In the ever-evolving world of finance, the US stock market remains a key indicator of economic health and investment potential. The year 2018 was marked by significant ups and downs, as the market responded to a variety of global and domestic factors. In this article, we delve into the 2018 US stock market chart, offering a comprehensive overview of the year's trends and insights.

The Year in Review

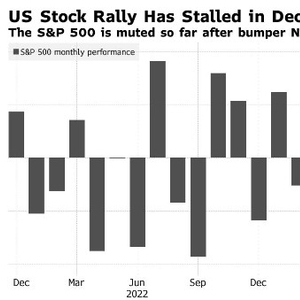

The US stock market in 2018 began on a strong note, with the S&P 500 Index reaching an all-time high in early January. However, as the year progressed, several headwinds emerged, including trade tensions, rising interest rates, and political uncertainty. These factors led to a turbulent period, with the market experiencing its worst December in over a decade.

Key Trends in 2018

- Rising Interest Rates: The Federal Reserve raised interest rates four times in 2018, leading to concerns about higher borrowing costs and potential economic slowdown.

- Trade Tensions: The ongoing trade war between the US and China created uncertainty and volatility in the market, particularly affecting sectors like technology and manufacturing.

- Political Uncertainty: The midterm elections and ongoing political debates contributed to market volatility, as investors remained cautious about the potential impact on policy and economic conditions.

- Tech Sector Performance: The technology sector, which had been a major driver of market gains in previous years, experienced a downturn in 2018, with major tech companies facing regulatory scrutiny and investor concerns.

Analysis of the US Stock Market Chart

Looking at the 2018 US stock market chart, we can observe several notable trends:

- Early Gains: The year began with strong gains, as the S&P 500 Index reached an all-time high in early January.

- Turbulent Mid-Year: The market experienced significant volatility in the second half of the year, with several sharp declines and recoveries.

- Late-Year Decline: The market closed the year with a notable decline, as investors grappled with rising interest rates, trade tensions, and political uncertainty.

Case Study: Apple Inc.

Apple Inc., one of the largest companies in the S&P 500 Index, serves as an interesting case study for the 2018 stock market. The company's stock price experienced a strong start to the year, mirroring the broader market's gains. However, as the year progressed, Apple faced challenges, including slowing iPhone sales and increased regulatory scrutiny. These factors contributed to a decline in the company's stock price, which mirrored the broader market's trends.

Conclusion

The 2018 US stock market chart reflects a year of volatility and uncertainty. While the market began on a strong note, it faced significant headwinds throughout the year. By analyzing the key trends and case studies, investors can gain valuable insights into the complexities of the stock market and the factors that influence its performance.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....