In 2017, the United States stock market experienced a period of significant growth, raising concerns about the potential for a stock bubble. This article delves into the factors that contributed to this bubble, its impact on the market, and the lessons learned from this period.

The Rise of the Stock Market in 2017

In 2017, the US stock market reached record highs, with the S&P 500 index surpassing 2,800 points. This surge in stock prices was driven by several factors, including strong economic growth, low unemployment rates, and the implementation of tax cuts by the Trump administration.

Factors Contributing to the Bubble

Several factors contributed to the formation of the stock bubble in 2017. One of the primary factors was the low-interest-rate environment, which made it cheaper for companies to borrow money and invest in their businesses. Additionally, the Federal Reserve's decision to keep interest rates low further fueled the stock market's growth.

Another factor was the surge in corporate earnings. Many companies reported strong profits, which led to higher stock prices. However, some of these earnings were driven by cost-cutting measures rather than organic growth, raising concerns about the sustainability of these profits.

Impact of the Bubble

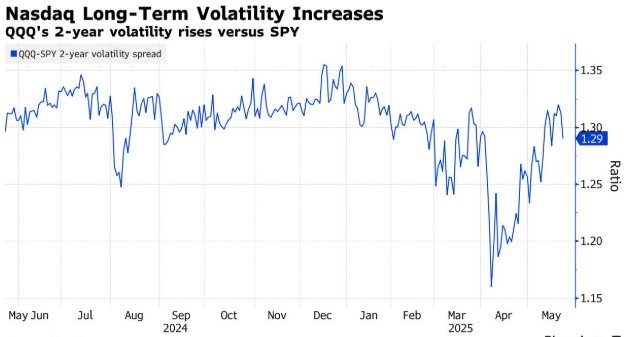

The stock bubble in 2017 had several impacts on the market. Firstly, it led to increased volatility, with stock prices fluctuating widely in a short period. Secondly, it created a sense of euphoria among investors, leading to excessive risk-taking and speculative trading.

Moreover, the bubble had a negative impact on the broader economy. As stock prices surged, many investors became complacent, believing that the market would continue to rise indefinitely. This led to a misallocation of capital, as investors focused on stocks rather than other investment opportunities.

Lessons Learned

The stock bubble in 2017 served as a reminder of the importance of risk management and diversification. Investors need to be aware of the potential risks associated with investing in the stock market and should not rely solely on stock prices to determine their investment decisions.

Furthermore, the bubble highlighted the need for regulatory oversight. The Federal Reserve and other regulatory bodies should monitor the market closely and take action to prevent excessive speculation and ensure market stability.

Case Studies

One notable case study of the 2017 stock bubble is the rise of tech stocks. Companies like Apple, Amazon, and Google saw their stock prices soar to unprecedented levels. However, some investors began to question the sustainability of these high valuations, leading to a correction in the tech sector later in the year.

Another case study is the rise of cryptocurrencies. In 2017, Bitcoin and other cryptocurrencies experienced a dramatic surge in value, raising concerns about a speculative bubble. This highlighted the need for caution when investing in emerging markets and new technologies.

In conclusion, the stock bubble in 2017 was a significant event that had a lasting impact on the US stock market. By understanding the factors that contributed to the bubble and the lessons learned from this period, investors can better navigate the market and make informed investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....