In recent years, the relationship between the United States and China has been marked by increasing tensions, particularly in the business sector. One significant area of contention has been the delisting of Chinese stocks from US exchanges. This article delves into the reasons behind this trend, its implications for both the Chinese and American markets, and potential solutions to this ongoing issue.

The Rising Tensions

The delisting of Chinese stocks from US exchanges has been a result of growing tensions between the two nations. Issues such as intellectual property theft, trade disputes, and cybersecurity concerns have all contributed to this situation. As a result, the US government has taken several measures to address these concerns, including the delisting of Chinese companies from US exchanges.

Reasons for Delisting

One of the primary reasons for the delisting of Chinese stocks from US exchanges is the lack of transparency and accountability in the Chinese corporate sector. Many Chinese companies have been accused of hiding financial information and engaging in fraudulent activities. This lack of transparency has made it difficult for US investors to make informed decisions.

Another reason is the increasing scrutiny from the US government. In 2020, the US House of Representatives passed the Holding Foreign Companies Accountable Act (HFCAA), which requires foreign companies listed on US exchanges to submit their audits to the Public Company Accounting Oversight Board (PCAOB). Failure to comply with these requirements can lead to delisting.

Implications for the Chinese Market

The delisting of Chinese stocks from US exchanges has had a significant impact on the Chinese market. Many Chinese companies rely on US exchanges for funding and access to global investors. The delisting has limited their ability to raise capital and has negatively impacted their market value.

Furthermore, the delisting has also raised concerns about the future of the Chinese stock market. With fewer foreign investors participating in the market, the Chinese market may become more volatile and less efficient.

Implications for the US Market

The delisting of Chinese stocks from US exchanges has also had implications for the US market. Many US investors have invested heavily in Chinese stocks, and the delisting has resulted in significant losses for these investors. This has raised concerns about the safety of investing in foreign stocks and has led to a decrease in investor confidence.

Case Studies

One notable case is that of China Telecom Corporation Limited, which was delisted from the New York Stock Exchange in 2021. The company was unable to comply with the HFCAA requirements and was subsequently delisted. This case highlights the challenges that Chinese companies face when trying to operate in the US market.

Another case is that of Alibaba Group Holding Limited, which was also threatened with delisting. However, the company managed to comply with the HFCAA requirements and avoid delisting. This case demonstrates the importance of transparency and accountability in maintaining access to the US market.

Potential Solutions

To address the issue of delisting, both the US and Chinese governments need to work together to improve transparency and accountability in the Chinese corporate sector. This could involve the establishment of a joint audit committee or the implementation of stricter regulations.

Additionally, the US government could consider creating a special regulatory framework for Chinese companies listed on US exchanges. This framework could address the concerns of both the US and Chinese governments while allowing Chinese companies to continue operating in the US market.

In conclusion, the delisting of Chinese stocks from US exchanges is a complex issue with significant implications for both the Chinese and American markets. Addressing this issue requires a collaborative approach from both governments and a commitment to transparency and accountability.

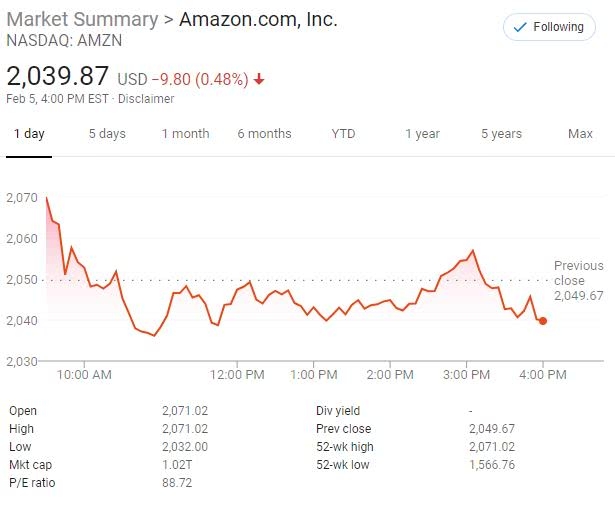

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....