Are you considering investing in stocks but unsure about the best way to do so? If you're a Canadian investor, a Tax-Free Savings Account (TFSA) could be the perfect solution. But can you hold stocks in a TFSA? The answer is yes, and in this article, we'll explore the benefits and considerations of investing in stocks within a TFSA.

Understanding TFSA

First, let's clarify what a TFSA is. A TFSA is a registered account that allows Canadians to save and invest money without paying tax on the income earned within the account. This means that any interest, dividends, or capital gains earned within your TFSA will be tax-free, making it an attractive option for long-term saving and investing.

Can You Hold Stocks in a TFSA?

The short answer is yes, you can hold stocks in a TFSA. In fact, stocks are one of the most popular investments within a TFSA. This is because stocks have the potential to offer high returns over the long term, and the tax-free nature of a TFSA means that you can benefit from these returns without worrying about taxes.

Benefits of Investing in Stocks within a TFSA

- Tax-Free Growth: As mentioned earlier, the tax-free nature of a TFSA means that any growth in your investments will be tax-free. This can significantly boost your returns over time.

- Diversification: Investing in stocks within a TFSA allows you to diversify your portfolio, reducing your risk. By investing in a variety of stocks, you can minimize the impact of any single stock's performance on your overall portfolio.

- Access to a Wide Range of Stocks: TFSA accounts offer access to a wide range of stocks, including both Canadian and international companies. This allows you to tailor your investments to your risk tolerance and investment goals.

- Long-Term Growth Potential: Stocks have historically offered higher returns than other types of investments, such as bonds or cash. By investing in stocks within a TFSA, you can take advantage of this potential for long-term growth.

Considerations When Investing in Stocks within a TFSA

- Risk: While stocks have the potential for high returns, they also come with higher risk. It's important to understand your risk tolerance and only invest in stocks that align with your comfort level.

- Diversification: As with any investment, diversification is key. Investing in a single stock can be risky, so it's important to diversify your TFSA portfolio.

- Management Fees: Some TFSA accounts may have management fees, which can eat into your returns. Be sure to compare fees and choose a TFSA provider that offers competitive rates.

Case Study: Investing in Stocks within a TFSA

Let's consider a hypothetical example. Imagine you invest

In conclusion, investing in stocks within a TFSA can be a smart and tax-efficient way to grow your wealth. By understanding the benefits and considerations, you can make informed decisions about your investments and potentially achieve higher returns over the long term.

new york stock exchange

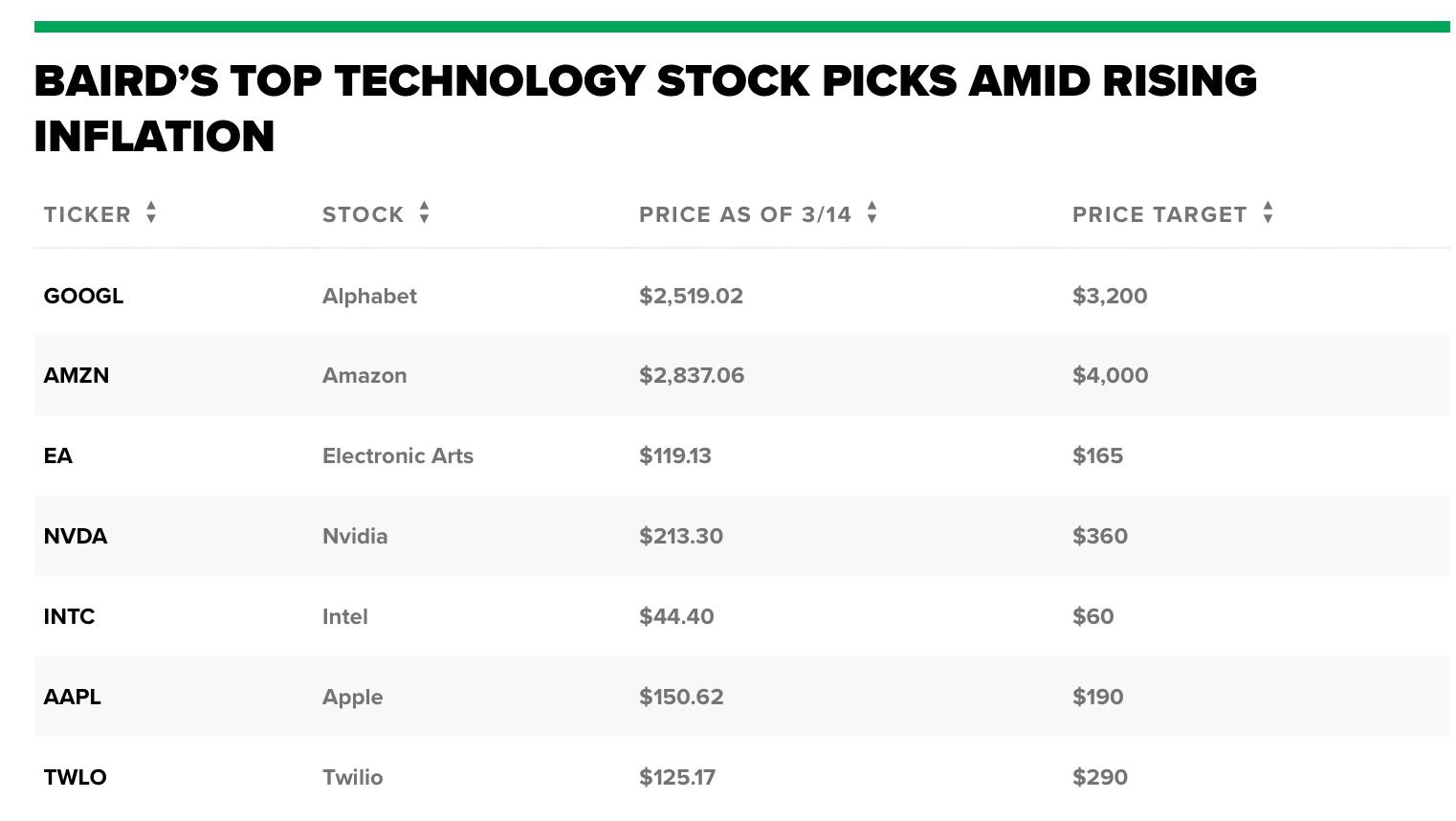

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....