chart also reveals the impact of the financial crisis on the stock market. In 2008, the S&P 500 experienced its worst one-day decline since 1987. Investors who remained invested during this period ultimately benefited from the subsequent recovery.

Conclusion

The US stock market all-time chart is a valuable tool for investors and analysts. By understanding the chart's key trends and insights, investors can make more informed decisions and potentially improve their investment returns. Whether you're a seasoned investor or just starting out, the all-time chart can provide valuable insights into the market's behavior and potential future movements.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....