The stock market is a pivotal part of the financial world, and the United States hosts some of the most significant exchanges. In this article, we will delve into the three major stock exchanges in the US: the New York Stock Exchange (NYSE), the NASDAQ, and the Chicago Stock Exchange (CSE). Each of these exchanges plays a crucial role in the global financial landscape, offering a unique set of opportunities and services for investors and traders.

1. The New York Stock Exchange (NYSE)

The NYSE, founded in 1792, is the oldest and largest stock exchange in the US. Located in Lower Manhattan, New York City, the NYSE is known for its iconic "Big Board" and its trading floor. The exchange is home to some of the world's most prominent companies, including Apple, Microsoft, and Amazon.

The NYSE operates on an auction-based system, where buyers and sellers meet in person to trade stocks. This traditional approach ensures a high level of transparency and liquidity. The exchange also offers a range of services, such as listing, trading, and market data.

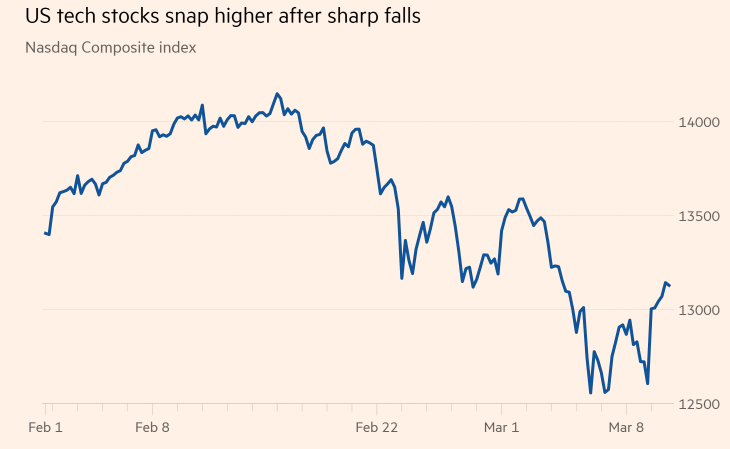

2. NASDAQ

NASDAQ, founded in 1971, is the second-largest stock exchange in the US by market capitalization. Unlike the NYSE, NASDAQ operates as an electronic marketplace, with trading conducted over a network of computers. This electronic trading system allows for faster execution and lower transaction costs.

The NASDAQ is well-known for its technology and growth companies, with many of the world's leading tech giants listed on the exchange, including Apple, Microsoft, and Google. The exchange also caters to a wide range of industries, offering a diverse selection of investment opportunities.

3. Chicago Stock Exchange (CSE)

The CSE, founded in 1882, is the smallest of the three major stock exchanges in the US. Located in Chicago, Illinois, the exchange primarily caters to small and mid-sized companies. The CSE offers a unique blend of traditional and electronic trading, with a focus on personalized customer service.

The CSE is known for its competitive pricing and innovative trading technology. It also provides a range of listing services, including primary and secondary market transactions, corporate finance, and market data.

Case Studies

To illustrate the impact of these exchanges, let's look at a few case studies:

- Facebook (now Meta Platforms): When Facebook went public on the NASDAQ in 2012, it became the largest IPO in history, raising $16 billion. This event showcased the NASDAQ's role as a gateway for tech giants to enter the public market.

- Tesla: Tesla, another prominent tech company, listed on the NASDAQ in 2010. The exchange's electronic trading system facilitated rapid growth and enabled Tesla to become a leading player in the electric vehicle industry.

- Groupon: Groupon, an online marketplace for local deals, listed on the NYSE in 2011. The NYSE's traditional trading floor and extensive listing services provided Groupon with the platform it needed to expand its operations.

In conclusion, the NYSE, NASDAQ, and CSE are three of the most important stock exchanges in the US. Each exchange offers unique opportunities for investors and traders, catering to a wide range of industries and investment styles. Understanding the distinct characteristics and services of these exchanges can help investors make informed decisions and maximize their returns.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....