Are you considering investing in US stocks but unsure how to get started? Using a credit card to buy stocks can be a convenient and accessible option for many investors. In this article, we'll explore the benefits and considerations of purchasing US stocks with a credit card, including the steps to follow and potential risks involved.

Understanding the Process

1. Eligibility and Approval

Before you can use your credit card to buy stocks, you need to ensure that your card is eligible. While most credit cards are suitable for stock purchases, some issuers may have specific terms and conditions. Check with your card issuer to confirm eligibility.

Once you've verified eligibility, you'll need to apply for approval. This process is similar to applying for a credit card, and you'll need to provide personal and financial information.

2. Choosing a Brokerage

After you've been approved for a credit card, the next step is to choose a brokerage firm. Several brokerage platforms, such as Robinhood, TD Ameritrade, and E*TRADE, allow you to purchase stocks using a credit card. Compare fees, features, and customer reviews to find the best fit for your needs.

3. Funding Your Brokerage Account

Once you've chosen a brokerage, you'll need to fund your account. This process is straightforward and can be done online. Simply link your credit card to your brokerage account and follow the prompts to transfer funds.

4. Purchasing Stocks

With your brokerage account funded, you're ready to purchase stocks. Use your credit card to make the purchase, just like you would with any other online transaction. Be sure to research the stock you're interested in before buying to ensure it aligns with your investment goals.

Benefits of Using a Credit Card

1. Convenience

Using a credit card to buy stocks offers a level of convenience that traditional methods cannot match. With just a few clicks, you can purchase stocks from anywhere in the world, at any time.

2. No Minimum Investment

Many brokers do not require a minimum investment when using a credit card, making it easier for new investors to get started.

3. Reward Points and Cash Back

Using a credit card to buy stocks can help you earn reward points and cash back on your investment. This can be a valuable benefit, especially if you're purchasing stocks in large quantities.

Considerations and Risks

1. Interest Rates

One of the main risks of using a credit card to buy stocks is the potential for high-interest rates. If you don't pay off your balance in full each month, you could end up paying significantly more for your investment.

2. Credit Score Impact

Using your credit card to buy stocks can impact your credit score, depending on your payment habits. Paying off your balance on time is crucial to avoid any negative effects.

3. Brokerage Fees

Some brokers charge additional fees for credit card transactions, so be sure to review your brokerage's fee structure before making a purchase.

Case Study: John's Stock Purchase

Let's say John wants to invest

Conclusion

Buying US stocks with a credit card can be a convenient and accessible way to invest. However, it's important to understand the potential risks and benefits before proceeding. By carefully considering your options and using a credit card responsibly, you can successfully invest in US stocks and potentially earn significant returns.

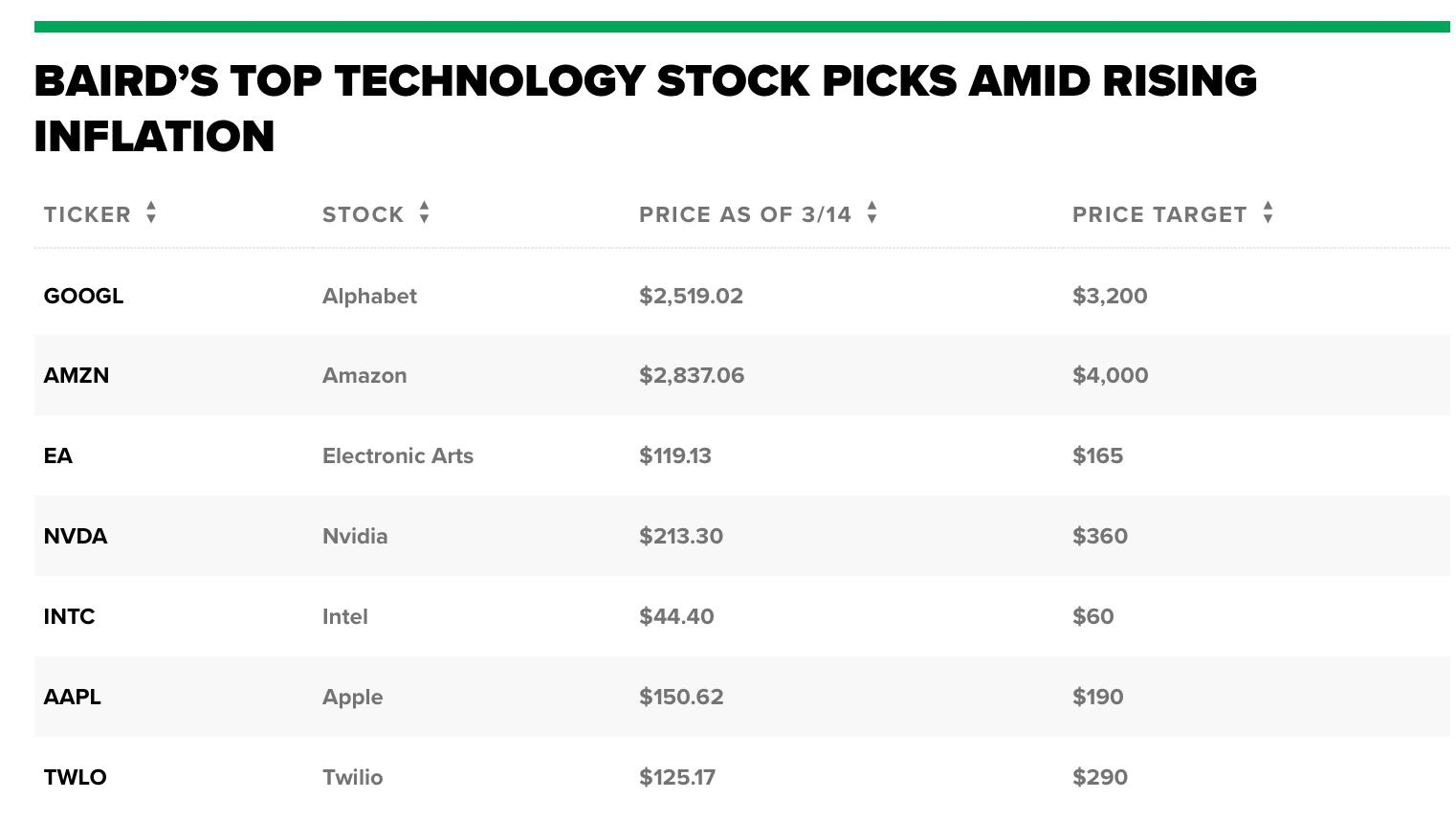

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....