Are you a Singaporean investor looking to expand your portfolio into the US stock market? Investing in US stocks can be a great way to diversify your investment portfolio and potentially increase your returns. With the rise of digital platforms and online brokers, investing in US stocks from Singapore has never been easier. In this article, we will guide you through the process of investing in US stocks from Singapore.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Some of the major exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. It is home to many well-known companies such as Apple, Microsoft, and Amazon.

Choosing a Broker

The first step in investing in US stocks from Singapore is to choose a reliable and reputable online broker. There are several brokers that offer services to Singaporean investors, including E*TRADE, TD Ameritrade, and Charles Schwab. It is important to compare the fees, trading platforms, and customer service of different brokers to find the one that best suits your needs.

Opening a Brokerage Account

Once you have chosen a broker, the next step is to open a brokerage account. This process typically involves filling out an online application, providing identification documents, and verifying your account. Some brokers may also require a minimum deposit to open an account.

Understanding the Risks

Before investing in US stocks, it is important to understand the risks involved. The US stock market can be volatile, and prices can fluctuate significantly. It is also important to be aware of currency exchange rates, as investing in US stocks will expose you to currency risk.

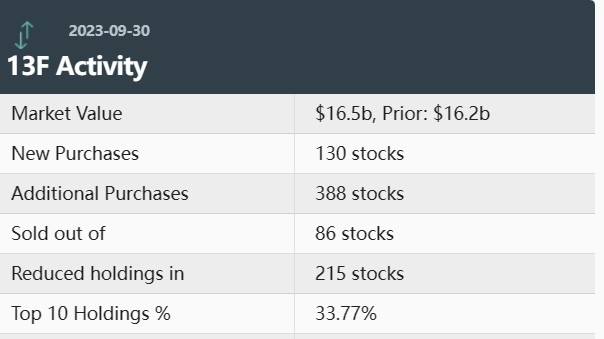

Researching and Analyzing Stocks

To make informed investment decisions, it is crucial to research and analyze the stocks you are interested in. This includes looking at the company's financial statements, earnings reports, and industry trends. There are numerous online resources and tools available to help you with your research, such as Yahoo Finance, Google Finance, and Bloomberg.

Using Stop-Loss Orders

To protect your investments, consider using stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a certain price. This can help limit your potential losses if the stock's price falls.

Diversifying Your Portfolio

Diversifying your portfolio can help reduce your risk. Consider investing in a mix of stocks from different sectors and industries. This can help protect your investments if one sector or industry performs poorly.

Case Study: Investing in Apple

Let's say you have decided to invest in Apple Inc. (AAPL), one of the world's most valuable companies. After researching the company and analyzing its financials, you believe that it is a good investment. You decide to purchase 100 shares of Apple at

Investing in US stocks from Singapore can be a rewarding experience if you do your research and follow a disciplined investment strategy. By choosing a reliable broker, understanding the risks, and diversifying your portfolio, you can potentially increase your returns while minimizing your risk.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....