The US stock market has experienced significant volatility in recent years, leading many investors to question whether it can bounce back. This article delves into the factors that could influence the market's future performance and provides insights into whether a rebound is possible.

Historical Performance

Historically, the US stock market has demonstrated an impressive ability to recover from downturns. For instance, the dot-com bubble burst in 2000, and the market took nearly a decade to fully recover. However, it eventually rebounded, and investors who remained patient were rewarded.

Economic Factors

Several economic factors could contribute to a potential bounce back in the US stock market. One of the most crucial factors is interest rates. The Federal Reserve has been gradually increasing interest rates, which could lead to higher inflation. However, if the Fed manages to control inflation without causing a recession, the stock market may benefit from increased corporate profits.

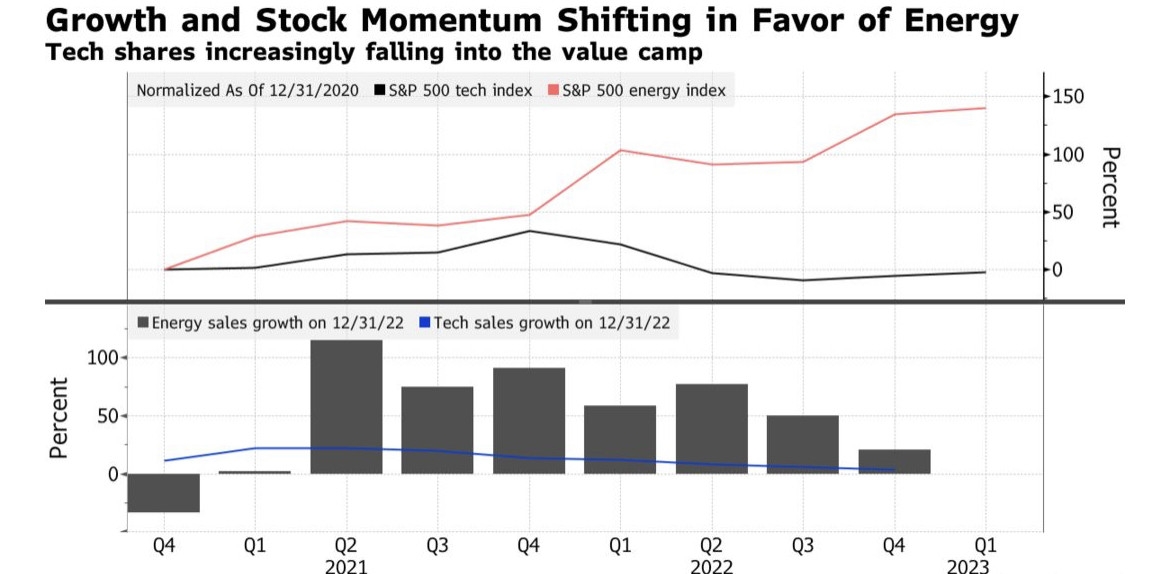

Technological Advancements

Technological advancements have been a significant driver of growth in the US stock market. Companies in sectors such as technology, healthcare, and renewable energy have been leading the charge. As these industries continue to innovate and expand, they could provide a strong foundation for the market's recovery.

Political Stability

Political stability plays a crucial role in the stock market's performance. The US has been relatively stable compared to other countries, which has helped to attract foreign investment. However, political tensions and policy changes can impact investor confidence. Therefore, maintaining political stability is essential for a potential market rebound.

Market Valuations

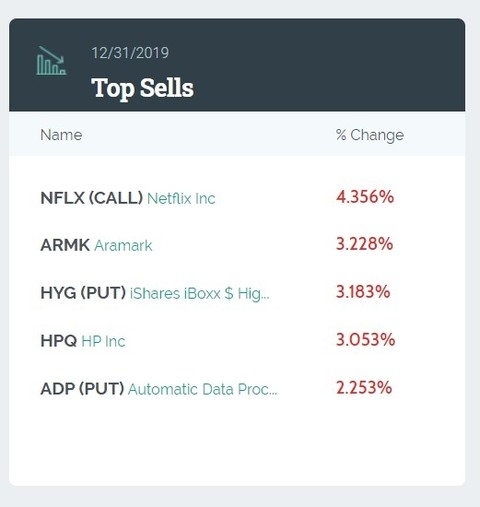

Another factor to consider is market valuations. The US stock market has been characterized by high valuations in recent years, which has raised concerns about sustainability. However, historical data suggests that the market can still experience significant growth even when valuations are high. It's essential to analyze the overall market sentiment and identify undervalued sectors.

Case Studies

Several case studies illustrate the US stock market's resilience. For example, during the financial crisis of 2008, the market plummeted, but it eventually recovered and reached new highs. Similarly, the market experienced a significant downturn in 2020 due to the COVID-19 pandemic, but it quickly rebounded.

Conclusion

While predicting the future of the US stock market is challenging, several factors suggest that a bounce back is possible. Economic stability, technological advancements, and political stability could contribute to a potential market recovery. However, it's essential for investors to remain cautious and conduct thorough research before making investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....