In recent years, the US economy has experienced periods of recession, and the stock market has often been a barometer of these economic downturns. This article delves into the impacts of recessions on the stock market, the factors that influence stock market performance during these times, and predictions for future market trends.

The Link Between Recessions and Stock Market Performance

When the US economy enters a recession, it typically leads to a decline in consumer spending, reduced corporate profits, and higher unemployment rates. These economic indicators often translate into a bearish stock market. During a recession, investors tend to become more risk-averse, leading to a sell-off of stocks.

Historically, there have been several notable recessions in the US, such as the dot-com bubble burst in 2000 and the Great Recession of 2007-2009. In both instances, the stock market experienced significant declines. The S&P 500, for example, fell by approximately 49% during the dot-com bubble burst and 57% during the Great Recession.

Factors Influencing Stock Market Performance During Recessions

Several factors can influence stock market performance during a recession:

Central Bank Policies: The Federal Reserve plays a crucial role in managing the economy during a recession. By adjusting interest rates and implementing quantitative easing, the Fed can help stimulate economic growth and stabilize the stock market.

Government Stimulus Packages: During a recession, the government may implement stimulus packages to boost economic activity. These packages can include tax cuts, increased government spending, and unemployment benefits, which can help mitigate the impact of the recession on the stock market.

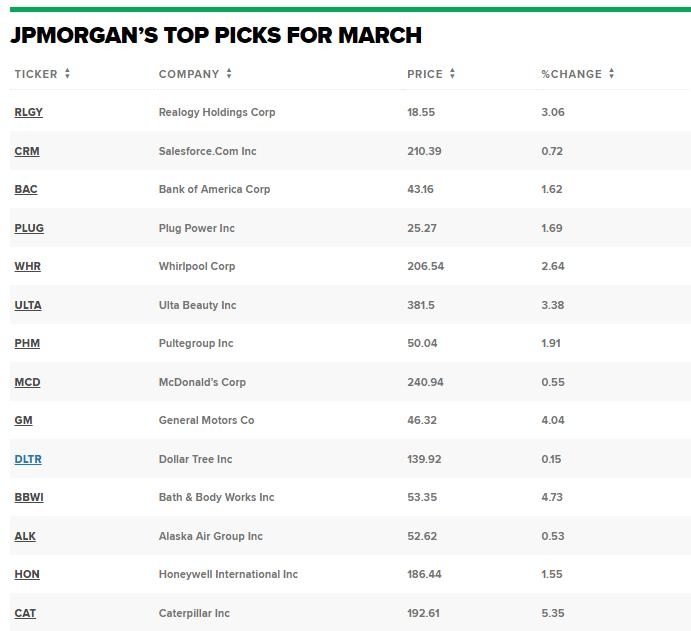

Sector Performance: Different sectors may perform differently during a recession. For example, consumer discretionary and technology sectors often suffer during a recession, while sectors like utilities and consumer staples may perform relatively well.

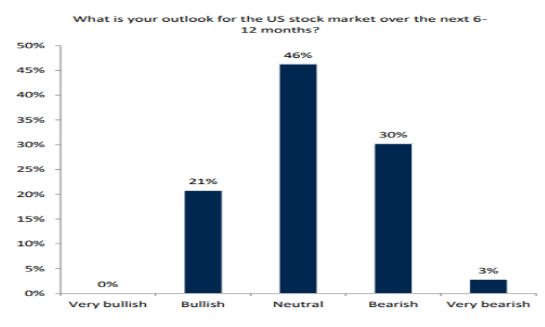

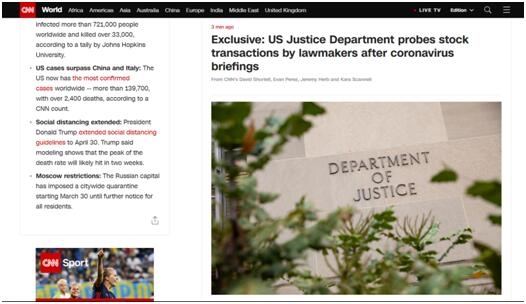

Market Sentiment: Investor sentiment can significantly impact stock market performance during a recession. Positive news and optimism can lead to a rally in the stock market, even during a recession.

Predictions for the Future

As of now, the US economy is facing a challenging environment, with concerns about inflation, supply chain disruptions, and the ongoing impact of the COVID-19 pandemic. However, some experts predict that the US stock market may weather this storm and continue to perform well in the long term.

Factors such as the Fed's accommodative monetary policy, the potential for a successful COVID-19 vaccine rollout, and the resilience of the US economy may contribute to a positive outlook for the stock market.

Case Studies

One notable case study is the 2008 financial crisis. Despite the severe recession that followed, the S&P 500 recovered and reached new highs by 2013. This highlights the potential for the stock market to recover from a recession, although it may take time.

Another example is the dot-com bubble burst in 2000. While the stock market experienced a significant decline during this period, it eventually recovered and reached new highs by 2007.

Conclusion

The relationship between recessions and the stock market is complex. While recessions often lead to a decline in stock market performance, various factors can influence the extent of the impact. As the US economy continues to navigate through challenging times, understanding the factors that drive stock market performance during recessions is crucial for investors.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....