In the dynamic world of investing, staying ahead of market trends is crucial. One such trend that has been capturing the attention of investors recently is the performance of large-cap stocks in the United States. This article delves into the momentum analysis of these stocks, offering insights into their recent performance and potential future trends.

Understanding Large Cap Stocks

Large-cap stocks refer to shares of companies with a market capitalization of over $10 billion. These companies are typically well-established and have a strong track record of performance. They often dominate their respective industries and are considered to be stable investments.

Momentum Analysis: What It Means

Momentum analysis is a strategy that involves identifying stocks that are currently on the rise and are likely to continue their upward trend. It's based on the principle that stocks that have been performing well in the past are more likely to continue performing well in the future.

Recent Performance of US Large Cap Stocks

The recent performance of US large cap stocks has been quite impressive. According to data from S&P Global, the S&P 500, which is a widely followed index that tracks the performance of the 500 largest companies in the US, has seen a significant increase in value over the past year. This is primarily driven by the strong performance of companies in sectors such as technology, healthcare, and consumer discretionary.

Case Study: Apple Inc.

One of the best examples of a large-cap stock that has seen impressive momentum recently is Apple Inc. (AAPL). Over the past year, Apple's stock has seen a remarkable increase in value, driven by strong sales of its products, especially the iPhone and iPad. The company's market capitalization has now surpassed $2 trillion, making it the most valuable company in the world.

Factors Influencing Large Cap Stock Performance

Several factors contribute to the performance of large-cap stocks. These include:

- Economic Conditions: Economic growth and low interest rates often lead to increased demand for large-cap stocks.

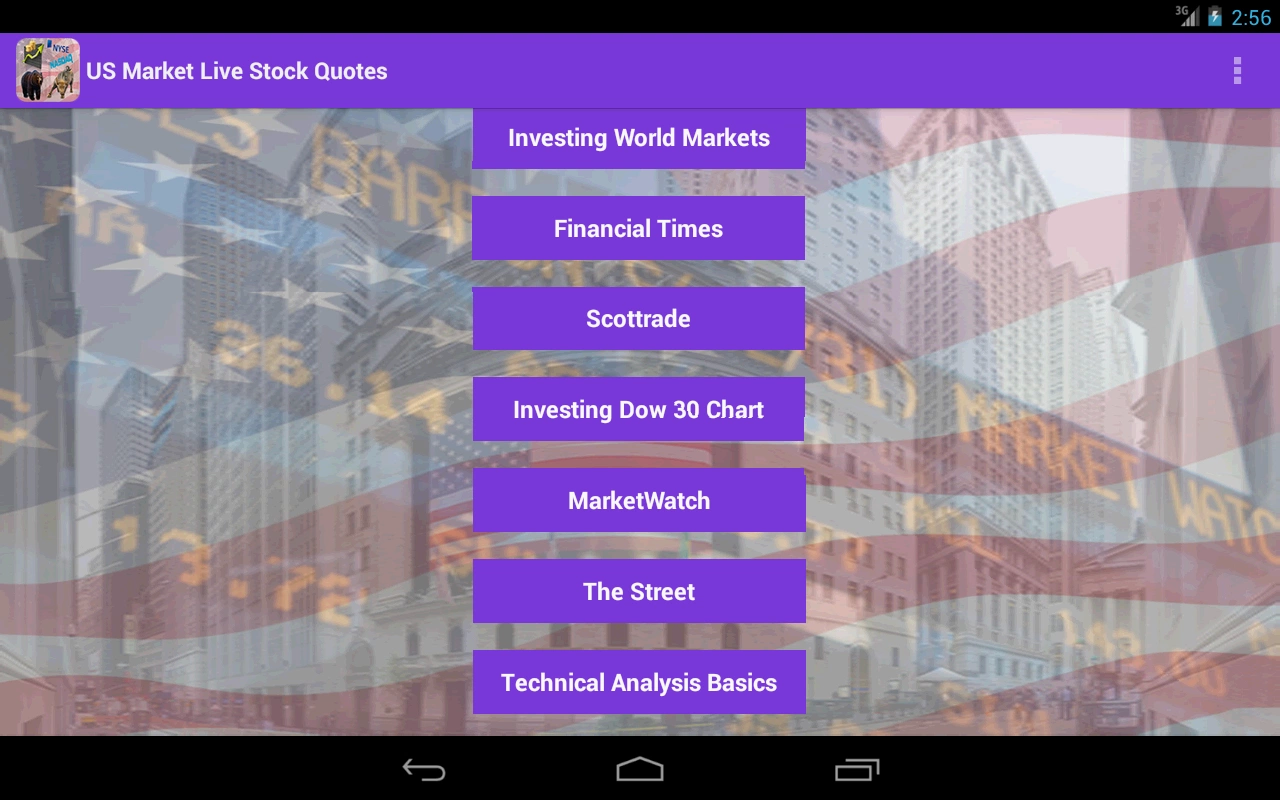

- Corporate Earnings: Strong earnings reports from large-cap companies can boost investor confidence and drive stock prices higher.

- Sector Performance: The performance of a particular sector can have a significant impact on the performance of large-cap stocks within that sector.

Conclusion

In conclusion, the momentum analysis of US large cap stocks suggests that they have been performing well recently. With factors such as economic growth and strong corporate earnings contributing to their performance, investors may want to consider adding these stocks to their portfolios. However, it's important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....