As we delve into the second half of 2025, the US stock market continues to be a hot topic among investors and financial analysts. With the market experiencing significant shifts, it's crucial to stay updated with the latest trends and forecasts. In this article, we'll provide a comprehensive analysis of the US stock market as of July 2025, highlighting key sectors, emerging trends, and potential risks.

Key Sectors in Focus

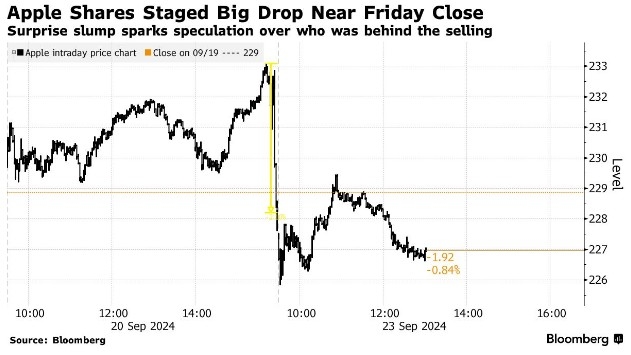

Technology Stocks: Technology remains a dominant force in the US stock market. Companies like Apple, Microsoft, and Google have been leading the charge, with strong earnings reports and continuous innovation. However, the sector is not without its challenges, with concerns over regulatory scrutiny and market saturation.

Energy Stocks: The energy sector has seen a remarkable turnaround, driven by the surge in renewable energy sources and the increasing demand for clean energy. Companies like Tesla and NVIDIA have been at the forefront of this trend, with their investments in electric vehicles and green technology.

Healthcare Stocks: The healthcare sector has been a steady performer, with companies focusing on biotechnology, pharmaceuticals, and medical devices. The rise in telemedicine and digital health solutions has also contributed to the sector's growth.

Emerging Trends

Artificial Intelligence (AI): AI continues to be a major driving force in the stock market. Companies that are at the forefront of AI development, such as IBM and Intel, are attracting significant investor interest. The potential applications of AI in various industries, including healthcare, finance, and manufacturing, are vast and promising.

Blockchain Technology: Blockchain technology is another area that has gained considerable attention. With its potential to revolutionize industries such as finance, healthcare, and supply chain management, companies like Ripple and Ethereum are poised to benefit from this emerging trend.

Potential Risks

Inflation and Interest Rates: The US Federal Reserve's decision on inflation and interest rates remains a key concern for the stock market. With inflation remaining high and the possibility of further rate hikes, this could impact investor sentiment and market performance.

Global Economic Uncertainty: The global economic landscape is fraught with uncertainty, with geopolitical tensions and trade disputes adding to the mix. These factors could lead to volatility in the stock market and impact investor confidence.

Case Study: Tesla

Tesla, a leader in the electric vehicle market, has been a prime example of the potential for innovation and growth in the stock market. With its recent earnings report showing significant revenue growth and increased deliveries, investors remain optimistic about the company's future. However, the company's reliance on government subsidies and the increasing competition in the electric vehicle market remain areas of concern.

In conclusion, the US stock market in July 2025 presents a complex mix of opportunities and challenges. As investors navigate this dynamic landscape, it's essential to stay informed and adapt to the changing trends. By focusing on key sectors, emerging trends, and potential risks, investors can make informed decisions and position themselves for long-term success.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....