In recent years, there has been a growing debate about whether the US stock market is akin to a Ponzi scheme. This article delves into this controversy, examining the arguments for and against this claim, and providing a comprehensive analysis of the situation.

Understanding the Concept of a Ponzi Scheme

Firstly, it is crucial to understand what a Ponzi scheme is. A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money, rather than from any actual profit earned by the business. The scheme typically collapses when it can no longer attract new investors to replace those who are withdrawing their money.

Arguments Against the US Stock Market Being a Ponzi Scheme

Many argue that the US stock market cannot be classified as a Ponzi scheme due to several reasons. Firstly, the stock market is a legitimate and regulated platform where companies can raise capital by selling shares to investors. These shares represent ownership in the company, and investors can benefit from the company's profits and growth.

Secondly, the stock market is subject to strict regulatory oversight by organizations such as the Securities and Exchange Commission (SEC). This regulatory framework ensures that companies provide accurate and transparent information to investors, thereby reducing the risk of fraud.

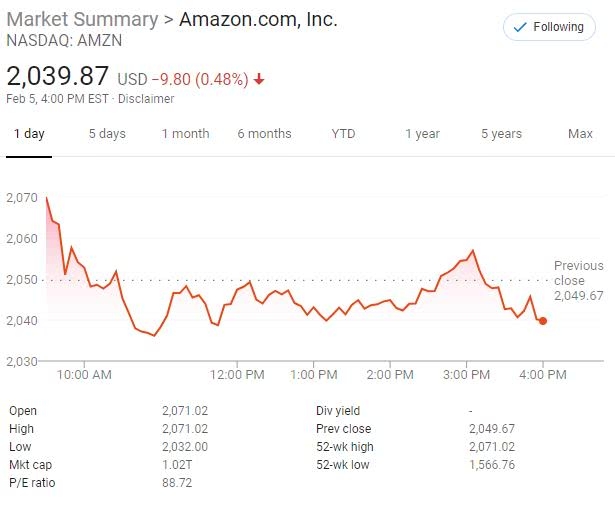

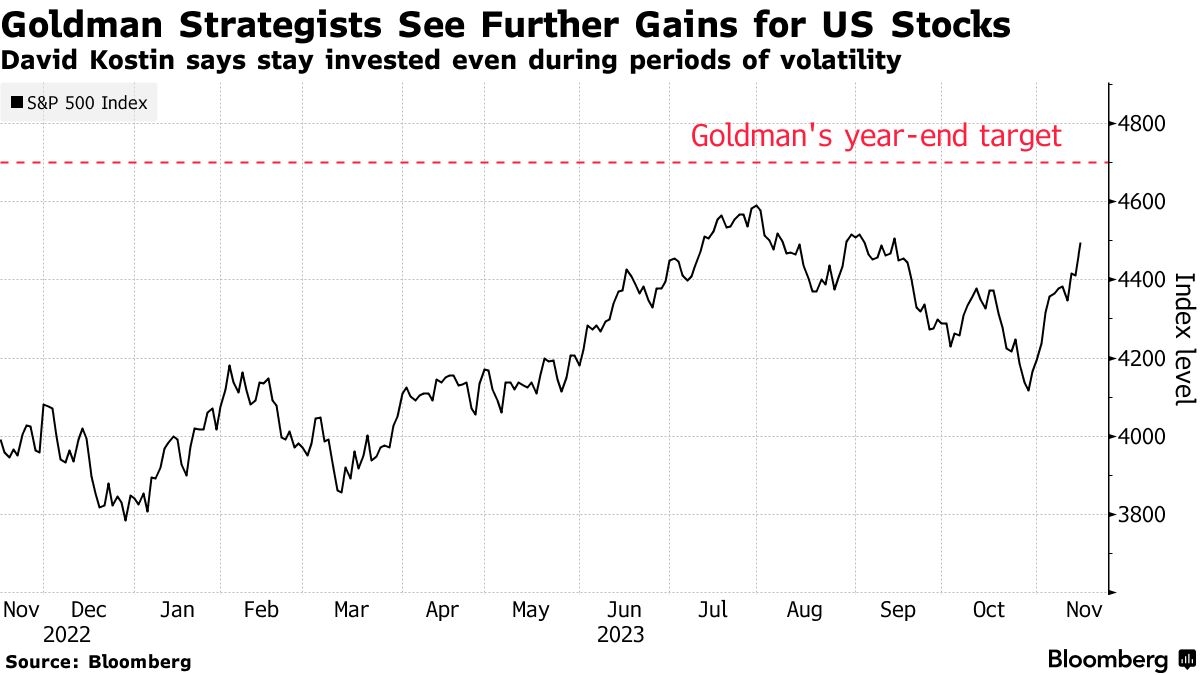

Moreover, the stock market has historically provided substantial returns to investors over the long term. While there are certainly periods of volatility and market crashes, the overall trend has been upward.

Arguments for the US Stock Market Being a Ponzi Scheme

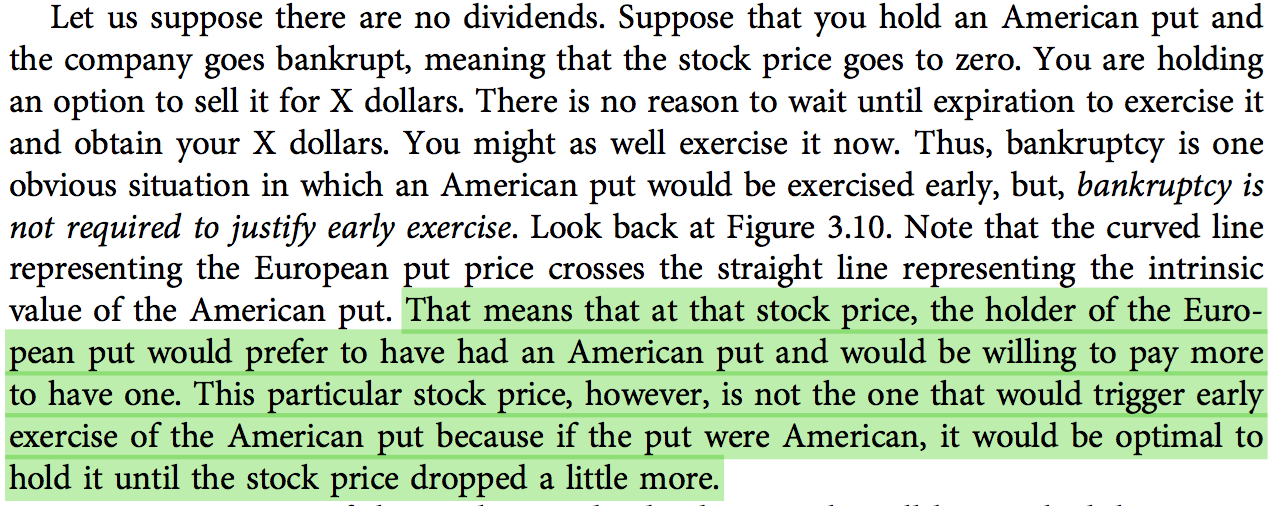

On the other hand, some experts argue that the US stock market exhibits characteristics similar to a Ponzi scheme. One of the key arguments is the concept of "greater fool theory." This theory suggests that investors buy stocks based on the belief that someone else will pay an even higher price in the future, rather than on the company's fundamentals.

This speculative nature of the stock market has led to a situation where the market is driven by excessive optimism and speculation, rather than by the actual performance of companies. As a result, stock prices can become detached from the underlying value of the companies, creating a bubble-like situation.

Furthermore, the growing wealth inequality in the US has been attributed to the stock market's role as a Ponzi scheme. The majority of the stock market's wealth is concentrated in the hands of a few wealthy individuals and institutions, while the average investor struggles to participate in the market's growth.

Case Studies

One notable case study is the dot-com bubble of the late 1990s. During this period, the stock market experienced a rapid and unsustainable increase in valuations, driven by speculative investment in internet companies. When the bubble burst, many investors lost substantial amounts of money, and the market experienced a significant downturn.

Another example is the housing market crisis of 2008. This crisis was partly caused by excessive speculation in the stock market, as investors bought mortgage-backed securities without fully understanding the risks involved. The subsequent collapse of the housing market had far-reaching consequences for the global economy.

Conclusion

While there are arguments on both sides of the debate, it is clear that the US stock market is not a straightforward Ponzi scheme. However, it is essential for investors to remain vigilant and conduct thorough research before investing in the stock market. By understanding the risks and being aware of the speculative nature of the market, investors can make more informed decisions and protect their investments.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....