Introduction: The total value of all US stocks is a significant indicator of the health and growth potential of the American economy. As the world's largest stock market, the US stock market plays a crucial role in shaping the global financial landscape. In this article, we will delve into the current state of the US stock market, its historical trends, and the factors that influence its total value.

The Current State of the US Stock Market: As of the latest available data, the total value of all US stocks stands at an impressive figure. This value is derived from the market capitalization of all publicly traded companies listed on major US stock exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ.

Historical Trends: Over the years, the total value of US stocks has seen significant fluctuations. In the early 2000s, the dot-com bubble burst, leading to a sharp decline in the total value of stocks. However, the market quickly recovered and reached new heights in the following years. The financial crisis of 2008-2009 again impacted the total value of stocks, but the market has since made a remarkable comeback.

Factors Influencing the Total Value of US Stocks: Several factors contribute to the total value of US stocks. Here are some of the key factors:

Economic Growth: A strong economy leads to higher corporate earnings, which in turn drives up stock prices and increases the total value of stocks.

Interest Rates: Lower interest rates tend to boost stock prices as they make borrowing cheaper for companies, leading to increased investment and growth.

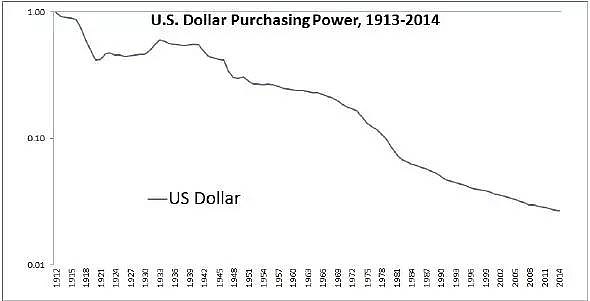

Inflation: Moderate inflation can be beneficial for stocks, as it erodes the value of fixed-income investments like bonds, making stocks relatively more attractive.

Market Sentiment: Investor confidence and sentiment play a crucial role in determining stock prices. Positive sentiment can lead to higher stock prices, while negative sentiment can cause a decline.

Technological Advancements: The US is home to many leading technology companies, which have significantly contributed to the growth of the total value of stocks.

Case Studies: To illustrate the impact of these factors, let's consider a few case studies:

Tech Stocks: Companies like Apple, Microsoft, and Amazon have been major contributors to the total value of US stocks. Their continuous growth and innovation have driven the market capitalization of these companies to unprecedented levels.

Energy Sector: The energy sector has seen significant fluctuations in the total value of stocks, primarily influenced by global oil prices. During periods of high oil prices, the energy sector has contributed significantly to the total value of stocks.

Financial Crisis of 2008: The financial crisis of 2008 had a profound impact on the total value of US stocks. Many financial institutions faced bankruptcy, leading to a sharp decline in the market. However, the market quickly recovered, driven by government interventions and the resilience of the American economy.

Conclusion: The total value of all US stocks is a critical indicator of the health and growth potential of the American economy. Understanding the factors that influence this value can help investors make informed decisions. As the US continues to be a global economic powerhouse, the total value of US stocks is expected to remain a significant focus for investors and policymakers alike.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....