On June 19, the US stock market experienced a tumultuous day, with several significant developments impacting investor sentiment. This article delves into the key highlights and offers a comprehensive analysis of the events that unfolded.

Market Overview

The S&P 500 and the Dow Jones Industrial Average (DJIA) opened higher on June 19, reflecting a positive start to the trading session. However, the momentum faded as the day progressed, leading to a mixed close for the major indices. The NASDAQ Composite closed lower, indicating a broader pullback across tech stocks.

Major Developments

1. Economic Data

The US Commerce Department released the May retail sales report, which showed a stronger-than-expected increase in consumer spending. This data suggested that the economy is still recovering from the pandemic, bolstering investor confidence.

2. Corporate Earnings

Several major companies reported their quarterly earnings on June 19, with mixed results. While some companies exceeded expectations, others missed the mark. This volatility added to the uncertainty in the market and led to a mixed performance.

3. Inflation Concerns

The Federal Reserve's latest minutes, released on June 19, showed that policymakers are concerned about rising inflation. This led to speculation about potential rate hikes in the near future, which contributed to the market's downward trend.

Stock Market Performance

1. S&P 500

The S&P 500 closed down 0.25% on June 19, with the majority of sectors ending the day in the red. The energy sector performed the best, while the consumer discretionary sector saw the most significant decline.

2. DJIA

The DJIA closed down 0.15%, with all 30 components ending the day lower. The worst-performing stocks were those from the financial and technology sectors.

3. NASDAQ Composite

The NASDAQ Composite closed down 0.75%, with a broad pullback across tech stocks. The semiconductor and biotech sectors were among the hardest-hit.

Sector Analysis

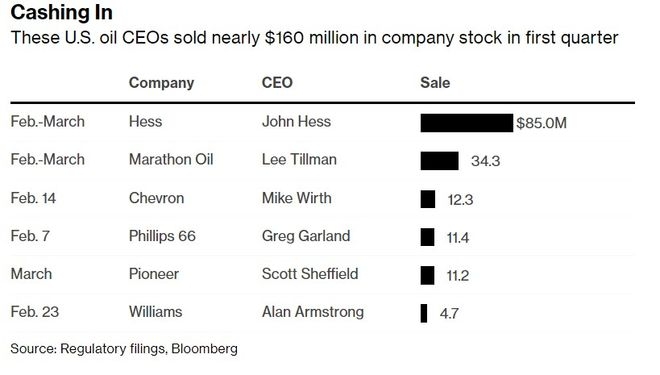

1. Energy

The energy sector saw the most significant gains on June 19, with oil prices rising on expectations of higher demand. Companies like Exxon Mobil and Chevron reported strong quarterly results, contributing to the sector's outperformance.

2. Tech

The tech sector faced significant selling pressure, with stocks like Apple and Microsoft ending the day lower. This pullback was attributed to concerns about rising inflation and the potential for rate hikes.

3. Financials

The financial sector ended the day lower, with banks and insurance companies experiencing declines. This was partly due to the Federal Reserve's concerns about rising inflation and the potential impact on the economy.

Conclusion

June 19 was a tumultuous day for the US stock market, with a mix of economic data, corporate earnings, and inflation concerns impacting investor sentiment. While the major indices ended the day mixed, the overall trend was downwards. Investors will need to stay vigilant and keep an eye on economic data and corporate earnings in the coming weeks.

Case Study: Tesla

Tesla, the electric vehicle (EV) manufacturer, reported its second-quarter earnings on June 19. The company reported record revenue and deliveries, exceeding market expectations. However, the stock closed lower, indicating that investors were more focused on the potential challenges ahead, such as rising raw material costs and increased competition. This highlights the volatility in the stock market and the importance of considering both the positive and negative aspects of a company's performance.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....