The financial world has experienced a significant shift with the recent drop in US stock futures. This sudden decline has sparked widespread concern and curiosity among investors. Understanding the reasons behind this downturn and its potential impact on the market is crucial for anyone with a stake in the US stock market. In this article, we will delve into the factors contributing to this drop and explore its implications for investors.

Factors Contributing to the Drop

The decline in US stock futures can be attributed to several factors:

- Economic Concerns: Global economic uncertainty has played a major role in the stock market's recent decline. Factors such as trade tensions, political instability, and slowing economic growth have created a sense of apprehension among investors.

- Interest Rate Hikes: The Federal Reserve's decision to raise interest rates has put additional pressure on the stock market. Higher interest rates can make borrowing more expensive, which can lead to lower corporate profits and decreased investor confidence.

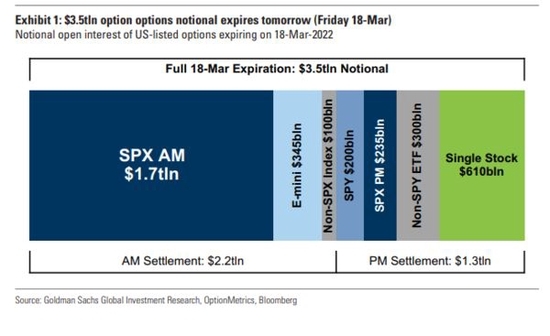

- Technology Sector Volatility: The technology sector, which has been a major driver of the stock market's growth in recent years, has experienced significant volatility. This sector's performance has a significant impact on the overall market, and its recent struggles have contributed to the overall decline in US stock futures.

Impact on Investors

The drop in US stock futures has several implications for investors:

- Opportunities for Investors: For investors who have been wary of the market, the decline presents an opportunity to buy shares at a lower price. However, it's important to conduct thorough research and consider the potential risks before making any investment decisions.

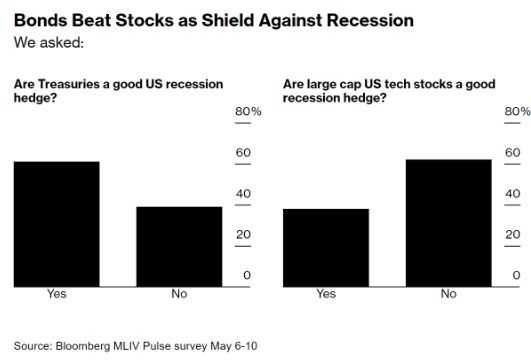

- Risk Management: It's crucial for investors to have a well-diversified portfolio to mitigate the impact of market volatility. This means allocating assets across different sectors, geographical regions, and asset classes to reduce exposure to any single market.

- Long-term Perspective: While the recent decline may be concerning, it's important for investors to maintain a long-term perspective. The stock market has historically experienced periods of volatility, and many investors have benefited from sticking to their long-term investment strategies.

Case Study: Technology Sector Volatility

To illustrate the impact of sector volatility on the stock market, let's take a look at the technology sector:

- Recent Performance: The technology sector has experienced significant volatility in recent months, with many high-profile companies witnessing sharp declines in their share prices.

- Impact on Market: The performance of the technology sector has a significant impact on the overall market. As the sector represents a substantial portion of the stock market, its struggles can lead to a broader market decline.

- Investor Reaction: Investors have responded to the sector's volatility by reassessing their exposure to technology stocks and considering alternative investments.

Conclusion

The recent drop in US stock futures has raised concerns among investors, but it also presents opportunities for those willing to conduct thorough research and manage risks effectively. By understanding the factors contributing to the downturn and maintaining a long-term perspective, investors can navigate the current market conditions and position themselves for potential growth.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....