The banking sector has always been a cornerstone of the US economy, and its performance is closely monitored by investors and analysts alike. In this article, we delve into the latest trends in bank earnings on the US stock exchange, highlighting key factors that influence these figures and providing insights into the current landscape.

Understanding Bank Earnings

Bank earnings, often referred to as net income, represent the profit a bank generates after deducting all expenses from its revenues. These earnings are a critical indicator of a bank's financial health and are closely watched by investors and regulators. The US stock exchange, particularly the New York Stock Exchange (NYSE) and the NASDAQ, is home to many of the largest and most influential banks in the world.

Factors Influencing Bank Earnings

Several factors can influence bank earnings, including:

- Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, can significantly impact bank earnings. Higher interest rates can lead to increased net interest margins, while lower rates can squeeze profit margins.

- Loan Growth: The amount of loans a bank originates can have a substantial impact on its earnings. Higher loan growth can lead to increased interest income, while slower growth can limit this revenue stream.

- Credit Quality: The quality of a bank's loan portfolio is crucial. High levels of non-performing loans can erode earnings, while a strong credit quality can lead to higher profitability.

- Cost Efficiency: Efficient cost management is essential for maintaining strong earnings. Banks that can control expenses while growing revenue tend to outperform their peers.

Recent Trends in Bank Earnings

In recent years, the US banking sector has experienced several key trends:

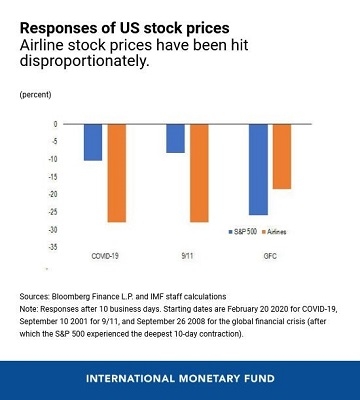

- Robust Earnings Growth: Despite the challenges posed by the COVID-19 pandemic, many banks have reported strong earnings growth. This can be attributed to a combination of factors, including robust loan growth and improved credit quality.

- Increased Focus on Digital Transformation: Many banks have accelerated their digital transformation efforts in response to changing customer preferences and competitive pressures. This has led to increased efficiency and improved customer experiences.

- Mergers and Acquisitions: The banking sector has seen a wave of mergers and acquisitions, particularly among regional banks. These deals have led to increased market share and improved profitability for the combined entities.

Case Study: JPMorgan Chase

One notable example of a bank that has performed well on the US stock exchange is JPMorgan Chase. The bank has reported strong earnings growth over the past few years, driven by factors such as robust loan growth and improved credit quality. Additionally, JPMorgan Chase has made significant investments in digital transformation, which has helped the bank maintain a competitive edge.

Conclusion

Bank earnings on the US stock exchange are a critical indicator of the health of the banking sector and the broader economy. By understanding the factors that influence bank earnings and monitoring the latest trends, investors and analysts can gain valuable insights into the future performance of the banking industry.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....