As we approach October 2025, investors are keenly analyzing the current US stock market outlook. With economic indicators, technological advancements, and geopolitical events shaping the market landscape, it is crucial to understand the key factors influencing the stock market's direction. This article delves into the current state of the US stock market, highlighting significant trends and potential opportunities for investors.

Economic Indicators

One of the primary factors influencing the stock market is the state of the economy. In October 2025, economic indicators such as GDP growth, unemployment rates, and inflation are closely monitored. While the US economy is expected to continue growing, investors are watching for any signs of a slowdown or recession.

Tech Stocks

Technology stocks have been a major driving force in the US stock market, and this trend is likely to continue in October 2025. Companies like Apple, Google, and Microsoft have seen significant growth in recent years, and their dominance in the market is expected to persist. However, investors should be cautious of potential regulatory challenges and competition from emerging markets.

Energy Sector

The energy sector has experienced a remarkable turnaround in recent years, thanks to advancements in technology and increased production. In October 2025, the energy sector is expected to remain a strong performer, driven by rising oil prices and increased demand for energy resources. Companies involved in renewable energy, such as solar and wind power, are also gaining traction.

Geopolitical Events

Geopolitical events can have a significant impact on the stock market. In October 2025, investors are keeping a close eye on global tensions, including trade disputes and political instability. While these events can create uncertainty, they can also present opportunities for investors to capitalize on market fluctuations.

Sector Analysis

Several sectors are expected to perform well in October 2025. Here are some key sectors to watch:

- Healthcare: The healthcare sector is expected to see robust growth, driven by an aging population and advancements in medical technology.

- Consumer Discretionary: As the economy continues to improve, consumer spending is expected to increase, benefiting companies in the consumer discretionary sector.

- Financials: The financial sector is expected to perform well, supported by low interest rates and a strong economy.

Case Studies

To illustrate the potential opportunities in the US stock market, let's consider a few case studies:

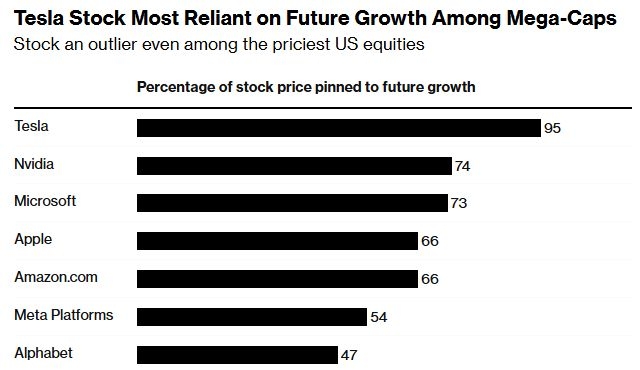

- Tesla: As an electric vehicle manufacturer, Tesla has seen remarkable growth in recent years. In October 2025, the company is expected to continue its upward trajectory, driven by increasing demand for electric vehicles and government incentives.

- Nike: The athletic footwear and apparel company has seen strong sales growth, driven by innovative products and a strong brand presence. In October 2025, Nike is expected to remain a top performer in the consumer discretionary sector.

- ExxonMobil: As an oil and gas company, ExxonMobil has seen significant growth in recent years, thanks to increased production and technological advancements. In October 2025, the company is expected to continue its upward trend, driven by rising oil prices.

In conclusion, the current US stock market outlook for October 2025 is promising, with several sectors poised for growth. However, investors should remain cautious and stay informed about the latest economic indicators and geopolitical events. By carefully analyzing the market and understanding key trends, investors can make informed decisions and potentially achieve significant returns.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....