The financial markets are on edge as investors brace for the Federal Reserve's upcoming meeting. With anticipation building, US stock futures have taken a dive, signaling a cautious approach to the potential changes in monetary policy. This article delves into the reasons behind this downward trend and examines the potential implications for the stock market.

Market Speculation and Expectations

The Federal Reserve's meeting is a highly anticipated event in the financial world. Investors closely monitor the Fed's decisions, as they can significantly impact the stock market and the broader economy. In recent weeks, speculation has been rife about the possibility of a rate hike or a change in the Fed's balance sheet normalization policy.

As a result, US stock futures have fallen, reflecting the cautious approach of investors. Many are concerned that a rate hike or a change in the Fed's policy could lead to higher borrowing costs, which could in turn slow down economic growth and negatively impact corporate profits.

Economic Indicators and Inflation Concerns

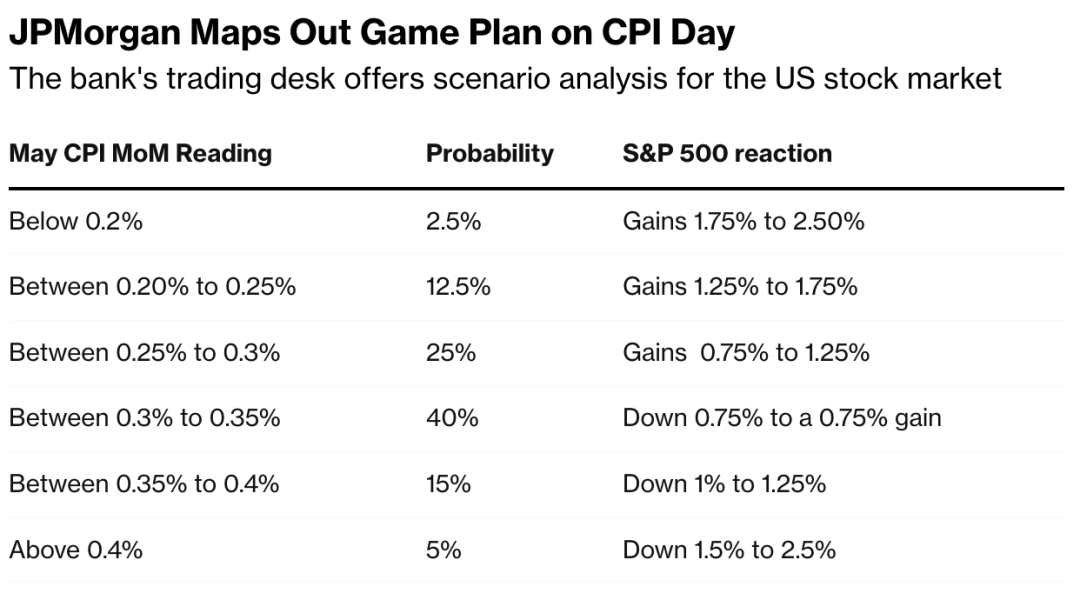

One of the key factors influencing the Fed's decision is inflation. The current inflation rate is well above the Fed's target of 2%, and there are concerns that it may continue to rise. This has led to speculation that the Fed may be forced to take a more aggressive approach to monetary policy, which could further weigh on stock market sentiment.

In addition to inflation, other economic indicators such as employment data and GDP growth are also closely watched. A strong economic outlook could lead to a rate hike, while a weaker outlook could prompt the Fed to hold off on tightening policy.

Impact on the Stock Market

The downward trend in US stock futures ahead of the Fed meeting is a clear indication of investor caution. However, the impact on the stock market will depend on the specific decisions made by the Fed and how these decisions are interpreted by investors.

If the Fed decides to raise interest rates or accelerate the pace of balance sheet normalization, it could lead to a sell-off in the stock market. Conversely, if the Fed signals a more dovish stance, it could provide a boost to stock prices.

Case Studies: Previous Fed Meetings

To understand the potential impact of the upcoming Fed meeting, it is helpful to look at previous Fed meetings and their aftermath. For example, in December 2018, the Fed raised interest rates for the fourth time that year. This led to a sell-off in the stock market, with the S&P 500 falling by nearly 6% in the weeks following the announcement.

In contrast, in September 2019, the Fed signaled a more dovish stance, indicating that it would be patient in raising interest rates. This helped to stabilize the stock market, with the S&P 500 recovering most of its losses in the following weeks.

Conclusion

The upcoming Federal Reserve meeting is a critical event for the financial markets. With US stock futures falling ahead of the meeting, investors are clearly expressing their concerns about the potential changes in monetary policy. The outcome of the meeting and how it is interpreted by investors will play a crucial role in determining the direction of the stock market in the coming weeks and months.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....