Introduction

Investing in the United States can be a lucrative opportunity for Canadian investors. With the diverse range of industries and the strong economic performance of the US, it's no wonder why many Canadians look to the US stock market for investment opportunities. However, one important aspect that needs to be considered is the tax implications. In this article, we will explore the taxes Canadian investors have to pay when buying US stocks and provide a comprehensive guide to help you navigate these complexities.

Understanding the Tax Implications

When a Canadian investor buys US stocks, they are subject to both Canadian and US tax laws. It's crucial to understand these laws to ensure compliance and optimize your tax situation.

Canadian Tax Implications

In Canada, the tax treatment of US stocks depends on the type of investment account you use:

Non-Registered Accounts: Any dividends received from US stocks are subject to Canadian tax at your marginal tax rate. However, capital gains from the sale of US stocks are taxed in the same way as gains from Canadian stocks.

Registered Accounts: Dividends received from US stocks in registered accounts, such as RRSPs or TFSAs, are not taxed at the time of receipt. However, when you withdraw funds from these accounts, the dividends will be taxed at your marginal tax rate.

US Tax Implications

The US tax system also plays a role in the tax implications of owning US stocks:

Withholding Tax: When Canadian investors receive dividends from US stocks, they are subject to a 30% withholding tax. However, this can be reduced under the Canada-US Tax Treaty.

Capital Gains Tax: The sale of US stocks is subject to capital gains tax in the US, but this is generally only applicable if the investor is a US resident or has a substantial presence in the US.

Navigating the Taxation Process

To navigate the taxation process effectively, consider the following tips:

Consult a Tax Professional: It's essential to consult with a tax professional to ensure compliance with both Canadian and US tax laws and to optimize your tax situation.

Keep Detailed Records: Keep detailed records of all your investments, including purchase and sale dates, cost basis, and dividend payments.

Understand the Tax Treaty: Familiarize yourself with the Canada-US Tax Treaty, as it can significantly reduce the tax burden on US dividends.

Case Study

Let's consider a hypothetical scenario:

John, a Canadian investor, purchases 100 shares of a US stock at

If John has a non-registered account, he will be subject to Canadian tax on the dividends received and capital gains tax on the sale of the shares. The Canadian tax on the dividends will be calculated based on John's marginal tax rate, while the capital gains tax will be calculated at the applicable rate.

If John has a registered account, the dividends received will not be taxed at the time of receipt. However, when he withdraws funds from the account, the dividends will be taxed at his marginal tax rate.

Conclusion

Investing in US stocks can be a profitable venture for Canadian investors. However, understanding the tax implications is crucial to ensure compliance and optimize your tax situation. By consulting a tax professional, keeping detailed records, and familiarizing yourself with the Canada-US Tax Treaty, you can navigate the complexities of Canadian and US tax laws effectively.

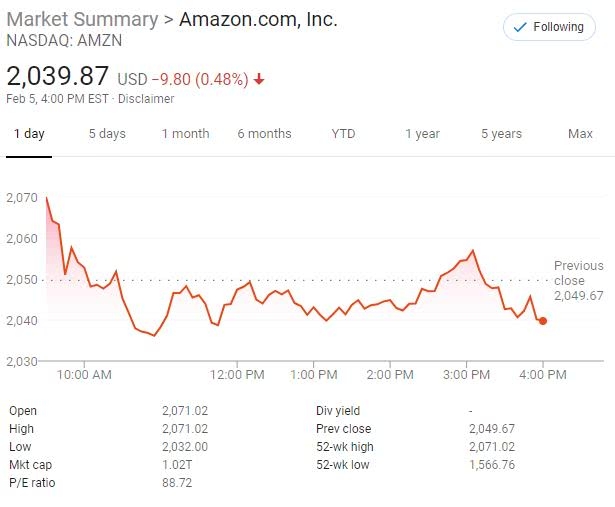

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....