The US election is not just a political event; it's a pivotal moment that sends ripples through the global financial landscape. As investors, understanding how the stock markets react to the election results is crucial for making informed decisions. This article delves into the historical trends, potential impacts, and key factors that influence stock market movements following a US election.

Historical Trends

Historically, the stock market has shown varying reactions to election outcomes. For instance, post-World War II, the stock market has tended to perform well in the years following a presidential election. According to a study by the Federal Reserve Bank of St. Louis, the S&P 500 has returned an average of 10.2% in the three years after a presidential election, compared to an average of 7.3% in the three years before the election.

However, it's important to note that these trends are not absolute. Presidential elections in 2000 and 2016, for example, saw significant volatility in the stock market in the weeks leading up to the election. In the case of the 2000 election, the S&P 500 fell by nearly 9% in the final month before the election, only to recover and reach new highs within a few months.

Potential Impacts

The impact of a US election on the stock market can be attributed to several factors, including:

Policy Changes: A change in administration can lead to significant changes in fiscal and monetary policy, which can directly impact various sectors of the economy. For example, a shift in tax policies, trade agreements, or healthcare regulations can have a profound effect on sectors such as energy, manufacturing, and healthcare.

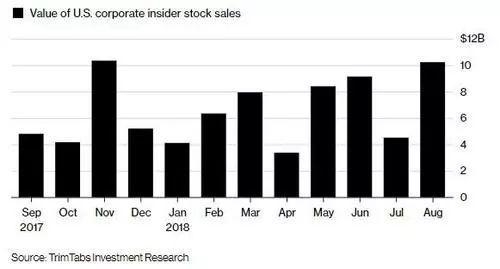

Economic Expectations: Investors often react to the election results based on their expectations of the future economic landscape. A perceived shift towards economic growth and stability can boost investor confidence, leading to increased stock market activity.

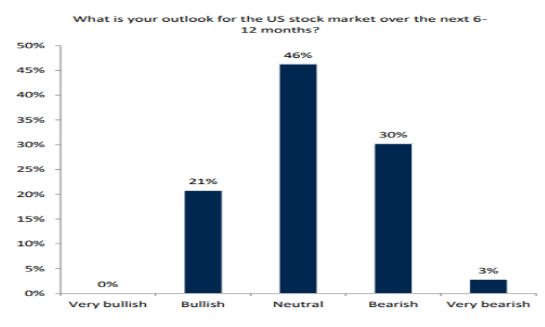

Market Sentiment: The stock market is influenced by investor sentiment, which can be heavily influenced by the outcome of a presidential election. A decisive victory can lead to increased optimism, while a closely fought race can cause uncertainty and volatility.

Key Factors Influencing Stock Market Movements

Several key factors can influence how the stock market reacts to a US election:

Partisan Control: The balance of power between the Democratic and Republican parties in Congress can significantly impact policy decisions and market reactions. For example, a divided government can lead to gridlock, making it difficult to pass major legislation.

Economic Indicators: Economic indicators such as unemployment rates, inflation, and GDP growth can influence investor sentiment and market movements. A strong economy can lead to increased confidence and higher stock prices, while a weak economy can lead to uncertainty and volatility.

International Factors: Global events and economic conditions can also influence the stock market's reaction to a US election. For example, a major geopolitical event or a global economic crisis can overshadow the domestic political landscape.

Case Studies

One notable example of the stock market's reaction to a US election is the 2016 presidential election. Despite initial volatility, the S&P 500 rallied significantly in the months following the election, reaching new highs within a year. This can be attributed to investor optimism about the potential for economic growth and tax cuts under President Trump's administration.

Another example is the 2000 election, where the stock market experienced significant volatility in the weeks leading up to the election. However, once the election results were finalized, the market recovered and continued to perform well in the following years.

Conclusion

In conclusion, the stock market's reaction to the US election is a complex and multifaceted issue. While historical trends and potential impacts can provide valuable insights, it's important to consider a wide range of factors when evaluating how the market will respond to election outcomes. As investors, staying informed and adaptable is key to navigating the uncertainty that comes with election season.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....