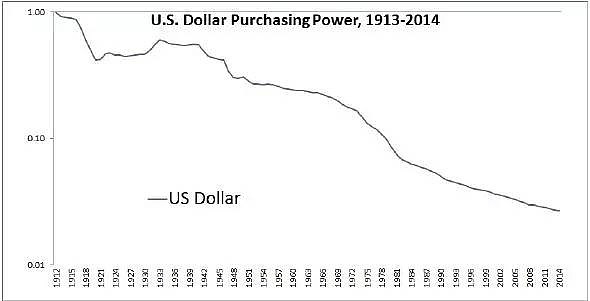

Are you intrigued by the potential of US penny stocks but unsure how to trade them from the UK? Look no further! This comprehensive guide will walk you through the process of trading US penny stocks from the comfort of your home in the UK. Whether you're a seasoned investor or just starting out, understanding how to navigate the US stock market can open up a world of investment opportunities.

Understanding Penny Stocks

Firstly, let's define what penny stocks are. Penny stocks are shares of companies that trade at less than $5 per share. They often come with higher risks and volatility compared to larger, more established companies. However, they also offer the potential for significant gains.

Finding a Broker

To trade US penny stocks, you'll need to open an account with a broker that allows trading in US stocks. Several brokers offer services for UK residents, including Interactive Brokers, TD Ameritrade, and Fidelity. It's important to choose a reputable broker with competitive fees and access to a wide range of US stocks.

Understanding the Risks

Before diving into the world of US penny stocks, it's crucial to understand the risks involved. Penny stocks can be highly speculative and volatile, making them unsuitable for risk-averse investors. It's essential to conduct thorough research and only invest money you can afford to lose.

Research and Due Diligence

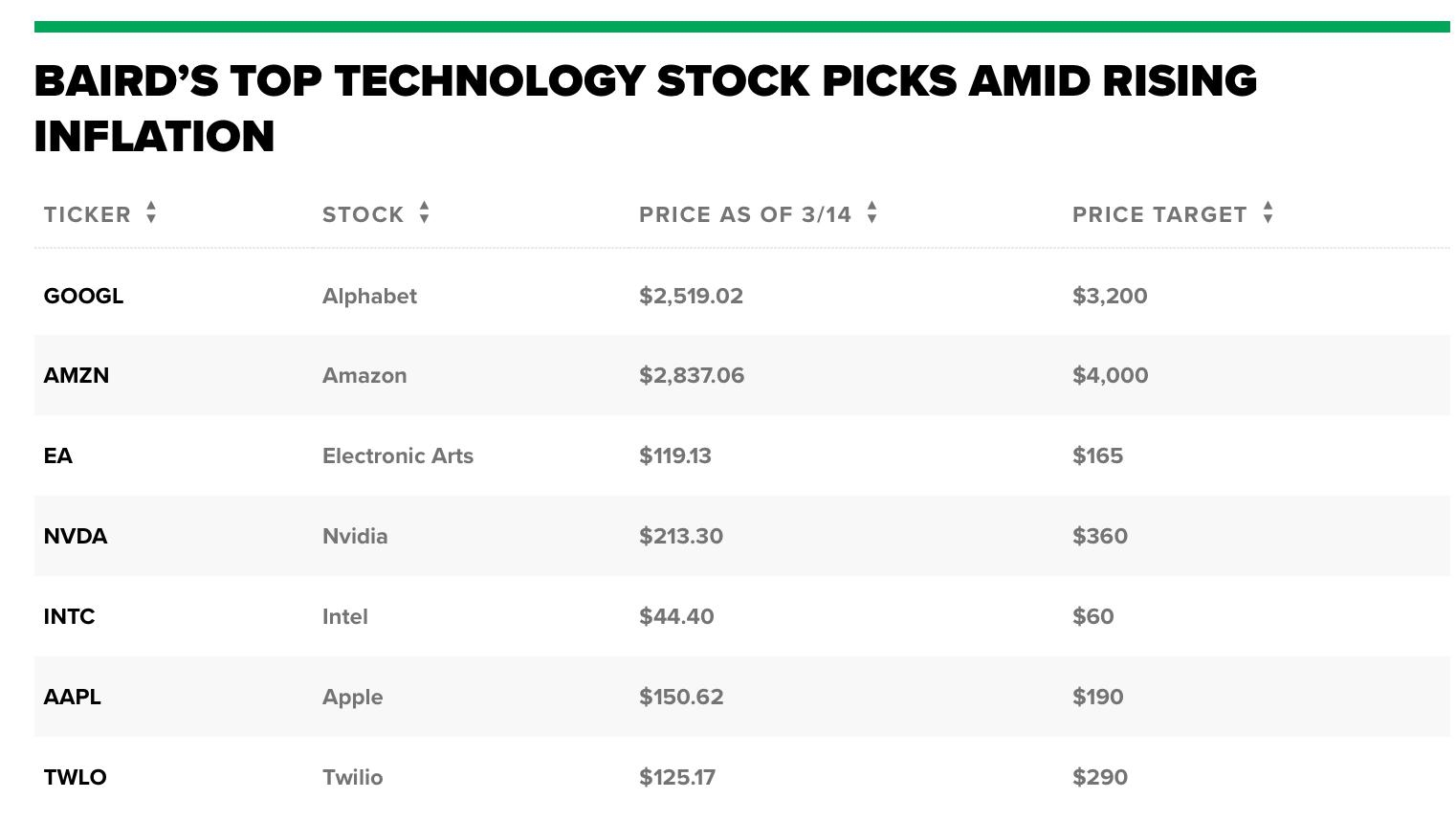

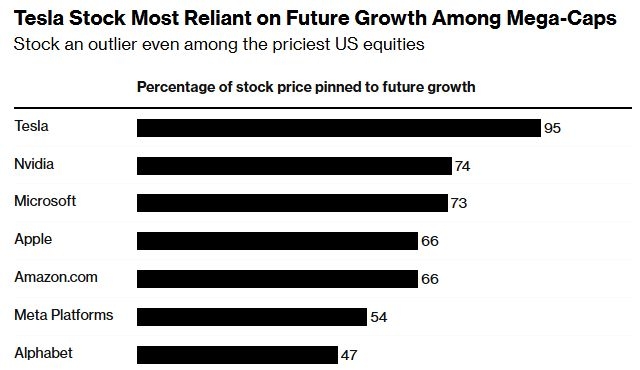

Research is key when trading penny stocks. Start by identifying sectors or companies you're interested in. Look for companies with strong fundamentals, a clear business model, and potential for growth. Utilize financial websites, news outlets, and social media platforms to gather information and stay updated on market trends.

Using Stop-Loss Orders

Implementing stop-loss orders is a crucial risk management strategy. A stop-loss order is an instruction to sell a stock if it reaches a certain price. This helps protect your investments from significant losses. Set a stop-loss order at a level that you feel comfortable with, considering the stock's volatility.

Analyzing Market Trends

Stay informed about market trends and news that can impact penny stock prices. Keep an eye on economic indicators, corporate earnings reports, and regulatory news. This information can help you make informed decisions and time your trades effectively.

Case Study: Company XYZ

Let's consider a hypothetical example of Company XYZ, a small biotech company with a promising drug in development. After conducting thorough research, you determine that the company has strong potential and decide to invest a portion of your portfolio in its stock. You set a stop-loss order at

Conclusion

Trading US penny stocks from the UK can be a lucrative opportunity, but it requires careful planning and research. By understanding the risks, choosing the right broker, conducting thorough research, and staying informed about market trends, you can navigate the US stock market and potentially earn substantial returns. Remember to never invest money you can't afford to lose and always seek professional advice if needed.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....