The U.S. stock market has long been considered a beacon of stability and economic health. However, the possibility of a dollar collapse in the stock market is a topic that has been increasingly discussed among investors and economists. This article delves into the potential causes and consequences of such an event, providing a comprehensive overview of the factors that could lead to a US stock market dollar collapse.

Understanding the Dollar and the Stock Market

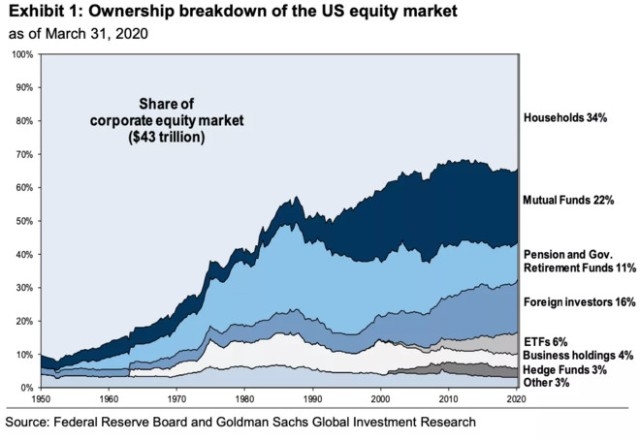

To comprehend the potential for a dollar collapse in the stock market, it's essential to understand the relationship between the two. The U.S. dollar is the world's primary reserve currency, and its strength is closely tied to the stability and performance of the U.S. stock market. Conversely, the stock market's performance can significantly impact the value of the dollar.

Potential Causes of a Dollar Collapse in the Stock Market

Economic Downturn: A severe economic downturn, such as a recession or depression, can lead to a collapse in the stock market. During such periods, investors become more risk-averse, leading to a sell-off of stocks and a depreciation of the dollar.

Political Instability: Political instability, such as a government shutdown or a major election, can create uncertainty in the market. This uncertainty can lead to a sell-off of stocks and a depreciation of the dollar.

High Debt Levels: If the U.S. government continues to accumulate high levels of debt, it could lead to a loss of confidence in the U.S. economy. This loss of confidence could result in a collapse of the stock market and a depreciation of the dollar.

Global Economic Issues: Global economic issues, such as a trade war or a financial crisis in a major economy, can have a significant impact on the U.S. stock market and the dollar. For example, a trade war with China could lead to a decrease in U.S. exports and a depreciation of the dollar.

Technological Disruptions: Technological disruptions, such as a major cyberattack or a major company going out of business, can lead to a collapse in the stock market and a depreciation of the dollar.

Consequences of a Dollar Collapse in the Stock Market

A dollar collapse in the stock market could have several consequences, including:

Inflation: A depreciation of the dollar can lead to higher inflation, as the cost of imported goods and services increases.

Debt Crisis: A collapse in the stock market and a depreciation of the dollar could lead to a debt crisis, as the U.S. government struggles to service its debt.

Loss of Confidence: A dollar collapse could lead to a loss of confidence in the U.S. economy, both domestically and internationally.

Economic Slowdown: A collapse in the stock market and a depreciation of the dollar could lead to an economic slowdown, as businesses and consumers become more cautious.

Case Study: The 2008 Financial Crisis

One of the most significant examples of a stock market collapse and a depreciation of the dollar is the 2008 financial crisis. The crisis was caused by a combination of factors, including the housing market bubble, excessive risk-taking by financial institutions, and a lack of regulation. The crisis led to a collapse in the stock market and a depreciation of the dollar, resulting in a severe economic downturn.

Conclusion

While a dollar collapse in the stock market is a complex and multifaceted issue, it's important for investors and policymakers to understand the potential causes and consequences. By being aware of the risks and taking appropriate measures, it's possible to mitigate the impact of such an event and ensure the stability of the U.S. economy.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....