In the ever-evolving world of finance, the stock market plays a pivotal role in the economic landscape. For investors and traders, understanding the stock price in the US is crucial for making informed decisions. This article delves into the dynamics of stock prices, the factors that influence them, and strategies for predicting future trends.

The Importance of Stock Price Analysis

The stock price of a company is a reflection of its market value. It is determined by the supply and demand for its shares in the stock market. As an investor, it is essential to analyze stock prices to identify potential investment opportunities and mitigate risks.

Factors Influencing Stock Prices

Several factors can influence the stock price in the US. Here are some of the key factors:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact stock prices. For example, higher GDP growth can lead to increased corporate earnings, which may drive up stock prices.

- Company Performance: The financial performance of a company, including its revenue, earnings, and profit margins, plays a crucial role in determining its stock price. Companies with strong financial performance tend to have higher stock prices.

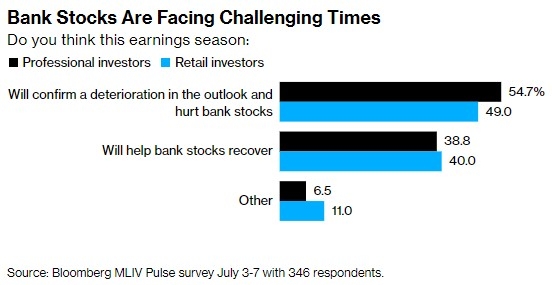

- Market Sentiment: Market sentiment refers to the overall mood of investors in the stock market. Positive sentiment can drive up stock prices, while negative sentiment can lead to declines.

- Political Events: Political events, such as elections or policy changes, can also impact stock prices. For example, a change in government policies can affect the profitability of certain industries, leading to fluctuations in stock prices.

Predicting Stock Price Trends

Predicting stock price trends is a challenging task, but there are several strategies that investors can use:

- Technical Analysis: Technical analysis involves analyzing historical stock price data to identify patterns and trends. Traders use various tools and indicators, such as moving averages and volume, to make predictions.

- Fundamental Analysis: Fundamental analysis involves evaluating the financial health and prospects of a company. Investors use financial ratios and other metrics to assess the intrinsic value of a stock.

- Sentiment Analysis: Sentiment analysis involves analyzing the mood of investors and the media to predict stock price movements. Traders use sentiment indicators, such as the VIX index, to gauge market sentiment.

Case Study: Tesla (TSLA)

A prime example of stock price dynamics is Tesla (TSLA). In 2020, Tesla's stock price experienced a significant surge, reaching an all-time high. This surge can be attributed to several factors:

- Strong Financial Performance: Tesla reported strong revenue and earnings growth in 2020, driven by increased sales of its electric vehicles.

- Positive Market Sentiment: The growing demand for electric vehicles and the company's innovative technology contributed to positive market sentiment.

- Political Support: The increasing focus on environmental sustainability and the push for electric vehicles by governments around the world also played a role in Tesla's stock price surge.

Conclusion

Understanding the dynamics of stock prices in the US is crucial for investors and traders. By analyzing the factors that influence stock prices and employing various strategies for predicting trends, investors can make informed decisions and maximize their returns. However, it is essential to remember that stock market investing involves risks, and it is crucial to conduct thorough research and consult with financial advisors before making investment decisions.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....