Are you a Canadian investor looking to expand your portfolio? Have you ever wondered if you can trade US stocks? The answer is a resounding yes! Trading US stocks from Canada is not only possible but also offers numerous benefits. In this article, we will explore the ins and outs of trading US stocks from Canada, including the process, regulations, and tips for successful investing.

Understanding the Basics

To begin with, it's essential to understand that trading US stocks from Canada is no different from trading stocks within Canada. The primary difference lies in the brokerage firm you choose. While Canadian brokerage firms are regulated by the Canadian Securities Administrators (CSA), US brokerage firms are regulated by the Securities and Exchange Commission (SEC).

Choosing the Right Brokerage Firm

The first step in trading US stocks from Canada is to choose a reliable brokerage firm. Here are some factors to consider when selecting a brokerage firm:

- Regulation: Ensure that the brokerage firm is regulated by both the CSA and the SEC.

- Fees: Compare the fees charged by different brokerage firms, including commission rates, currency conversion fees, and other related charges.

- Platform: Look for a user-friendly platform that offers advanced features, such as real-time quotes, charting tools, and research reports.

- Customer Support: Choose a brokerage firm with excellent customer support, including responsive customer service and educational resources.

Opening an Account

Once you have chosen a brokerage firm, the next step is to open an account. The process is similar to opening an account with a Canadian brokerage firm:

- Provide Personal Information: Fill out a form with your personal information, including your name, address, and social insurance number.

- Proof of Identity: Submit a government-issued ID, such as a driver's license or passport.

- Proof of Residence: Provide proof of your Canadian address, such as a utility bill or bank statement.

- Funding Your Account: Transfer funds from your Canadian bank account to your brokerage account.

Trading US Stocks

Once your account is funded, you can start trading US stocks. Here are some tips for successful trading:

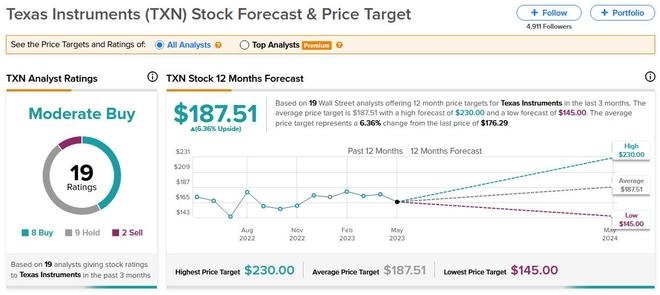

- Research: Conduct thorough research on the companies you are interested in before making any investment decisions.

- Diversify: Diversify your portfolio to reduce risk and maximize returns.

- Stay Informed: Keep up with market news and economic indicators that may affect the stocks you are trading.

- Use Stop-Loss Orders: Use stop-loss orders to protect your investments from significant losses.

Case Study: Investing in US Tech Stocks

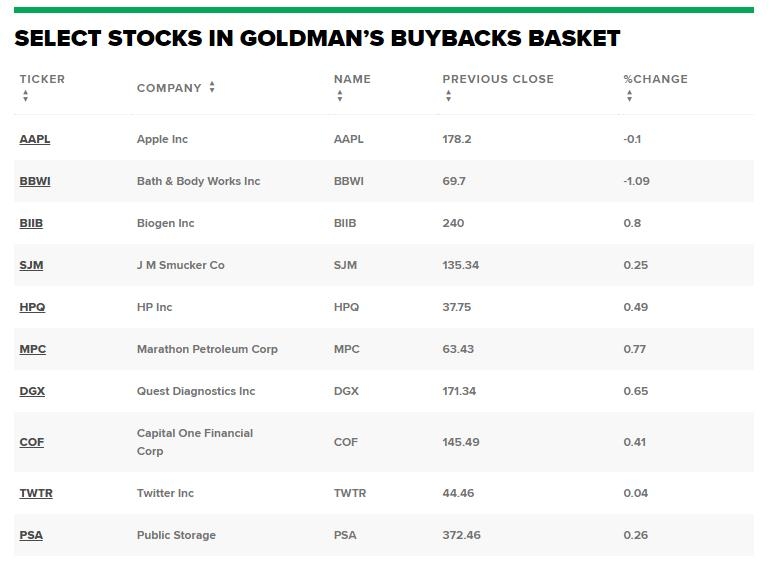

Let's consider a hypothetical scenario where a Canadian investor decides to invest in US tech stocks. By following the steps outlined in this article, the investor selects a reputable brokerage firm, opens an account, and funds it. After conducting thorough research, the investor decides to invest in a well-known tech company, such as Apple Inc. (AAPL).

By using the brokerage firm's platform, the investor can monitor the stock's performance, set stop-loss orders, and make informed decisions based on market news and economic indicators. Over time, the investor's investment in US tech stocks grows, providing a valuable addition to their Canadian portfolio.

Conclusion

Trading US stocks from Canada is a viable and beneficial option for Canadian investors. By choosing the right brokerage firm, opening an account, and conducting thorough research, investors can successfully expand their portfolios and achieve their financial goals.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....