In the ever-fluctuating world of the stock market, investors are always on the lookout for opportunities to capitalize on monthly gains. The US stock indexes, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, are key indicators of market trends and investor sentiment. This article delves into the monthly gains of these indexes, offering insights into the factors that drive their performance and potential investment strategies.

Understanding Monthly Gains

Monthly gains refer to the increase in the value of a stock index over a period of one month. This metric is crucial for investors as it provides a snapshot of the market's direction and the potential for returns. For instance, if the S&P 500 index increases by 2% in a month, it indicates that the overall performance of the 500 largest companies in the United States has improved.

Factors Influencing Monthly Gains

Several factors can influence the monthly gains of US stock indexes. These include:

- Economic Indicators: Data such as GDP, unemployment rates, and inflation rates can significantly impact investor sentiment and the stock market.

- Corporate Earnings: Strong earnings reports from companies can boost investor confidence and drive index gains.

- Political Events: Elections, trade agreements, and regulatory changes can create uncertainty and volatility in the stock market.

- Technological Advancements: Innovations and advancements in technology can drive growth in specific sectors and contribute to index gains.

Recent Monthly Gains

Let's take a look at some recent monthly gains of the US stock indexes:

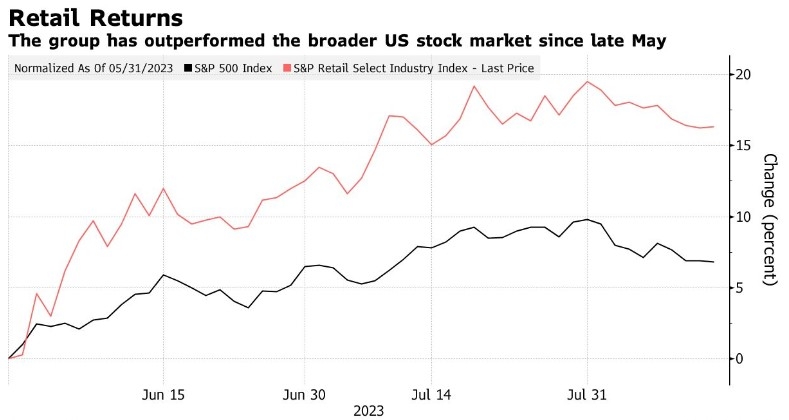

- S&P 500: In the past 12 months, the S&P 500 has experienced a 9.2% increase. This can be attributed to factors such as strong corporate earnings, low unemployment rates, and favorable economic conditions.

- Dow Jones Industrial Average: The Dow Jones has seen a 6.5% increase over the same period. This gain can be attributed to the performance of its largest components, such as Apple and Microsoft.

- NASDAQ Composite: The NASDAQ has experienced the most significant growth, with a 15.8% increase. This can be attributed to the strong performance of technology companies, such as Tesla and Facebook.

Investment Strategies for Monthly Gains

Investors looking to capitalize on monthly gains can consider the following strategies:

- Diversification: Diversifying your portfolio across different sectors and asset classes can help mitigate risk and maximize returns.

- Focus on Strong Companies: Investing in companies with strong fundamentals, such as strong earnings and low debt levels, can increase the likelihood of monthly gains.

- Stay Informed: Keeping up with economic indicators and market trends can help you make informed decisions and capitalize on opportunities.

Case Studies

To illustrate the impact of monthly gains, let's consider a hypothetical scenario:

- Investor A: Invests

10,000 in the S&P 500 index at the beginning of the year. By the end of the year, the index has increased by 9.2%. Investor A's investment is now worth 10,920. - Investor B: Invests

10,000 in a technology-focused ETF. By the end of the year, the ETF has increased by 15.8%. Investor B's investment is now worth 11,580.

As you can see, the difference in monthly gains can have a significant impact on the overall returns of an investment.

In conclusion, monthly gains in US stock indexes are influenced by a variety of factors, including economic indicators, corporate earnings, and political events. By understanding these factors and implementing effective investment strategies, investors can capitalize on these gains and achieve their financial goals.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....