In the vast realm of financial markets, stocks are often a beacon of potential wealth and opportunity. One such stock that has garnered significant attention is LMT. This article delves into the latest news and insights surrounding LMT stock, highlighting its impact on the US market and offering valuable financial advice for investors.

Understanding LMT Stock

LMT, or Lockheed Martin Corporation, is a leading global security and aerospace company based in the United States. With a diverse portfolio of products and services, including military systems, cyber security solutions, and advanced technologies, LMT has become a vital player in the defense and aerospace industry. Its stock has been closely monitored by investors and analysts alike, and for good reason.

US News and Money Insights on LMT Stock

Recent Performance: LMT has experienced a robust performance in recent quarters, driven by strong defense spending and a growing demand for its advanced technologies. The stock has seen significant growth, and investors are keen to see if this upward trend will continue.

Sector Analysis: LMT operates in the defense sector, which has historically been a stable and profitable market. The company's exposure to government contracts and its role in developing cutting-edge technologies position it for continued growth, even amidst global economic uncertainties.

Economic Factors: The US economy's overall health can significantly impact LMT's stock. As the economy strengthens, government spending on defense and national security is likely to increase, potentially boosting LMT's revenue and profitability.

Industry Trends: The defense and aerospace industry is continuously evolving, with a focus on innovation and technological advancements. LMT's commitment to investing in research and development ensures its position as a leader in the industry, which bodes well for its stock.

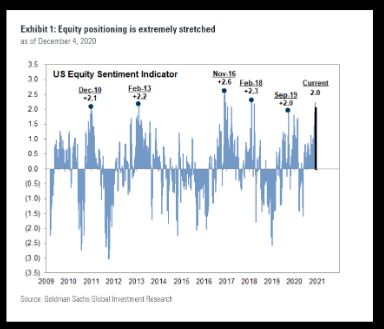

Investor Sentiment: LMT has garnered a positive investor sentiment, with many analysts rating the stock as a "buy" or "strong buy." This sentiment is supported by the company's strong financial performance and potential for future growth.

Case Study: LMT's Acquisition of Sikorsky

A notable recent development involving LMT is its acquisition of Sikorsky, a leading helicopter manufacturer. This acquisition has several implications for LMT's stock:

Market Expansion: Sikorsky's addition to the LMT portfolio allows the company to tap into a new market segment, potentially increasing its revenue streams and diversifying its business.

Strategic Value: Sikorsky's advanced helicopter technology aligns with LMT's focus on developing cutting-edge technologies, further enhancing the company's position in the aerospace industry.

Investor Reactions: The acquisition was well-received by investors, leading to a positive impact on LMT's stock. This highlights the importance of strategic acquisitions in driving stock performance.

Conclusion

In conclusion, LMT stock has been a focal point for investors and analysts due to its impressive performance and strategic positioning in the defense and aerospace industry. As the US market continues to grow, LMT is well-positioned to capitalize on emerging opportunities. By staying informed about the latest news and trends, investors can make well-informed decisions regarding LMT stock.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....