The relationship between the United States and China has been a significant factor influencing global trade and, subsequently, the stock market. As the world's two largest economies, any changes in their trade relationship can have far-reaching effects on businesses and investors alike. This article delves into how the US-China trade relationship impacts stocks, highlighting key areas of concern and providing examples of companies that have been most affected.

Trade Tensions and Stock Market Volatility

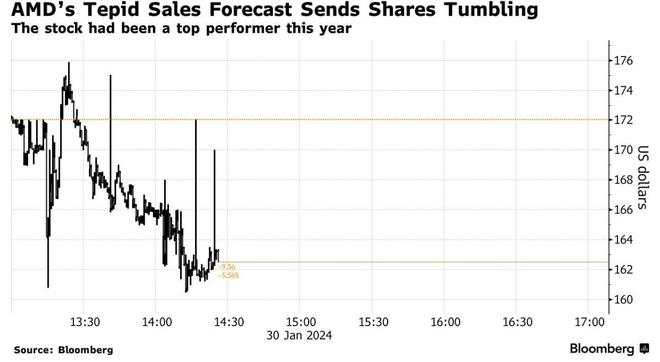

The trade tensions between the US and China have been a source of considerable uncertainty in the stock market. Trade wars can lead to higher tariffs, reduced exports, and increased costs for businesses, which can negatively impact their earnings and, in turn, their stock prices.

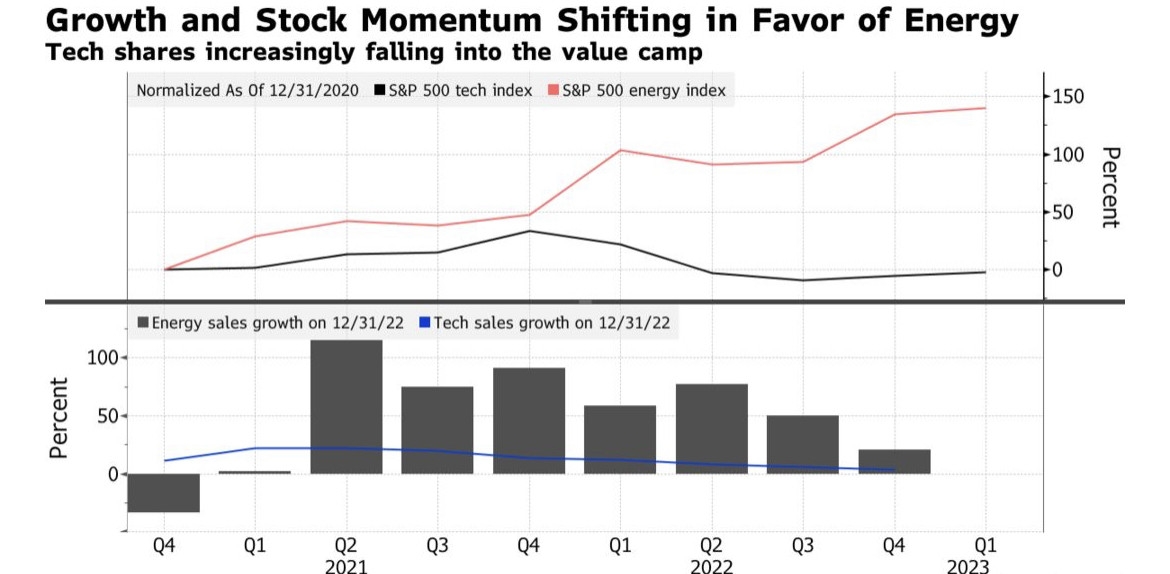

Impact on Specific Industries

Several industries have been particularly sensitive to the US-China trade relationship. Technology companies, for example, have been at the forefront of the trade disputes. Companies like Apple and Microsoft have seen their stocks fluctuate as tensions escalate, with concerns over increased tariffs on Chinese-made goods.

Consumer Goods

Consumer goods companies, such as Nike and Disney, have also been affected. These companies rely heavily on Chinese manufacturing and face the risk of higher production costs and supply chain disruptions.

Automotive Industry

The automotive industry has also been impacted. Many car manufacturers have significant operations in China, and any disruption in the supply chain or increased tariffs could lead to higher costs and reduced profitability.

Case Study: Boeing

One notable example of how the US-China trade relationship can impact stocks is the case of Boeing. The company has faced increased scrutiny from the Chinese government over its 737 MAX aircraft. The grounding of the aircraft in China has had a significant impact on Boeing's sales and revenue, leading to a decline in its stock price.

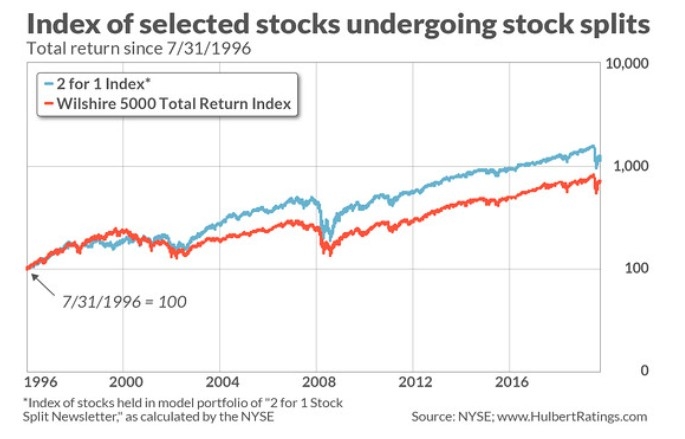

Investor Strategies

Given the uncertainty surrounding the US-China trade relationship, investors need to be cautious and adopt a diversified investment strategy. This includes investing in companies that are less exposed to the trade tensions and considering hedging strategies to protect against potential market volatility.

Conclusion

The US-China trade relationship remains a critical factor influencing the stock market. As tensions continue to escalate, investors should stay informed and be prepared to adjust their portfolios accordingly. By understanding the impact of trade disputes on specific industries and companies, investors can make more informed decisions and mitigate potential risks.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....