In the ever-evolving world of finance, investors are constantly seeking answers to their most pressing questions. One of the most common queries is whether US stocks are heading downward. This article delves into the factors that could potentially lead to a decline in the US stock market and provides a comprehensive analysis to help investors make informed decisions.

Economic Indicators and Stock Market Trends

The stock market is influenced by a variety of economic indicators. One of the most critical factors is the Federal Reserve's monetary policy. Interest rates play a significant role in the stock market's performance. When the Federal Reserve raises interest rates, borrowing costs increase, which can lead to a slowdown in economic growth and a subsequent decline in stock prices.

Another important economic indicator is unemployment rates. Lower unemployment rates often indicate a strong economy, which can drive stock prices higher. Conversely, higher unemployment rates can signal economic weakness and potentially lead to a decline in stock prices.

Market Sentiment and Geopolitical Factors

Market sentiment is another crucial factor that can impact the stock market. When investors are optimistic about the future, they are more likely to invest in stocks, driving prices higher. However, when sentiment turns negative, investors may sell off their stocks, leading to a decline in prices.

Geopolitical factors, such as trade wars and political instability, can also have a significant impact on the stock market. For example, the trade war between the United States and China has caused uncertainty and volatility in the stock market.

Sector-Specific Risks

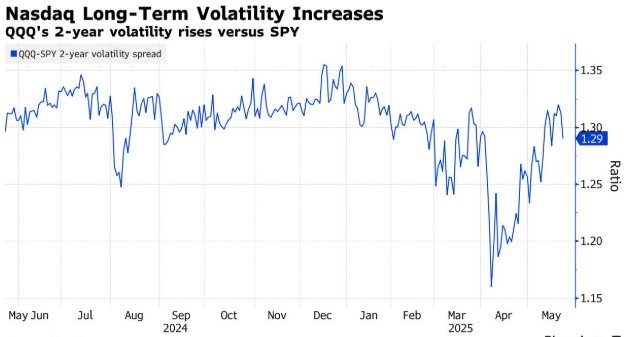

Certain sectors of the stock market are more vulnerable to specific risks. For instance, the technology sector has experienced significant growth in recent years, but it is also more susceptible to regulatory changes and market sentiment shifts.

The energy sector is another area that can be affected by geopolitical factors and changes in oil prices. A decrease in oil prices can negatively impact energy stocks, while an increase in prices can have the opposite effect.

Historical Stock Market Performance

Looking at historical data can provide valuable insights into the potential direction of the stock market. Over the past few decades, the US stock market has experienced both bull and bear markets. While it is impossible to predict the future with certainty, historical trends can offer some guidance.

For example, the stock market experienced a significant downturn during the 2008 financial crisis. However, it recovered strongly in the following years. This demonstrates the resilience of the stock market and the potential for recovery even after a major decline.

Case Studies

To illustrate the potential risks and opportunities in the stock market, let's consider a few case studies:

- Tech Giant Decline: In 2021, tech giant Facebook (now Meta) experienced a significant decline in its stock price after announcing a major restructuring and a shift in focus to the metaverse. This event highlights how sector-specific risks can impact individual stocks.

- Energy Sector Volatility: In 2020, the energy sector experienced significant volatility due to the COVID-19 pandemic and subsequent decrease in oil demand. However, as the global economy began to recover, oil prices and energy stocks started to rebound.

Conclusion

While it is impossible to predict the future direction of the US stock market with certainty, understanding the various factors that can influence it is crucial for investors. By analyzing economic indicators, market sentiment, and sector-specific risks, investors can make more informed decisions and navigate the complexities of the stock market.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....