Introduction: In recent years, the US government has been actively involved in the stock market, purchasing stocks as part of its economic strategy. This article delves into the reasons behind this decision, the impact it has on the market, and the potential benefits and risks involved.

Understanding the Motivation

The primary reason behind the US government's decision to buy stocks is to stimulate economic growth and stabilize the market during times of crisis. By investing in stocks, the government aims to boost investor confidence and encourage private sector investment. This move is often seen as a way to support the broader economy and create jobs.

Impact on the Stock Market

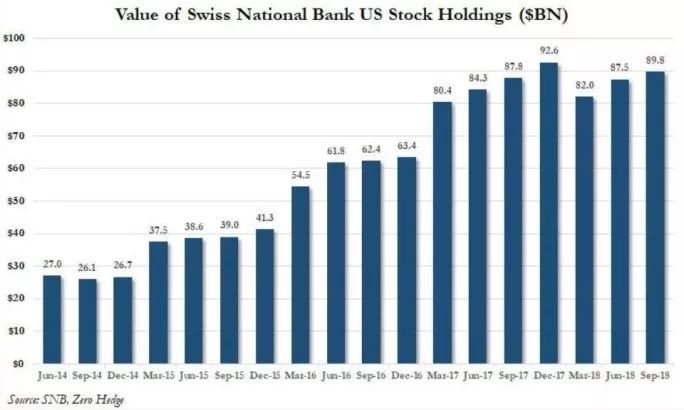

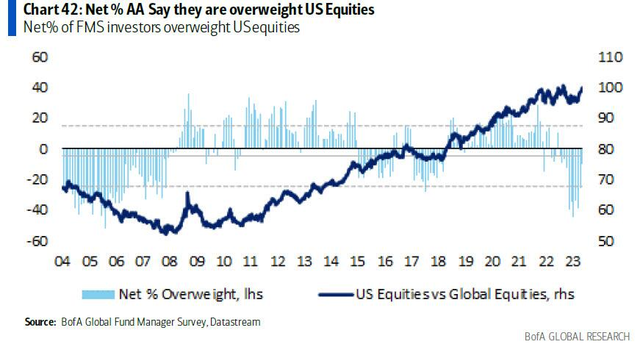

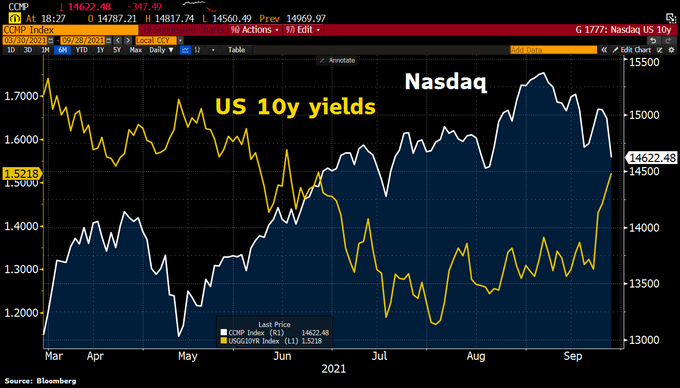

The government's involvement in the stock market has had a significant impact on market dynamics. When the government buys stocks, it can lead to increased demand and potentially drive up stock prices. This can be beneficial for investors who hold stocks, as it may lead to higher returns. However, it can also create concerns about market manipulation and the potential for an artificial bubble.

Benefits of Government Stock Purchases

One of the main benefits of the government buying stocks is the potential for increased economic stability. By investing in the stock market, the government can help support companies and industries that are struggling, which can have a positive ripple effect on the broader economy. Additionally, the government's investment can encourage other investors to participate in the market, leading to increased liquidity and stability.

Risks and Concerns

While there are benefits to the government buying stocks, there are also risks and concerns that need to be addressed. One of the main concerns is the potential for market manipulation. When the government is actively involved in the stock market, it can create an uneven playing field for investors. Additionally, there is a risk that the government's investment may not yield the desired results, leading to potential losses.

Case Studies

To illustrate the impact of government stock purchases, let's look at a few case studies:

2008 Financial Crisis: During the 2008 financial crisis, the US government implemented the Troubled Asset Relief Program (TARP), which included the purchase of stocks in various financial institutions. This move helped stabilize the market and prevent further economic collapse.

2020 COVID-19 Pandemic: In response to the COVID-19 pandemic, the US government passed the CARES Act, which included provisions for stock purchases. This helped support the market during a period of significant uncertainty and volatility.

Conclusion:

The US government's decision to buy stocks is a complex and multifaceted issue. While there are potential benefits and risks involved, it is clear that the government's involvement in the stock market can have a significant impact on economic stability and investor confidence. As the market continues to evolve, it will be interesting to see how the government's role in the stock market will evolve as well.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....