In today's interconnected global market, investors are constantly seeking new opportunities to diversify their portfolios. One such opportunity is trading U.S. stocks in Hong Kong. This guide will explore the benefits of trading U.S. stocks in Hong Kong, the process involved, and key considerations to keep in mind.

Why Trade U.S. Stocks in Hong Kong?

Hong Kong is a major financial hub in Asia, offering a gateway for international investors to access the U.S. stock market. Here are some reasons why trading U.S. stocks in Hong Kong is a compelling option:

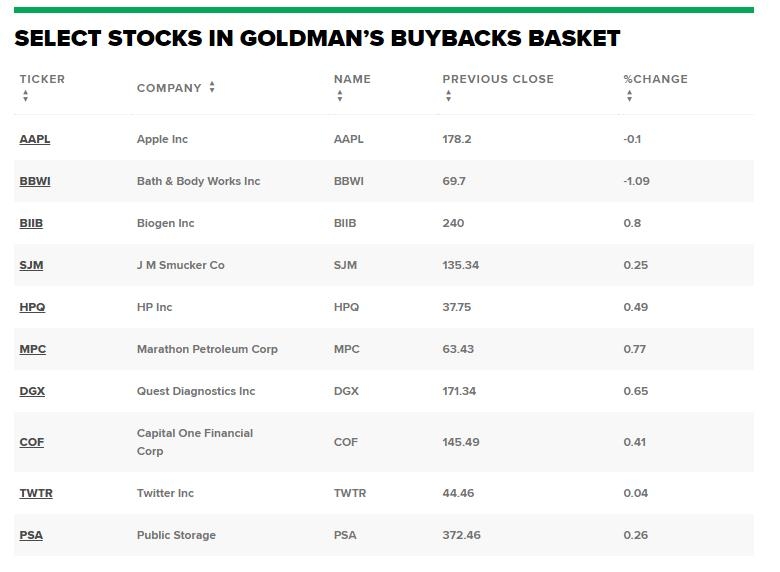

- Access to a Wide Range of U.S. Stocks: Hong Kong offers access to a diverse range of U.S. stocks, including those listed on major exchanges like the New York Stock Exchange (NYSE) and the Nasdaq.

- Convenience: Trading U.S. stocks in Hong Kong is convenient for investors based in Asia, as it allows them to trade during Hong Kong's trading hours, which overlap with the U.S. market.

- Regulatory Framework: Hong Kong has a robust regulatory framework that ensures investor protection and market integrity.

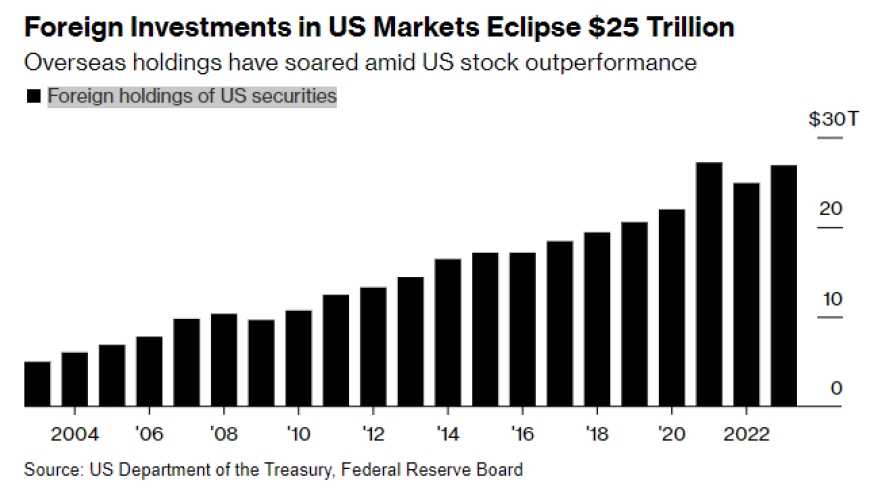

- Potential for High Returns: The U.S. stock market has historically offered high returns, and trading U.S. stocks in Hong Kong can provide exposure to these opportunities.

How to Trade U.S. Stocks in Hong Kong

To trade U.S. stocks in Hong Kong, you need to follow these steps:

- Open a Trading Account: The first step is to open a trading account with a reputable brokerage firm in Hong Kong that offers U.S. stock trading services.

- Understand the Trading Platform: Familiarize yourself with the trading platform provided by your brokerage firm. This platform will allow you to place trades, monitor your portfolio, and access market data.

- Fund Your Account: Transfer funds from your bank account to your trading account. Ensure that your brokerage firm supports the currency you wish to trade in.

- Research and Analyze: Conduct thorough research and analysis of U.S. stocks you are interested in. Consider factors such as financial health, market trends, and company news.

- Place Your Trade: Once you have identified a stock to trade, use your brokerage firm's platform to place your trade. You can choose to buy or sell stocks, and set a limit or market order.

Key Considerations

When trading U.S. stocks in Hong Kong, it's important to keep the following considerations in mind:

- Currency Risk: The U.S. dollar and Hong Kong dollar may fluctuate against each other, which can impact your investment returns.

- Tax Implications: Be aware of the tax implications of trading U.S. stocks in Hong Kong. Consult with a tax professional to understand your obligations.

- Transaction Costs: Consider the transaction costs associated with trading U.S. stocks in Hong Kong, such as brokerage fees, stamp duty, and exchange rate fees.

Case Study: ABC Corp

Let's consider a hypothetical scenario involving a Hong Kong-based investor named John. John decides to trade U.S. stocks in Hong Kong to diversify his portfolio. He researches and identifies ABC Corp, a leading technology company listed on the Nasdaq. After analyzing ABC Corp's financials and market trends, John decides to buy 100 shares of ABC Corp at

This case study demonstrates the potential benefits of trading U.S. stocks in Hong Kong, including the opportunity to profit from market movements and diversify your portfolio.

In conclusion, trading U.S. stocks in Hong Kong offers numerous advantages for international investors. By following the steps outlined in this guide and considering key factors, you can successfully trade U.S. stocks in Hong Kong and potentially achieve significant returns.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....