Introduction

India, with its burgeoning middle class and growing interest in financial markets, has seen a surge in demand for international investments, particularly in US stocks. The allure of the American stock market is undeniable, with its diverse range of sectors and companies offering investors a wide array of opportunities. However, trading US stocks from India can be a complex task. In this article, we will guide you through the process of trading US stocks in India, including the necessary steps and platforms to consider.

Understanding the Basics

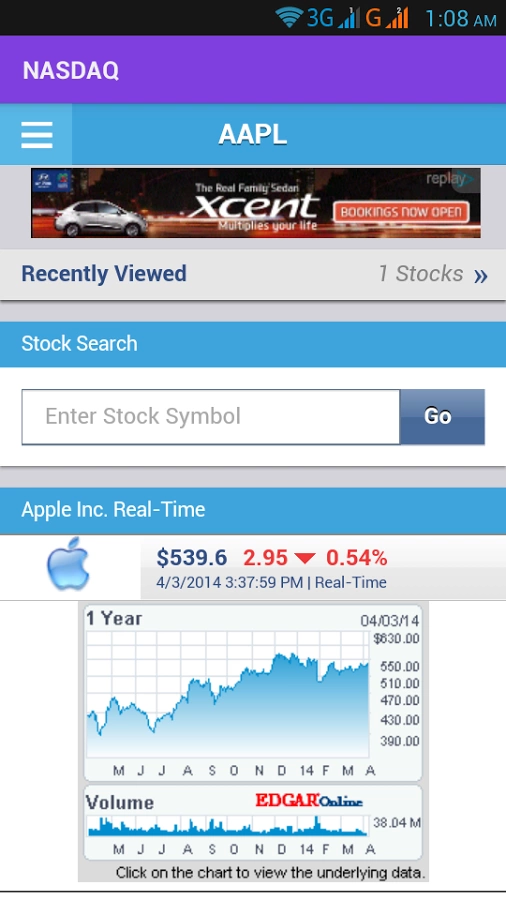

Before delving into the intricacies of trading US stocks from India, it's crucial to understand the basics. The US stock market is primarily composed of two major exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list stocks from a wide range of industries, including technology, finance, healthcare, and more.

Regulatory Considerations

One of the first hurdles to overcome is the regulatory framework. While India has its own stock market regulations, trading US stocks requires adherence to both Indian and US regulations. This includes understanding the Foreign Exchange Management Act (FEMA) in India and the relevant regulations in the US.

Choosing a Platform

To trade US stocks from India, you need to choose a reliable platform that offers access to the US stock market. Here are some popular options:

Online Brokers: Many Indian online brokers offer access to the US stock market. These include Zerodha, Upstox, and Angel One. These platforms often charge a flat fee per trade or a percentage of the trade value.

Global Brokers: Some international brokers, like Interactive Brokers and TD Ameritrade, offer services to Indian investors. These brokers usually have a more comprehensive range of services and research tools but may charge higher fees.

Banking Platforms: Some Indian banks, such as HDFC Bank and ICICI Bank, offer platforms that allow customers to trade US stocks. These platforms are convenient but may have limited research and trading tools.

Opening an Account

Once you have chosen a platform, the next step is to open an account. This process typically involves providing your personal and financial information, including your PAN card, Aadhaar card, and bank details. Some platforms may also require you to complete a Know Your Customer (KYC) process.

Understanding Trading Hours

It's important to note that the US stock market operates during different hours than the Indian market. The trading hours for the NYSE and NASDAQ are typically from 9:30 AM to 4:00 PM Eastern Time (ET). This means that you will need to be aware of the time difference when placing trades.

Risk Management

Trading US stocks involves risks, just like any other investment. It's crucial to understand these risks and implement effective risk management strategies. This includes diversifying your portfolio, setting stop-loss orders, and not investing more than you can afford to lose.

Conclusion

Trading US stocks from India can be a rewarding investment opportunity. By understanding the basics, choosing the right platform, and implementing effective risk management strategies, you can navigate the complexities of the US stock market and potentially benefit from its diverse range of opportunities.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....