In the volatile world of the stock market, the relationship between a company's earnings and its stock price is a topic of constant debate. When a company posts spectacular earnings, does this automatically justify a skyrocketing stock price? This article delves into this question, examining the factors that contribute to this relationship and providing insights into the dynamics of the US stock market.

Understanding Spectacular Earnings

Spectacular earnings refer to a company's financial performance that significantly exceeds market expectations. This could be due to a surge in revenue, an increase in profits, or both. Companies with such impressive results often attract the attention of investors, leading to a surge in their stock prices.

The Impact of Spectacular Earnings on Stock Prices

While spectacular earnings can boost a company's stock price, it doesn't always guarantee a spectacular increase. Several factors influence this relationship:

Market Sentiment: Investors' perceptions and expectations play a crucial role in determining stock prices. If investors believe that a company's spectacular earnings are a sign of strong future growth, they are more likely to buy the stock, driving up prices. Conversely, if investors are skeptical, they may sell off the stock, leading to a decline in prices.

Sector and Market Trends: The stock price of a company can also be influenced by broader market and sector trends. For instance, if the entire technology sector is performing well, a company within that sector with spectacular earnings may see a more significant stock price increase.

Historical Performance: A company's historical performance can also affect its stock price. If a company has a track record of delivering impressive earnings, investors may be more confident in its future performance, leading to higher stock prices.

Valuation Metrics: The price-to-earnings (P/E) ratio is a commonly used valuation metric. If a company's earnings are growing at a rapid pace, investors may be willing to pay a higher P/E ratio, leading to a higher stock price.

Case Studies

To illustrate this relationship, let's consider a few case studies:

Amazon: When Amazon reported its earnings, the stock price soared. This was partly due to the company's strong performance and partly because investors were excited about its potential for future growth.

Apple: Apple has consistently delivered spectacular earnings, leading to a significant increase in its stock price. However, there have been instances when the stock price has declined despite impressive earnings, primarily due to market sentiment and valuation concerns.

Tesla: Tesla's stock price has been highly volatile, often driven by its earnings reports. When the company reported strong earnings, the stock price surged. However, there have been instances when the stock price has fallen despite positive earnings, mainly due to concerns about its growth prospects.

Conclusion

In conclusion, while spectacular earnings can contribute to a company's stock price, it's not the sole determinant. Market sentiment, sector trends, historical performance, and valuation metrics all play a crucial role in determining stock prices. As investors, it's important to consider these factors before making investment decisions.

us stock market live

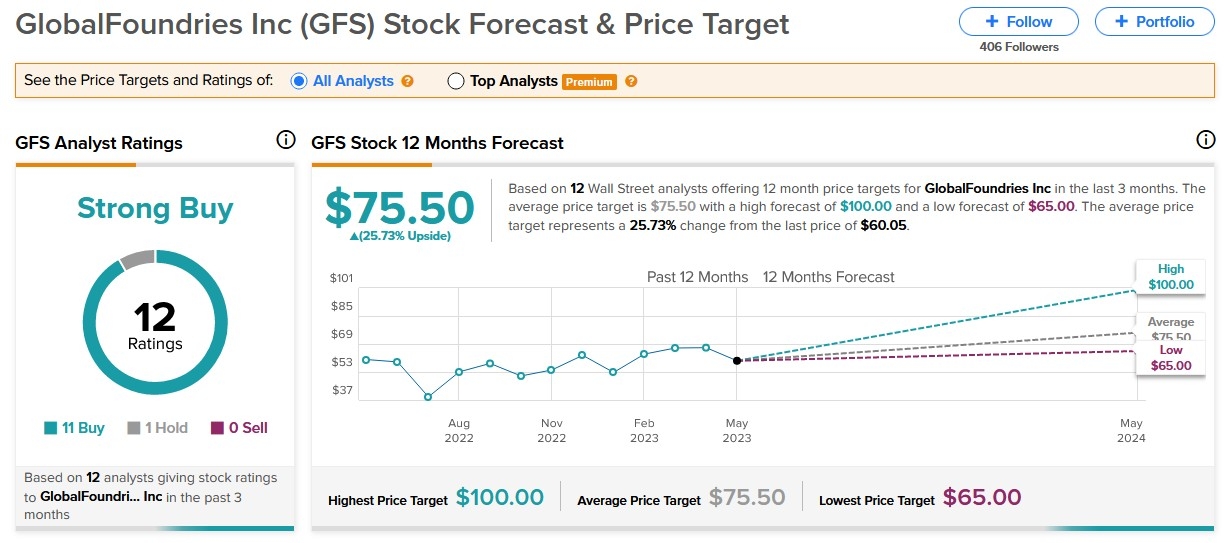

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....