In the ever-evolving world of finance, the question "How are US stocks doing?" is one that investors and financial enthusiasts alike are always eager to know. This article delves into the current state of the US stock market, offering insights into the performance of various sectors and the factors that could influence future trends.

Market Overview

As of the latest reports, the US stock market has shown a mixed performance in recent months. The S&P 500, a widely followed benchmark index, has experienced both ups and downs, reflecting the broader economic landscape.

Sector Performance

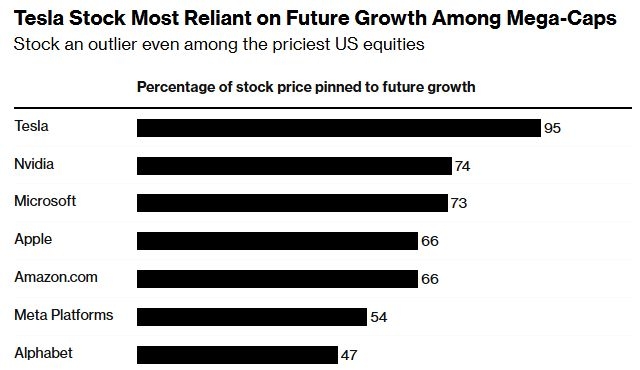

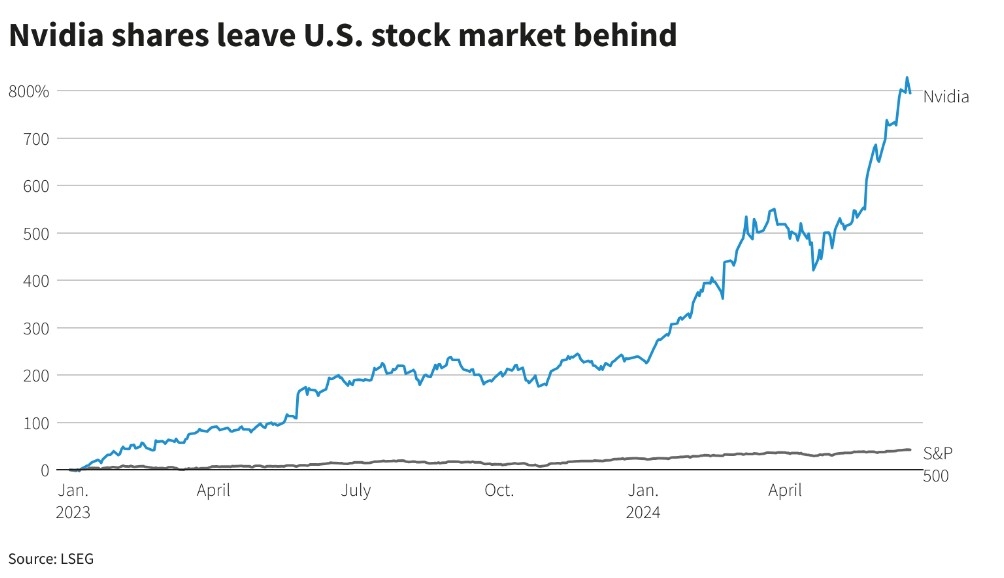

Several sectors have stood out in the US stock market. Technology stocks, in particular, have been a major driver of growth, with companies like Apple, Microsoft, and Amazon leading the pack. The tech sector's resilience can be attributed to strong demand for digital services and products, especially during the pandemic.

Energy Stocks

In contrast, the energy sector has faced significant challenges. The ongoing oil price volatility has affected the performance of energy stocks, with many investors cautious about the long-term outlook. However, some analysts believe that the energy sector could see a rebound as the global economy recovers and demand for oil and natural gas increases.

Financial Stocks

The financial sector has also been a topic of interest. With interest rates remaining low, many financial institutions have benefited from higher net interest margins. Additionally, the rise of digital banking has opened up new opportunities for growth in this sector.

Economic Factors

Several economic factors are influencing the US stock market. The Federal Reserve's monetary policy, including interest rate decisions and bond purchases, plays a crucial role. Additionally, the government's fiscal policies, such as stimulus packages, can have a significant impact on market sentiment.

Geopolitical Issues

Geopolitical issues, such as trade tensions and political instability, also affect the US stock market. These factors can create uncertainty and volatility, leading to fluctuations in stock prices.

Case Studies

Let's take a closer look at a couple of case studies to illustrate the current state of the US stock market.

Apple Inc. (AAPL): As mentioned earlier, Apple has been a major driver of growth in the technology sector. The company's strong financial performance, coupled with its innovative products and services, has helped it maintain its market dominance. However, investors remain cautious about the potential impact of supply chain disruptions and increasing competition.

Exxon Mobil Corporation (XOM): Exxon Mobil, a leading energy company, has faced challenges due to the volatile oil market. Despite these challenges, the company has managed to maintain a strong presence in the energy sector. Some analysts believe that Exxon Mobil could see a rebound as the global economy recovers and demand for oil increases.

Conclusion

In conclusion, the US stock market has shown a mixed performance in recent months, with various sectors experiencing different levels of growth. While the technology sector has been a major driver of growth, the energy and financial sectors have faced challenges. Investors should keep a close eye on economic factors, geopolitical issues, and sector performance to make informed decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....