In the world of investing, diversification is often emphasized as a key strategy for mitigating risk and maximizing returns. However, the question of whether to invest solely in US stocks arises frequently. This article aims to explore the pros and cons of focusing your investment portfolio on US stocks, and provide insights to help you make an informed decision.

Pros of Investing in US Stocks

Strong Market Performance: The US stock market has historically offered some of the highest returns in the world. Companies listed on US exchanges, such as the S&P 500, have a track record of strong performance and innovation.

Diverse Industry Representation: The US stock market is home to a wide range of industries, from technology and healthcare to consumer goods and finance. This diversity can provide exposure to various sectors and help reduce the risk of being negatively impacted by a single industry.

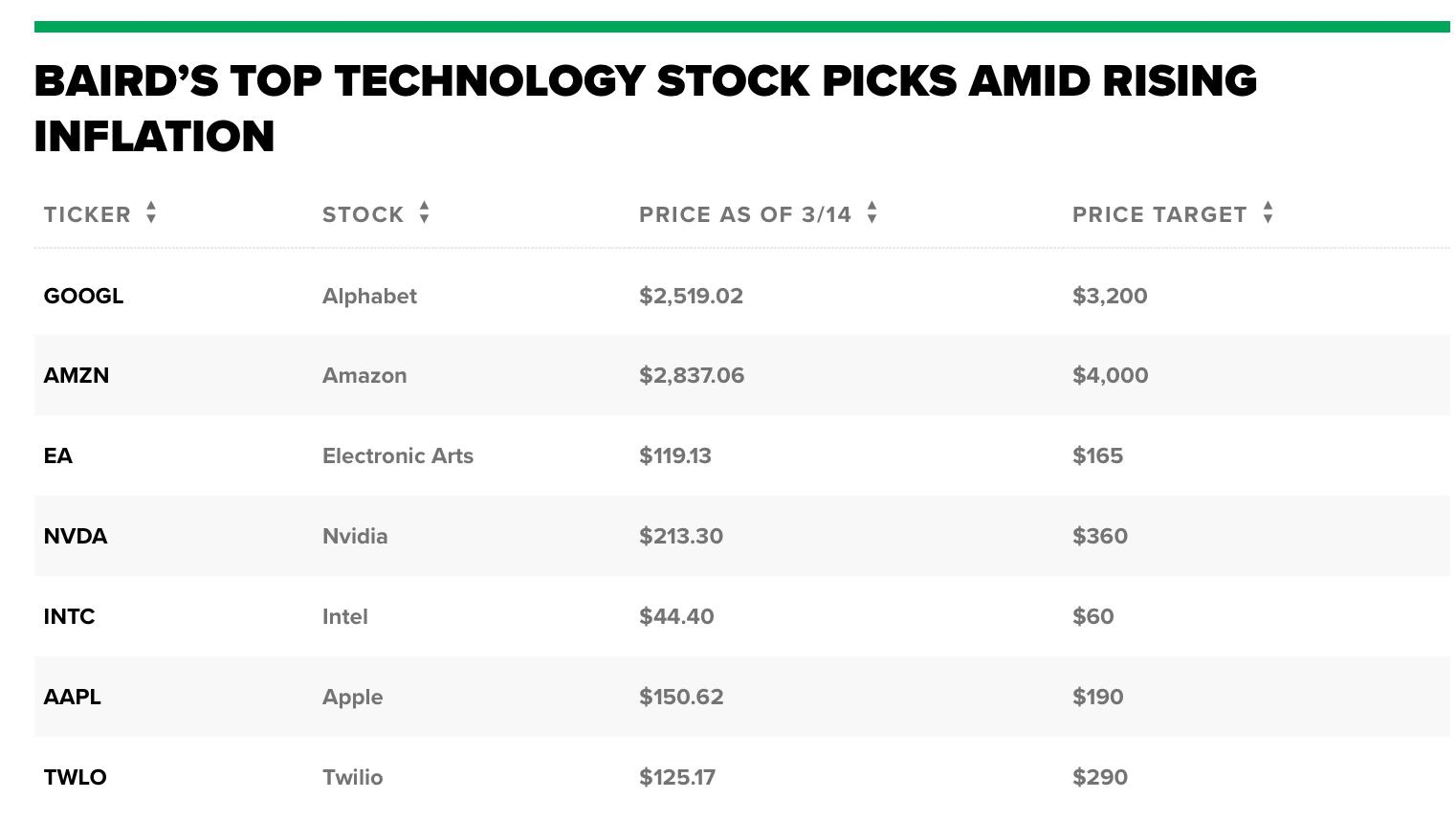

Access to Leading Companies: Investing in US stocks allows you to gain exposure to some of the world's most successful and influential companies, such as Apple, Microsoft, and Amazon.

Cons of Investing in US Stocks

Market Volatility: The US stock market can be highly volatile, especially during economic downturns or geopolitical events. This can lead to significant fluctuations in your investment value.

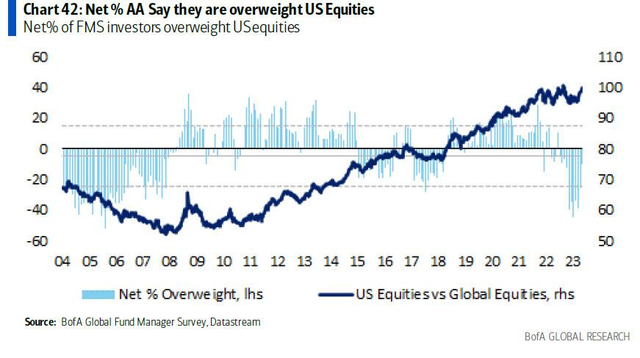

Potential for Overvaluation: The US stock market has experienced periods of overvaluation, which can make it challenging to find undervalued stocks and potentially lead to lower returns.

Limited International Exposure: Investing solely in US stocks means missing out on the potential benefits of investing in international markets, which can offer diversification and exposure to different economic cycles.

Alternatives to Investing in Only US Stocks

International Diversification: Investing in international stocks can provide exposure to different economies and currencies, helping to reduce the risk of being negatively impacted by global events.

Sector Rotation: Rotating between different sectors within the US stock market can help you capitalize on market trends and maximize returns.

Dividend Stocks: Investing in dividend-paying stocks can provide a steady stream of income and potentially reduce the risk of capital loss.

Case Study: The 2008 Financial Crisis

One of the most significant examples of the risks associated with investing solely in US stocks is the 2008 financial crisis. Many investors who had a concentrated portfolio of US stocks suffered significant losses, while those with diversified portfolios fared better.

In conclusion, while investing in US stocks can offer strong returns and exposure to leading companies, it is important to consider the potential risks and limitations. Diversifying your investment portfolio across different asset classes and geographies can help mitigate risk and potentially improve your overall returns. Whether you choose to invest solely in US stocks or diversify your portfolio, it is crucial to do thorough research and consult with a financial advisor to make informed decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....