In recent months, the US economy has been grappling with a significant slowdown, prompting hedge funds to rapidly unwind their stock positions. As concerns mount over the potential for a recession, investors are increasingly seeking shelter in more stable assets. This article delves into the reasons behind this trend, the implications for the stock market, and the potential strategies investors can adopt to navigate these uncertain times.

Economic Slowdown and its Impact on the Stock Market

The US economy has been experiencing a slowdown in various sectors, including manufacturing, consumer spending, and housing. This slowdown has been exacerbated by factors such as rising inflation, supply chain disruptions, and the ongoing impact of the COVID-19 pandemic. As a result, investors are becoming increasingly cautious and are seeking to protect their portfolios from potential losses.

Hedge Funds Unwinding Stocks

Hedge funds, known for their speculative nature and high-risk investments, have been among the first to respond to the economic slowdown. These funds are rapidly unwinding their stock positions to mitigate potential losses. Several factors have contributed to this trend:

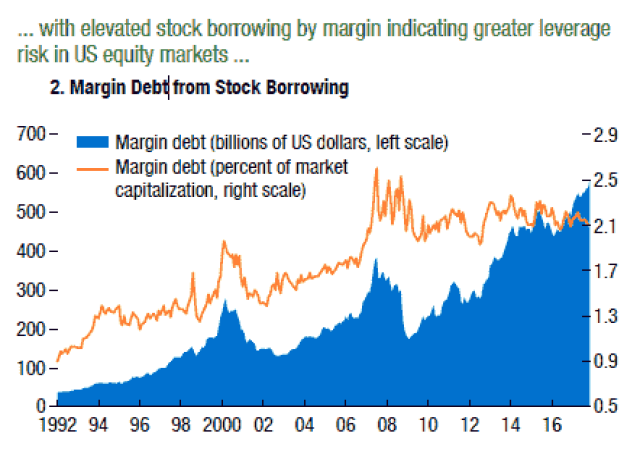

Market Volatility: The stock market has been experiencing heightened volatility, making it challenging for hedge funds to maintain their positions. As a result, they are seeking to reduce their exposure to stocks to minimize potential losses.

Rising Interest Rates: The Federal Reserve has been raising interest rates to combat inflation, which has made stocks less attractive. Higher interest rates can lead to increased borrowing costs for companies, reducing their profitability and stock valuations.

Economic Concerns: As the economic slowdown continues, investors are becoming increasingly concerned about the potential for a recession. This has led hedge funds to unwind their stock positions to protect their portfolios.

Implications for the Stock Market

The rapid unwinding of stock positions by hedge funds is likely to have a significant impact on the stock market. Here are some potential implications:

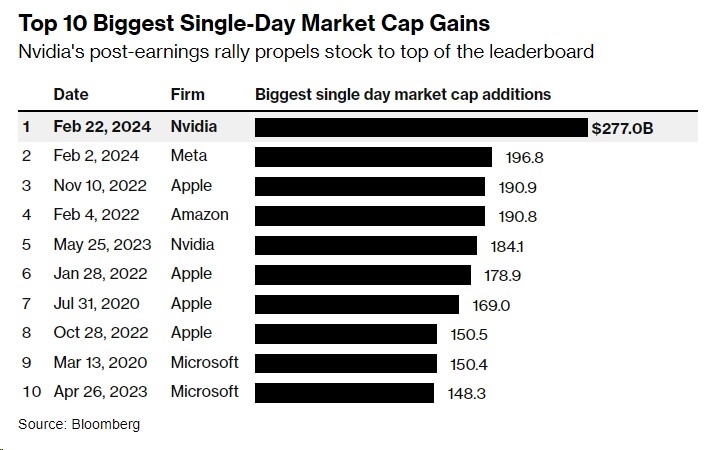

Stock Market Decline: As hedge funds sell off their stock positions, it could lead to a decline in stock prices. This could further exacerbate market volatility and create a negative feedback loop.

Increased Focus on Value Stocks: Investors may shift their focus towards value stocks, which tend to be more resilient during economic downturns. This could lead to a rotation out of growth stocks and into value stocks.

Increased Risk of Recession: The rapid unwinding of stock positions by hedge funds may signal an increased risk of a recession. This could lead to further economic uncertainty and a potential bear market.

Strategies for Investors

Given the current economic climate, investors need to adopt a cautious approach to protect their portfolios. Here are some strategies they can consider:

Diversification: Diversifying their portfolios across various asset classes can help investors mitigate potential losses. This can include stocks, bonds, real estate, and other alternative investments.

Focus on Quality Stocks: Investors should focus on quality stocks with strong fundamentals and a history of resilience during economic downturns.

Consider Dividend-Paying Stocks: Dividend-paying stocks can provide investors with a steady income stream and potential capital appreciation.

Stay Informed: Staying informed about the latest economic and market developments is crucial for making informed investment decisions.

In conclusion, the rapid unwinding of stock positions by hedge funds amid concerns of an economic slowdown is a clear sign of caution in the market. As investors navigate these uncertain times, adopting a cautious approach and focusing on quality investments is crucial for protecting their portfolios.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....