Are you interested in investing in the US stock market but don't know where to start? You're not alone. Many individuals and investors are looking to enter the US stock market, but they're unsure of the process. In this article, we'll guide you through the steps to help you get started on your investment journey.

Understanding the US Stock Market

Before diving into the investment process, it's crucial to understand the US stock market. The US stock market is one of the largest and most liquid in the world, with numerous exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list thousands of companies, ranging from small startups to multinational corporations.

Opening a Brokerage Account

The first step in entering the US stock market is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. Here are some tips for choosing a brokerage account:

- Research: Look for a brokerage with a strong reputation, low fees, and a user-friendly platform.

- Fees: Consider the fees associated with the account, including trading fees, account maintenance fees, and any other hidden costs.

- Platform: Choose a platform that meets your needs, whether you're a beginner or an experienced investor.

Understanding Stock Market Terms

To navigate the US stock market, you need to understand some key terms:

- Stock: A share of ownership in a company.

- Ticker Symbol: A unique identifier for a stock, such as AAPL for Apple Inc.

- Market Cap: The total value of a company's outstanding shares.

- Dividend: A portion of a company's profits distributed to shareholders.

Choosing Stocks to Invest In

Once you have a brokerage account, it's time to choose stocks to invest in. Here are some strategies to help you make informed decisions:

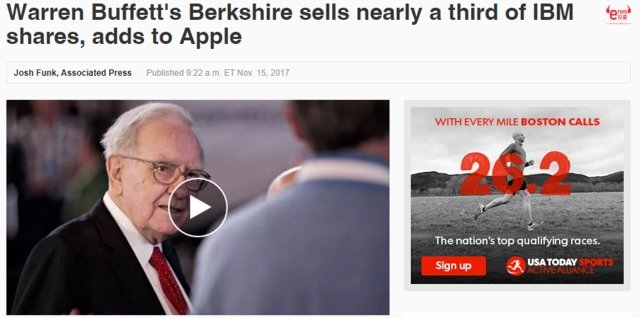

- Research: Conduct thorough research on companies you're interested in, including their financial statements, business model, and market position.

- Diversify: Don't put all your money into one stock. Diversify your portfolio to reduce risk.

- Long-Term Investing: Consider long-term investing rather than trying to time the market. Historically, long-term investing has proven to be more profitable.

Using Stop-Loss Orders

To protect your investments, consider using stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a certain price. This can help you limit potential losses.

Monitoring Your Investments

Once you've invested in the US stock market, it's important to monitor your investments regularly. Keep an eye on the market, your portfolio, and the companies you've invested in. This will help you make informed decisions and adjust your strategy as needed.

Case Study: Investing in Apple Inc.

Let's say you're interested in investing in Apple Inc. (AAPL). After conducting thorough research, you decide that Apple is a solid investment. You open a brokerage account, deposit funds, and purchase 100 shares of Apple stock at $150 per share. Over the next few years, Apple's stock price increases, and you decide to sell your shares for a profit.

Conclusion

Entering the US stock market can be a daunting task, but with the right knowledge and strategy, you can successfully navigate the market and potentially earn a significant return on your investments. By opening a brokerage account, understanding stock market terms, choosing stocks to invest in, and monitoring your investments, you can take the first steps towards becoming a successful investor.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....