Introduction: The ongoing US-China trade war has been a significant topic of discussion in the financial world. The conflict between the two economic giants has led to a variety of consequences, one of which is its impact on stocks. In this article, we will explore how the US-China trade war has affected the stock market and what investors can expect in the future.

Impact on Stocks

1. Decline in Stock Prices

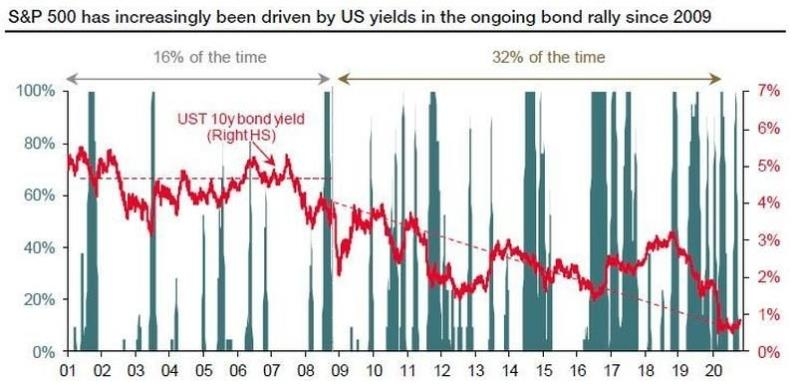

One of the most immediate impacts of the US-China trade war has been a decline in stock prices. As tensions escalate, investors often become more cautious, leading to a sell-off in the market. This can be seen in the S&P 500 and the NASDAQ, where many companies have a significant presence in both the US and China.

2. Sector-Specific Effects

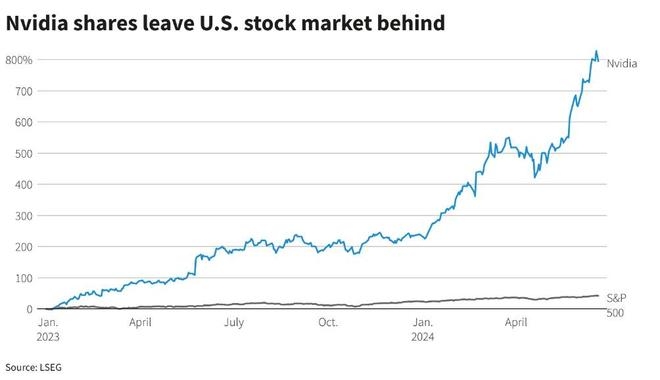

The trade war has had a varied impact on different sectors. For example, technology companies that have a significant presence in China, such as Apple and Micron, have seen their stocks decline due to the potential for increased tariffs and supply chain disruptions. On the other hand, companies that rely on the US market, such as Walmart and Home Depot, have seen their stocks perform relatively well.

3. Volatility in the Market

The trade war has also contributed to increased volatility in the stock market. With the possibility of new tariffs and trade restrictions, investors are often uncertain about the future, leading to rapid changes in stock prices.

Case Study: Apple

One of the most notable examples of the impact of the US-China trade war on stocks is Apple Inc. The company, which relies heavily on its Chinese market for sales, has seen its stock price decline as a result of the trade tensions. Additionally, Apple has been forced to raise the prices of some of its products in China, which has also affected its sales.

Investment Strategies

Given the ongoing nature of the US-China trade war, investors need to be cautious when it comes to their stock investments. Here are some strategies that investors can consider:

Diversify Your Portfolio: Diversifying your portfolio can help mitigate the risks associated with the trade war. Investing in companies across various sectors and geographical locations can provide a level of protection against market volatility.

Focus on Companies with Strong Domestic Markets: Investing in companies that have a strong presence in the US market can help reduce the impact of the trade war on your portfolio.

Monitor the Situation: Keep a close eye on the developments of the trade war and its impact on the stock market. This will help you make informed decisions regarding your investments.

Conclusion:

The US-China trade war has had a significant impact on the stock market. While the decline in stock prices and increased volatility can be concerning, investors can mitigate the risks by adopting a cautious and diversified investment strategy. As the situation continues to evolve, it is essential for investors to stay informed and adapt their strategies accordingly.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....