In the ever-evolving world of biotechnology, Lonza Group AG (SWX: LONN) stands as a major player, offering a robust and dynamic investment opportunity for those interested in the biopharmaceutical sector. In this article, we'll delve into the details of Lonza stock, exploring its market performance, future prospects, and investment strategies.

Understanding Lonza's Business Model

Lonza, headquartered in Basel, Switzerland, is a global leader in life sciences, offering solutions for pharmaceutical and biotech companies. The company's core competencies include biopharmaceutical manufacturing, cell therapy, and gene therapy. Lonza's diverse product portfolio and strategic partnerships with leading pharmaceutical companies have contributed to its strong market position.

Market Performance of Lonza Stock

Since its initial public offering (IPO) in 2015, Lonza stock has seen a remarkable rise, making it one of the most sought-after investments in the biopharmaceutical industry. Over the past few years, the stock has demonstrated a steady increase in value, with several factors contributing to this growth.

One of the key factors has been Lonza's strong financial performance. The company reported revenue of approximately

Future Prospects of Lonza Stock

Looking ahead, Lonza's future prospects appear promising, driven by several factors. Firstly, the growing demand for biopharmaceutical products is expected to continue, as the industry experiences rapid growth. According to a report by Grand View Research, the global biopharmaceutical market is projected to reach $600 billion by 2025.

Secondly, Lonza's expansion into new markets, such as China and India, will help the company tap into the growing demand for biopharmaceutical products in these regions. Additionally, Lonza's investment in research and development will likely lead to new product launches and improve its competitive position in the market.

Investment Strategies for Lonza Stock

Investing in Lonza stock requires a thorough understanding of the market and a well-defined investment strategy. Here are a few tips for potential investors:

Diversify Your Portfolio: Consider including Lonza stock in a diversified portfolio, as it can offer exposure to the biopharmaceutical industry.

Analyze Financial Ratios: Evaluate Lonza's financial ratios, such as earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio, to gain insights into its financial health.

Monitor Industry Trends: Stay informed about the latest developments in the biopharmaceutical industry, as these trends can impact Lonza's stock performance.

Long-term Perspective: Given the nature of the biopharmaceutical industry, investing in Lonza stock requires a long-term perspective.

Case Study: Lonza's Collaboration with Novartis

One of Lonza's notable partnerships is with Novartis, a global leader in pharmaceuticals. In 2019, the two companies announced a collaboration to develop and produce cell therapy products. This partnership not only demonstrates Lonza's commitment to innovation but also highlights its strong position in the biopharmaceutical market.

In conclusion, Lonza Group AG is a compelling investment opportunity in the biopharmaceutical sector. With its robust business model, impressive market performance, and promising future prospects, Lonza stock could be a valuable addition to your investment portfolio.

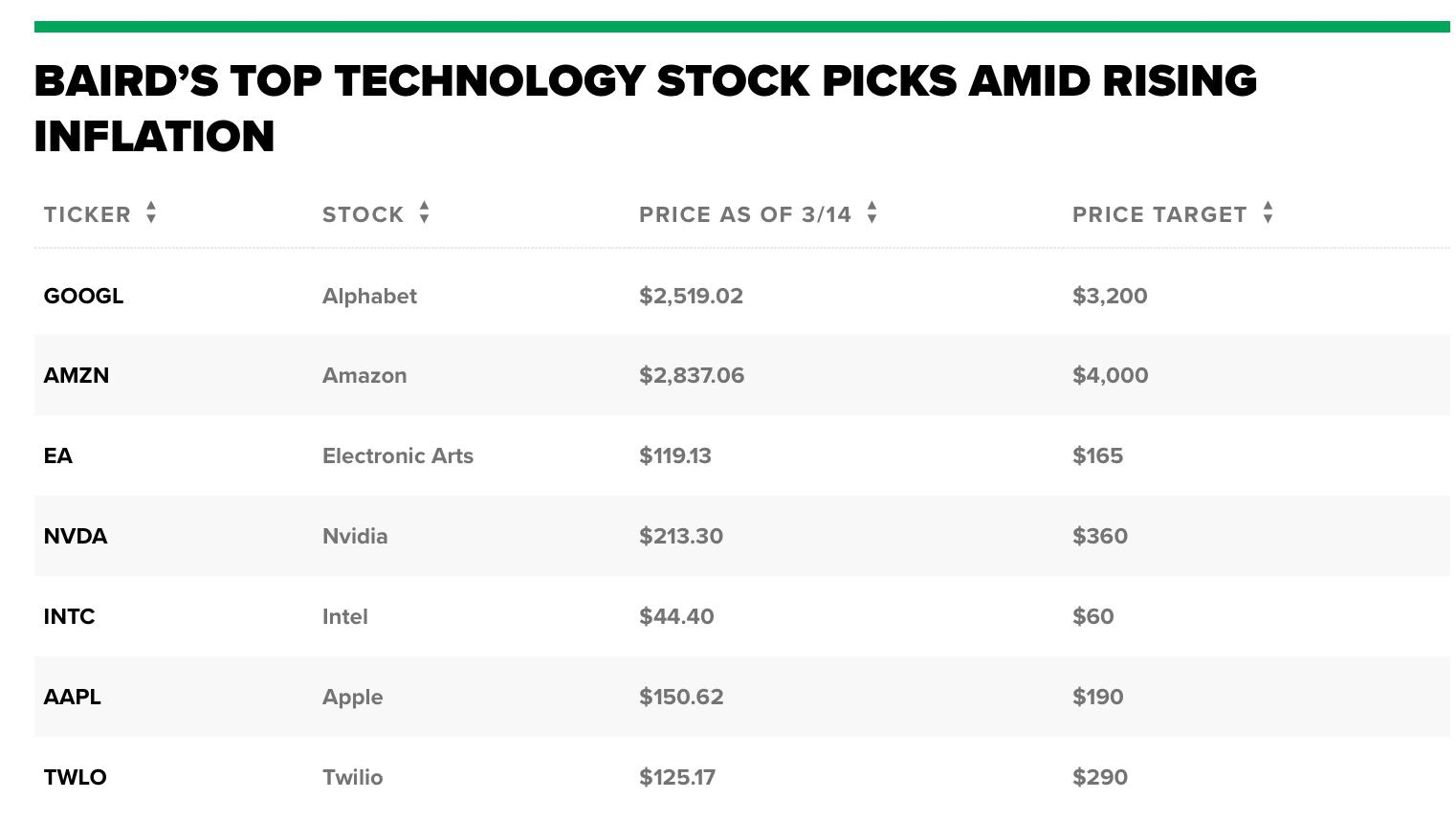

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....