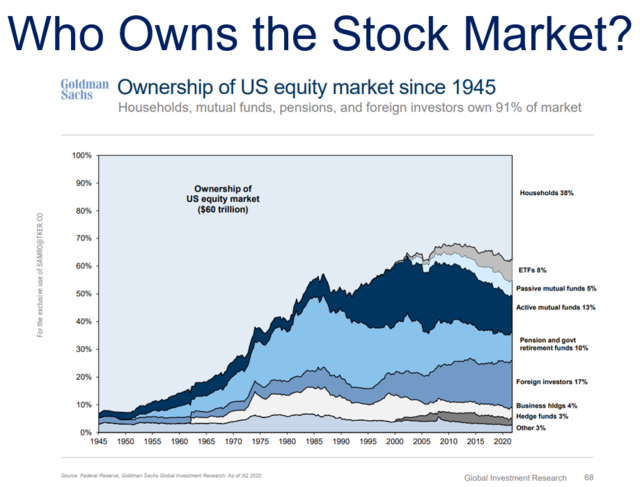

In today's fast-paced financial world, understanding the total US stock market capitalization is crucial for investors, analysts, and anyone interested in the health and trends of the American economy. The US market cap, as it's commonly referred to, represents the total value of all publicly traded companies in the United States. This article aims to provide a comprehensive overview of the US stock market capitalization, exploring its significance, historical trends, and key components.

Understanding Total US Stock Market Capitalization

The total US stock market capitalization is a measure of the market value of all publicly traded companies in the United States. It's calculated by multiplying the share price of each company by the number of shares outstanding. This figure provides a snapshot of the overall value of the US stock market and is often used as an indicator of economic health and investor confidence.

Significance of Total US Stock Market Capitalization

The total US stock market capitalization is a critical metric for several reasons:

- Economic Indicator: It reflects the overall value of the American economy and provides insights into the health of the financial markets.

- Investment Opportunities: Understanding the market cap helps investors identify potential investment opportunities and diversify their portfolios.

- Market Trends: Analyzing historical market cap data can help predict future market trends and economic growth.

Historical Trends of Total US Stock Market Capitalization

Over the past few decades, the total US stock market capitalization has experienced significant growth. Here are some key trends:

- Rise in Market Cap: From around

6 trillion in the early 1990s, the total US stock market capitalization has grown to over 40 trillion in 2023. - Market Boom and Bust: The market has seen several periods of rapid growth, followed by downturns. Notable examples include the dot-com bubble in the late 1990s and the financial crisis of 2008.

- Sector Diversification: Over time, the composition of the market has shifted, with technology and healthcare sectors playing a more significant role.

Key Components of Total US Stock Market Capitalization

The total US stock market capitalization is composed of various components:

- S&P 500: This index represents the top 500 companies listed on U.S. exchanges and is often used as a benchmark for the overall market.

- NASDAQ: Focused on technology and growth companies, the NASDAQ index is a significant part of the total market cap.

- Dow Jones Industrial Average (DJIA): Comprising 30 large, publicly-owned companies, the DJIA provides a snapshot of the broader market.

Case Studies: Understanding Market Movements

To illustrate the importance of total US stock market capitalization, let's consider a few case studies:

- Tech Sector Growth: In the early 2000s, the technology sector experienced rapid growth, contributing significantly to the increase in total market cap. Companies like Apple and Microsoft became household names.

- Financial Crisis of 2008: The financial crisis led to a sharp decline in the total market cap, highlighting the volatility of the stock market and the interconnectedness of global economies.

In conclusion, the total US stock market capitalization is a crucial indicator of economic health and investment opportunities. By understanding its historical trends, key components, and significance, investors and analysts can make more informed decisions and better navigate the complex world of finance.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....