Introduction

Are you an international student studying in the United States and intrigued by the idea of investing in the stock market? You're not alone. Many students dream of making some extra money or building a nest egg while they're away from home. But can international students buy stocks in the US? The answer is a resounding yes! This article will explore the process, benefits, and considerations for international students interested in investing in the American stock market.

Understanding the Basics of Stock Investing

What is a Stock?

A stock is a share of ownership in a company. When you buy a stock, you are essentially buying a piece of that company, represented by one share or more. The price of a stock can fluctuate based on various factors, such as the company's performance, market sentiment, and economic conditions.

Why Invest in Stocks?

Investing in stocks can offer several benefits, including:

- Potential for High Returns: Stocks have historically outperformed many other investment options over the long term.

- Liquidity: You can buy and sell stocks relatively quickly, providing flexibility in your investment strategy.

- Dividends: Some stocks pay dividends, which are periodic payments made to shareholders from the company's profits.

How Can International Students Buy Stocks in the US?

1. Open a Brokerage Account

The first step for international students is to open a brokerage account. A brokerage account allows you to buy and sell stocks and other investments. There are many brokerage firms to choose from, including Charles Schwab, TD Ameritrade, and E*TRADE.

2. Verify Your Identity

When opening a brokerage account, you will need to verify your identity. This typically involves providing your passport, driver's license, and other personal information. Some brokers may also require a proof of address.

3. Fund Your Account

Once your account is open, you'll need to fund it with money. You can transfer funds from your bank account or credit card.

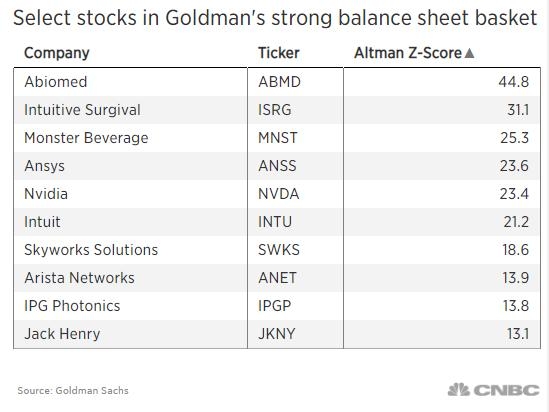

4. Research and Select Stocks

Before buying stocks, it's essential to research the companies you're interested in. Look for companies with strong financials, a good reputation, and a promising future. Consider using online research tools and financial news sources to help you make informed decisions.

5. Buy Stocks

Once you've done your research, you can place a buy order for the stocks you want to purchase. Your broker will execute the order, and you will become a shareholder in the company.

Considerations for International Students

1. Tax Implications

International students need to be aware of the tax implications of investing in the US stock market. Some gains may be subject to tax, and it's essential to consult with a tax professional to ensure compliance with tax laws.

2. Exchange Rate Fluctuations

Since you'll be dealing with US dollars, exchange rate fluctuations can impact your investments. It's essential to monitor the exchange rate and consider the potential risks.

Case Study: Alex from India

Alex, a student from India, opened a brokerage account and invested in tech stocks. Within a year, his investment grew by 50%. Alex carefully selected his stocks based on thorough research and stayed updated on market trends. He also sought advice from a financial advisor to manage his portfolio effectively.

Conclusion

Investing in the US stock market can be a great opportunity for international students. By following the steps outlined in this article and being aware of the potential risks, you can start building a nest egg for your future. Remember to do your research, stay disciplined, and consult with professionals as needed.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....