Are you looking to invest in stocks with significant momentum? If so, you're in the right place. This article provides an in-depth analysis of the top momentum stocks in the US for 2023. We'll delve into what makes these stocks tick and how they can potentially benefit your investment portfolio.

Understanding Momentum Stocks

Momentum stocks are shares of companies that have shown significant price appreciation over a short period. These stocks often experience rapid growth and are popular among day traders and long-term investors alike. The key to identifying momentum stocks lies in analyzing their performance, market sentiment, and underlying fundamentals.

Top Momentum Stocks in the US for 2023

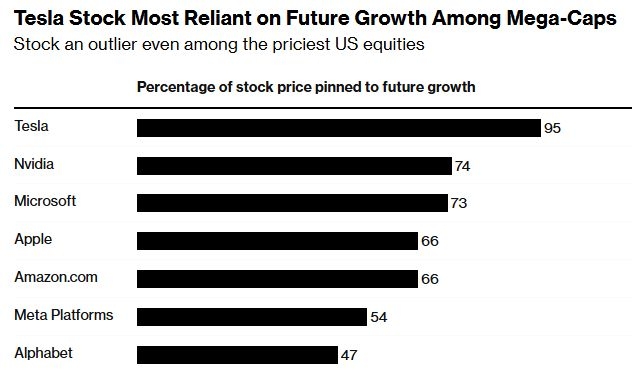

Tesla, Inc. (TSLA) Tesla, a leader in electric vehicles and renewable energy solutions, has been a prime example of a momentum stock. With the increasing demand for electric vehicles and advancements in battery technology, Tesla's future looks promising.

NVIDIA Corporation (NVDA) NVIDIA, a global leader in graphics processing units (GPUs), has seen significant growth in demand for its products due to the rise of artificial intelligence and gaming. Its robust revenue growth and impressive earnings reports have propelled it to the top of the momentum stocks list.

Shopify Inc. (SHOP) Shopify, an e-commerce platform, has seen a surge in demand as more businesses move online. The company's impressive revenue growth and expansion into new markets have made it a favorite among investors.

Palantir Technologies Inc. (PLTR) Palantir, a software company that specializes in data analytics, has gained traction due to its work with government agencies and private sector clients. The company's innovative approach to data analysis and recent partnerships have driven its stock price up.

Snowflake Inc. (SNOW) Snowflake, a cloud data platform, has seen rapid growth in demand as businesses seek to migrate their data to the cloud. Its unique approach to data warehousing and partnerships with leading cloud providers have contributed to its momentum.

Case Study: Tesla, Inc. (TSLA)

To illustrate the potential of momentum stocks, let's take a closer look at Tesla. In the past year, Tesla's stock has surged by over 65%. This growth can be attributed to several factors:

- Strong Revenue Growth: Tesla's revenue has been on a consistent upward trend, driven by the increasing demand for its electric vehicles and energy solutions.

- Market Sentiment: Positive news about the company, such as partnerships with other automakers and advancements in battery technology, has helped boost investor confidence.

- Innovative Approach: Tesla's commitment to innovation and continuous improvement has kept the company at the forefront of the electric vehicle market.

By investing in Tesla, investors have the potential to benefit from the company's strong momentum and future growth prospects.

Conclusion

In conclusion, momentum stocks can be a valuable addition to any investment portfolio. By understanding the factors that drive momentum and analyzing the performance of leading companies, you can identify potential opportunities for growth. However, it's important to do your research and consider the risks associated with investing in momentum stocks.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....