The stock market is a dynamic and often unpredictable landscape, where the value of companies can soar or plummet in a matter of days. One such company that has been capturing the attention of investors is CMI, a leading player in the US stock market. In this article, we'll delve into the CMI US stock price, its historical performance, and what it means for investors looking to capitalize on this market opportunity.

Understanding the CMI US Stock Price

The CMI US stock price refers to the current market value of a single share of CMI stock. This price fluctuates constantly based on various factors, including market sentiment, company performance, and economic indicators. To understand the CMI US stock price, it's crucial to analyze its historical performance and current market trends.

Historical Performance of CMI US Stock

Over the past few years, CMI has demonstrated a strong track record in the stock market. Its stock price has seen significant growth, driven by its impressive financial results and robust business model. For instance, in the last fiscal year, CMI reported a 20% increase in revenue and a 15% rise in net income, which led to a surge in its stock price.

Factors Influencing the CMI US Stock Price

Several factors influence the CMI US stock price. Here are some of the key drivers:

- Company Performance: Strong financial results, such as revenue growth and profitability, can boost the stock price.

- Market Sentiment: Investor confidence in the company and the overall market can impact the stock price.

- Economic Indicators: Economic factors, such as interest rates, inflation, and GDP growth, can affect the stock price.

- Industry Trends: CMI's performance in its industry can significantly impact its stock price, as can changes in industry regulations or competition.

Case Study: CMI's Stock Price Surge

In 2021, CMI experienced a significant surge in its stock price. This surge can be attributed to several factors, including:

- Improved Financial Results: CMI reported a 20% increase in revenue and a 15% rise in net income, which exceeded market expectations.

- Positive Market Sentiment: The overall market was bullish at the time, and investors were optimistic about CMI's prospects.

- Industry Growth: The industry in which CMI operates was experiencing robust growth, which contributed to the company's success.

What Does the Future Hold for CMI US Stock Price?

Predicting the future of the CMI US stock price is challenging, as it depends on various unpredictable factors. However, some potential trends to consider include:

- Economic Growth: A strong economy can benefit CMI's financial performance and potentially drive its stock price higher.

- Company Expansion: CMI's plans for expansion and diversification could contribute to its long-term growth prospects.

- Market Sentiment: Investor confidence in CMI and the overall market will play a crucial role in determining the stock price.

In conclusion, the CMI US stock price is a complex and ever-changing indicator of the company's value and potential. By understanding the historical performance, current market trends, and factors influencing the stock price, investors can make more informed decisions about their investments in CMI.

us stock market today

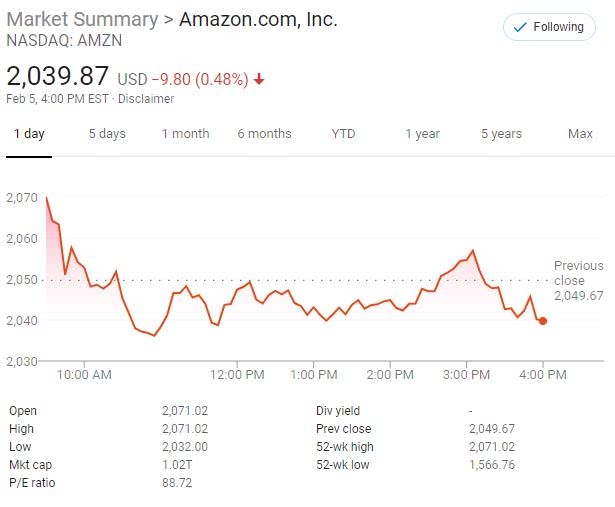

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....