Introduction:

In today's globalized economy, tariffs have become a significant factor influencing stock market dynamics, particularly in the United States. With trade wars and geopolitical tensions on the rise, investors are keen to understand the impact of tariffs on US stocks. This article aims to delve into the intricacies of this issue, providing insights into how tariffs can affect the performance of American companies and the broader stock market.

The Tariff War and its Consequences:

The recent tariff war, initiated primarily by the Trump administration, has caused ripples across various industries, affecting the global supply chain and the value of US stocks. Companies that rely heavily on imported goods have faced increased costs, which in turn, have impacted their profitability and share prices.

Impact on Key Industries:

- Technology and Electronics:

High tariffs imposed on technology and electronic products, such as smartphones, computers, and televisions, have directly affected the bottom line of companies like Apple and Samsung. These companies, which depend on global supply chains, have had to pass on additional costs to consumers, leading to decreased demand and falling stock prices.

- Automotive Industry:

Tariffs on autos and auto parts have posed a significant challenge to the automotive industry, particularly to companies like General Motors and Ford. These companies have seen their costs rise, prompting layoffs and reduced production, ultimately impacting their stock prices negatively.

- Agriculture:

Trade disputes have also hit the agriculture sector, with the administration imposing retaliatory tariffs on imported food products. Companies like Monsanto and Archer Daniels Midland have felt the heat, leading to concerns about the broader impact on US agricultural stocks.

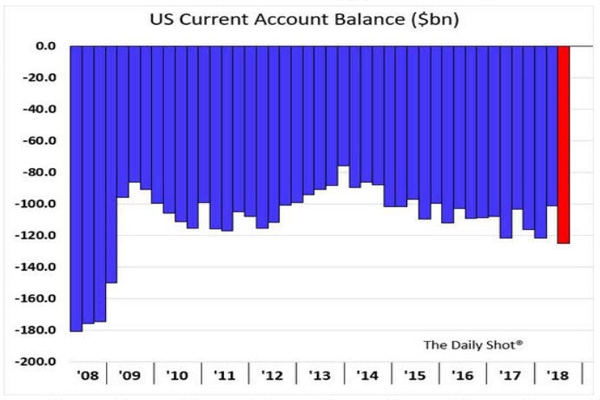

Global Supply Chain Disruptions:

The implementation of tariffs has disrupted the global supply chain, making it challenging for US companies to source materials efficiently. This has led to increased costs and decreased profitability, negatively affecting the performance of various industries, including manufacturing and retail.

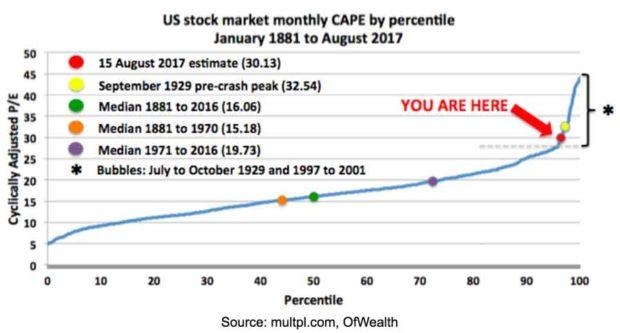

Impact on the Stock Market:

The impact of tariffs on the stock market can be observed through the fluctuations in major indices such as the S&P 500 and the Dow Jones Industrial Average. In times of rising tensions, these indices often witness sharp declines, reflecting investors' concerns about the overall economic impact of tariffs.

Case Study: Boeing and the Tariff War

Boeing, a major player in the aviation industry, provides a compelling case study on the impact of tariffs. Following the imposition of tariffs on steel and aluminum imports, Boeing faced increased costs for building aircraft, leading to reduced profitability. The stock price of Boeing experienced a decline, illustrating the direct impact of tariffs on a company's valuation.

Conclusion:

The impact of tariffs on US stocks cannot be understated. While they have posed challenges to certain industries and companies, they have also prompted innovation and adaptation. As investors, it is crucial to stay informed about the evolving tariff landscape and its implications on the stock market. By understanding these dynamics, one can better navigate the complexities of the market and make informed investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....