In the fast-paced world of investing, identifying stocks with strong momentum can be the key to significant returns. When it comes to US large-cap stocks, certain companies have been making waves with their impressive 5-day performance. This article delves into the best momentum stocks in the US large-cap sector and provides an analysis of their recent performance.

Top Momentum Stocks in US Large Cap

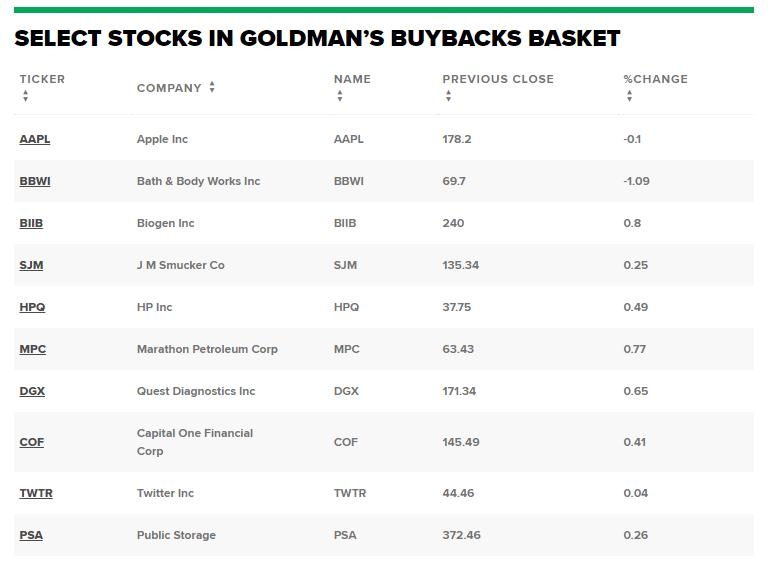

Apple Inc. (AAPL) *Performance: Apple has been a powerhouse in the tech industry, and its 5-day performance reflects its continued dominance. With a strong pipeline of innovative products and services, Apple has managed to maintain its position as a leader in the tech sector. *Analysis: The stock has seen a surge in momentum due to strong earnings reports and positive sentiment from investors. Its robust financial performance and commitment to innovation make it a top pick for momentum investors.

Microsoft Corporation (MSFT) *Performance: Microsoft has been on a roll, with its 5-day performance showcasing its resilience and growth potential. The company's cloud computing services and software offerings have been key drivers of its success. *Analysis: Investors are optimistic about Microsoft's long-term prospects, particularly in the cloud computing sector. Its diversified revenue streams and strategic partnerships have contributed to its momentum.

Amazon.com, Inc. (AMZN) *Performance: Amazon has been a dominant force in the e-commerce and cloud computing markets. Its 5-day performance reflects its ability to adapt to changing consumer trends and maintain its market leadership. *Analysis: The stock's momentum is driven by strong sales growth, expansion into new markets, and investments in technology. Amazon's commitment to innovation and customer satisfaction continues to attract investors.

Johnson & Johnson (JNJ) *Performance: Johnson & Johnson has been a stable performer in the healthcare sector, with its 5-day performance reflecting its strong fundamentals and growth potential. *Analysis: The company's diversified portfolio of healthcare products and services, along with its commitment to research and development, has contributed to its momentum. Investors are confident in its ability to navigate the healthcare landscape.

Procter & Gamble Co. (PG) *Performance: Procter & Gamble has been a reliable performer in the consumer goods sector, with its 5-day performance highlighting its resilience and growth potential. *Analysis: The company's focus on innovation and brand-building has contributed to its momentum. Its strong global presence and diverse product portfolio make it an attractive investment for momentum investors.

Case Study: Tesla, Inc. (TSLA)

Tesla, Inc. has been a prime example of a stock with significant momentum in the US large-cap sector. The electric vehicle manufacturer has seen a remarkable surge in its stock price over the past few years, driven by its innovative products and strong market demand.

*Performance: Tesla's 5-day performance showcases its continued growth trajectory. The company has managed to maintain its position as a leader in the electric vehicle market, despite facing challenges and competition. *Analysis: Tesla's momentum is fueled by its commitment to innovation, expansion into new markets, and strong brand recognition. Its ability to disrupt the traditional automotive industry has captured the attention of investors and analysts alike.

In conclusion, identifying stocks with strong momentum can be a lucrative strategy for investors. By analyzing the performance and fundamentals of US large-cap stocks, investors can make informed decisions and capitalize on potential opportunities. The best momentum stocks in the US large-cap sector, as highlighted in this article, offer a glimpse into the potential of the market and the importance of staying informed and adapting to changing trends.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....