The United States stock market is one of the most dynamic and influential financial markets in the world. Its performance is a key indicator of the overall health of the global economy. In this article, we provide a comprehensive overview of the current US stock market results, examining recent trends, major indices, and factors that are shaping the market landscape.

Recent Trends

The US stock market has experienced a rollercoaster ride in recent years. After a strong performance in the first half of 2021, the market took a downturn in the second half, with concerns over rising inflation and interest rates. However, as of early 2022, the market has started to show signs of recovery, driven by strong corporate earnings and a gradual easing of inflationary pressures.

Major Indices

The performance of the major US stock market indices can provide valuable insights into the overall market trend. The following are some of the key indices and their recent results:

- S&P 500: The S&P 500 is widely considered the best measure of the performance of the large-cap companies in the United States. As of early 2022, the index has recovered from its late-2021 lows and is trading near its all-time highs.

- Dow Jones Industrial Average: The Dow Jones Industrial Average represents the performance of 30 large, publicly-owned companies in the United States. It has also seen a strong recovery in early 2022, although it remains below its all-time highs.

- NASDAQ Composite: The NASDAQ Composite is a broader index that includes more than 3,000 companies, many of which are technology and growth-oriented. The NASDAQ has been one of the strongest performing indices in recent years, and it remains near its all-time highs.

Factors Shaping the Market

Several factors are currently shaping the US stock market:

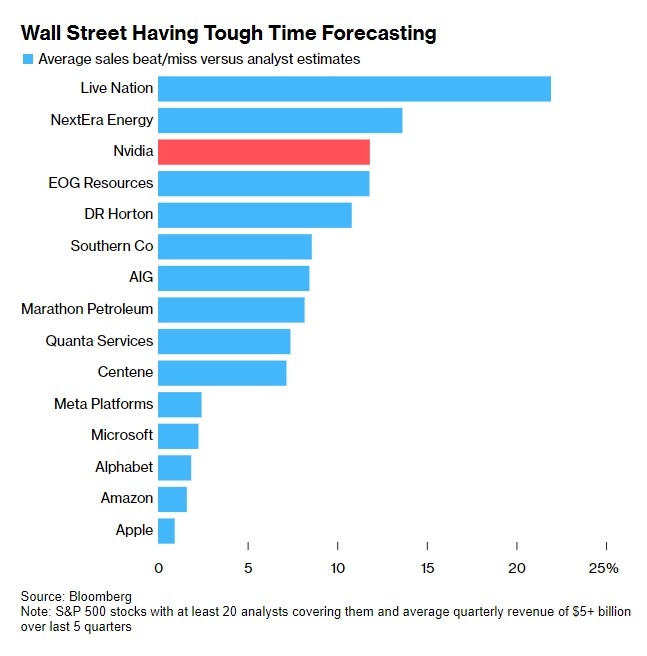

- Corporate Earnings: Strong corporate earnings have been a key driver of the market's recovery. Many companies have reported better-than-expected earnings, which has helped boost investor confidence.

- Inflation: Concerns over rising inflation have been a major factor affecting the stock market. However, as inflation starts to ease, the market is likely to benefit.

- Interest Rates: The Federal Reserve's decision to raise interest rates has had a significant impact on the stock market. However, as the Fed has signaled a more cautious approach, the market has started to stabilize.

Case Study: Apple Inc.

A notable case study is Apple Inc., one of the largest companies in the S&P 500. Despite the market downturn in late 2021, Apple's stock has remained relatively strong, driven by its strong financial performance and growing market share in the tech industry.

Apple's Q3 2021 earnings report showed a revenue increase of 20% year-over-year, driven by strong demand for its iPhone, iPad, and Mac products. This performance has helped to sustain investor confidence in the company and the broader market.

Conclusion

The current US stock market results show a mix of resilience and recovery. While there are still concerns over inflation and interest rates, the strong performance of corporate earnings and a gradual easing of inflationary pressures have helped to stabilize the market. As investors continue to monitor these and other factors, it will be interesting to see how the market evolves in the coming months.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....