Introduction: In the ever-evolving landscape of the US stock market, understanding the current trends and analyzing potential future directions is crucial for investors. As we dive into May 2025, this article provides a comprehensive analysis of the current US stock market, highlighting key factors and offering insights into potential opportunities and risks.

Market Overview As of May 2025, the US stock market is experiencing a period of stability after a turbulent year. The S&P 500 index has reached a new all-time high, showcasing a strong performance across various sectors. However, it is important to note that the market is still subject to volatility and unexpected shifts.

Economic Factors The current economic environment plays a significant role in shaping the stock market. Key factors to consider include:

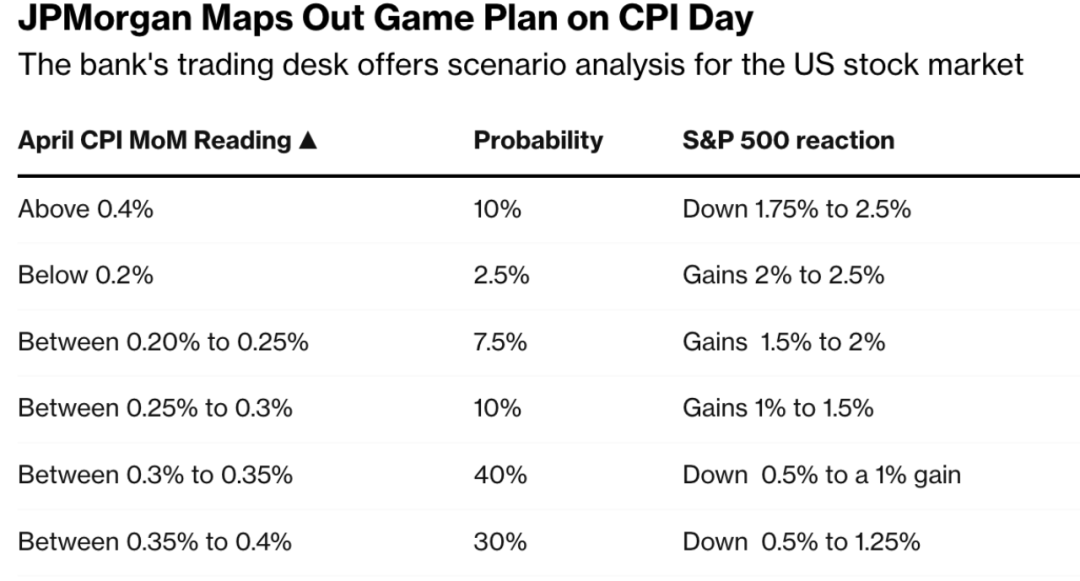

- Inflation: Despite recent efforts by the Federal Reserve to control inflation, it remains a concern. Investors are closely monitoring inflation data to gauge the possibility of further interest rate hikes.

- Economic Growth: The US economy has shown signs of moderate growth, supported by a strong labor market and consumer spending. However, geopolitical tensions and supply chain disruptions continue to pose challenges.

- Corporate Earnings: Companies are expected to report strong earnings, driven by factors such as increased demand, improved productivity, and cost-cutting measures.

- Sector Analysis The US stock market is diversified across various sectors, each with its own strengths and weaknesses:

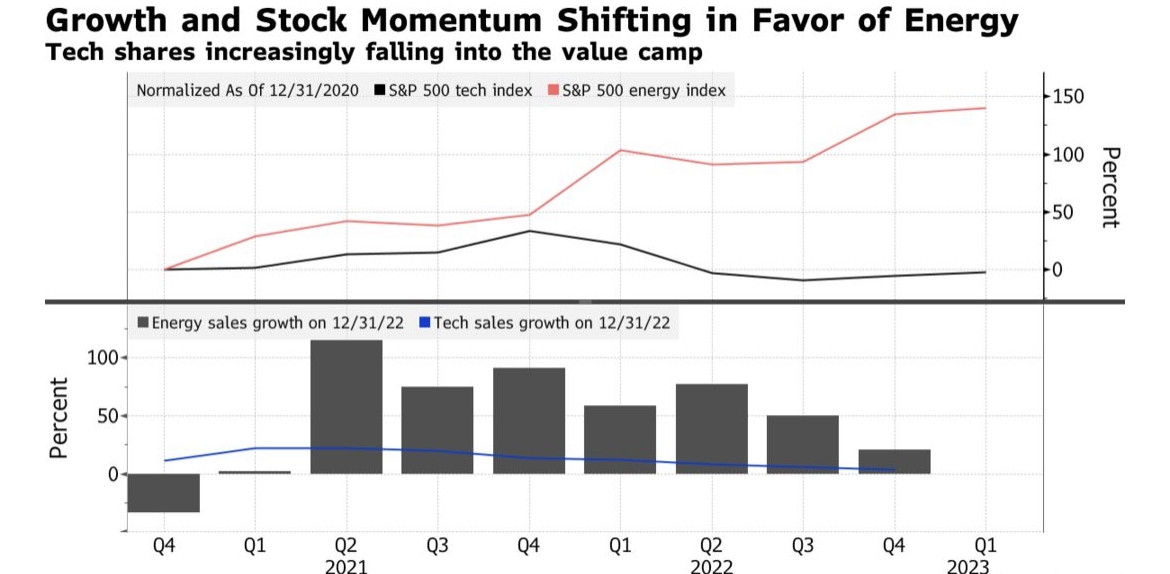

- Technology: The technology sector remains a key driver of market growth, with companies like Apple, Microsoft, and Amazon leading the pack. However, rising concerns about data privacy and regulatory changes could impact sector performance.

- Energy: The energy sector has experienced a surge in recent years, driven by the increased demand for oil and natural gas. However, volatile oil prices and environmental concerns continue to create uncertainty.

- Healthcare: The healthcare sector has demonstrated resilience, supported by the growing demand for pharmaceuticals, biotechnology, and medical devices. Innovation and advancements in healthcare technology are expected to drive future growth.

- Market Valuations Market valuations play a crucial role in determining the potential returns and risks of investing in the stock market. As of May 2025, the following key metrics are worth considering:

- Price-to-Earnings (P/E) Ratio: The P/E ratio is a common valuation metric that compares a company's stock price to its earnings per share. The current P/E ratio of the S&P 500 is at a historical average, indicating a fair valuation.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company's stock price to its book value per share. A higher P/B ratio suggests that investors are willing to pay more for the company's assets, while a lower ratio indicates a potential undervaluation.

- Case Study: Tesla (TSLA) Tesla, a leading electric vehicle (EV) manufacturer, has become a bellwether for the EV industry. Its recent partnership with China's BYD and expansion into new markets have fueled optimism among investors. However, concerns about battery supply chain issues and competition from established automakers remain key risks.

Conclusion: The US stock market, as of May 2025, is displaying a mix of strengths and challenges. Investors should remain vigilant and focus on factors such as economic indicators, sector performance, and market valuations to make informed decisions. By staying informed and adapting to market conditions, investors can navigate the complexities of the stock market and potentially achieve significant returns.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....